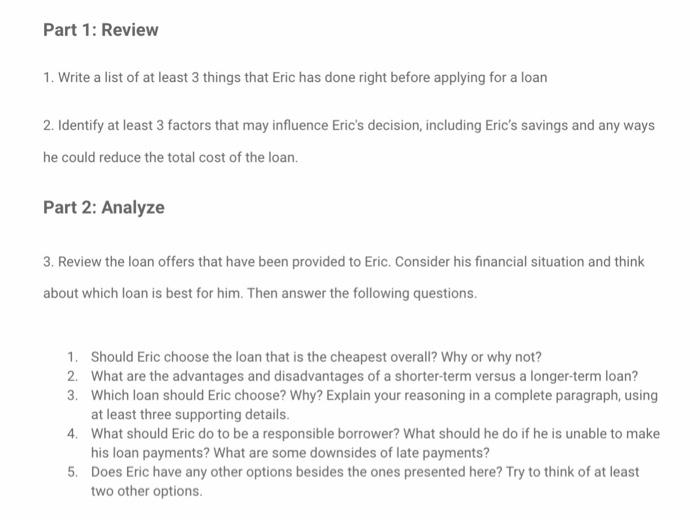

Making a Smart Automobile Purchase Eric is shopping for a car. He doesn't have enough cash to pay for it outright, so he will have to get a loan. There's a lot to think about when getting a loan. Not all loans have the same terms, for example. How can Eric know which automobile loan is best for him? For this assignment, you will consider a number of different finance options, compare and evaluate loan terms, and ultimately choose the loan that you believe to be best for Eric. Eric wants to buy a SUV and can afford a monthly car payment of $500. What kind of loan options does he have? Finance Options Eric works as a chef. He needs a reliable vehicle to get to and from work and to transport some food to catered events. The car he has been driving is too small and breaks down frequently. He likes the idea of an SUV because he also enjoys camping. His budget suggests that he can afford to make a monthly car payment of about $500.00, but he might be able to pay more during some times of the year when the restaurant offers bonuses or additional work shifts. Eric has a $10,000 certificate of deposit that he is ready to cash in and he is considering several finance options. Consider his options below and then answer questions 1 and 2 on your assignment sheet. Car dealership Car manufacturer Bank or credit union Car dealerships often have special arrangements with banks to offer car loans. It may seem convenient, because you don't have to search for a lender and the loan paperwork can be done right at the dealership, but you might not receive the best interest rate. A car dealership may be a convenient Large car dealerships sometimes offer place to apply for a loan, but you might in-house financing, meaning no bank not get the best interest rate would be involved. The interest rate on this financing is almost guaranteed to be higher than a bank's. Eric might be better off comparison shopping for a loan. In fact, if the dealer is paid a fee by the bank for selling him the loan, he can probably get a better rate from the same bank on his own. Car dealership Car manufacturer Bank or credit union Many large automobile makers have financing divisions. They might try to entice you with a 0% annual percentage rate (APR) for the first year. But be careful - this may be a variable interest rate and could increase quickly. especially if you miss a payment If Eric has an excellent credit history, he Many car manufacturers offer low may qualify for a more favorable rate introductory APRs as a way to entice you to purchase than someone with a poor credit history. He will have to shop carefully. Car dealership Car manufacturer Bank or credit union APPROVED APPR car loan ap It is possible to apply to several banks or credit unions at one time to compare loan terms. The advertised rate that banks offer is often for people with the very best credit histories. Because a credit union is a nonprofit organization, members may qualify for lower interest rates and fees its wide to comparison shop when 14 Eric's credit history is less than applying for a loan perfect, a credit union may be a good bet If he is a member of a credit union, he probably has a relationship with the manager of the financial institution, and that can sometimes make a difference Loan Terms The sticker price of Eric's new car is $36,000. He decides to cash in his $10,000 certificate of deposit and make a down payment of $11,000. That means he will need to take out a loan an for $25,000 Overall, Eric has a good credit history, although he does currently have $2,000 in credit card debt at 18 percent interest Eric applies for and receives offers of credit from four lenders: the car dealership, the manufacturer, his credit union, and a bank. Review the table of their offers and then respond to question 3 on the assignment sheet Lender Length of Interest loan rate Dealership 3 years 6.5% Manufacturer 7 years 5.0% Credit union 5 years 5.0% Bank 7 years 6.5% Monthly payment $643.63 $353.35 $471.78 $311.84 Total Total cost of interest loan $2,170.65 $27.170.65 $4,681.21 $29,681.21 $3,306,85 $28,306,85 $5,194.41 $30,194.41 Part 1: Review 1. Write a list of at least 3 things that Eric has done right before applying for a loan 2. Identify at least 3 factors that may influence Eric's decision, including Eric's savings and any ways he could reduce the total cost of the loan. Part 2: Analyze 3. Review the loan offers that have been provided to Eric. Consider his financial situation and think about which loan is best for him. Then answer the following questions, 1. Should Eric choose the loan that is the cheapest overall? Why or why not? 2. What are the advantages and disadvantages of a shorter-term versus a longer-term loan? 3. Which loan should Eric choose? Why? Explain your reasoning in a complete paragraph, using at least three supporting details. 4. What should Eric do to be a responsible borrower? What should he do if he is unable to make his loan payments? What are some downsides of late payments? 5. Does Eric have any other options besides the ones presented here? Try to think of at least two other options. Making a Smart Automobile Purchase Eric is shopping for a car. He doesn't have enough cash to pay for it outright, so he will have to get a loan. There's a lot to think about when getting a loan. Not all loans have the same terms, for example. How can Eric know which automobile loan is best for him? For this assignment, you will consider a number of different finance options, compare and evaluate loan terms, and ultimately choose the loan that you believe to be best for Eric. Eric wants to buy a SUV and can afford a monthly car payment of $500. What kind of loan options does he have? Finance Options Eric works as a chef. He needs a reliable vehicle to get to and from work and to transport some food to catered events. The car he has been driving is too small and breaks down frequently. He likes the idea of an SUV because he also enjoys camping. His budget suggests that he can afford to make a monthly car payment of about $500.00, but he might be able to pay more during some times of the year when the restaurant offers bonuses or additional work shifts. Eric has a $10,000 certificate of deposit that he is ready to cash in and he is considering several finance options. Consider his options below and then answer questions 1 and 2 on your assignment sheet. Car dealership Car manufacturer Bank or credit union Car dealerships often have special arrangements with banks to offer car loans. It may seem convenient, because you don't have to search for a lender and the loan paperwork can be done right at the dealership, but you might not receive the best interest rate. A car dealership may be a convenient Large car dealerships sometimes offer place to apply for a loan, but you might in-house financing, meaning no bank not get the best interest rate would be involved. The interest rate on this financing is almost guaranteed to be higher than a bank's. Eric might be better off comparison shopping for a loan. In fact, if the dealer is paid a fee by the bank for selling him the loan, he can probably get a better rate from the same bank on his own. Car dealership Car manufacturer Bank or credit union Many large automobile makers have financing divisions. They might try to entice you with a 0% annual percentage rate (APR) for the first year. But be careful - this may be a variable interest rate and could increase quickly. especially if you miss a payment If Eric has an excellent credit history, he Many car manufacturers offer low may qualify for a more favorable rate introductory APRs as a way to entice you to purchase than someone with a poor credit history. He will have to shop carefully. Car dealership Car manufacturer Bank or credit union APPROVED APPR car loan ap It is possible to apply to several banks or credit unions at one time to compare loan terms. The advertised rate that banks offer is often for people with the very best credit histories. Because a credit union is a nonprofit organization, members may qualify for lower interest rates and fees its wide to comparison shop when 14 Eric's credit history is less than applying for a loan perfect, a credit union may be a good bet If he is a member of a credit union, he probably has a relationship with the manager of the financial institution, and that can sometimes make a difference Loan Terms The sticker price of Eric's new car is $36,000. He decides to cash in his $10,000 certificate of deposit and make a down payment of $11,000. That means he will need to take out a loan an for $25,000 Overall, Eric has a good credit history, although he does currently have $2,000 in credit card debt at 18 percent interest Eric applies for and receives offers of credit from four lenders: the car dealership, the manufacturer, his credit union, and a bank. Review the table of their offers and then respond to question 3 on the assignment sheet Lender Length of Interest loan rate Dealership 3 years 6.5% Manufacturer 7 years 5.0% Credit union 5 years 5.0% Bank 7 years 6.5% Monthly payment $643.63 $353.35 $471.78 $311.84 Total Total cost of interest loan $2,170.65 $27.170.65 $4,681.21 $29,681.21 $3,306,85 $28,306,85 $5,194.41 $30,194.41 Part 1: Review 1. Write a list of at least 3 things that Eric has done right before applying for a loan 2. Identify at least 3 factors that may influence Eric's decision, including Eric's savings and any ways he could reduce the total cost of the loan. Part 2: Analyze 3. Review the loan offers that have been provided to Eric. Consider his financial situation and think about which loan is best for him. Then answer the following questions, 1. Should Eric choose the loan that is the cheapest overall? Why or why not? 2. What are the advantages and disadvantages of a shorter-term versus a longer-term loan? 3. Which loan should Eric choose? Why? Explain your reasoning in a complete paragraph, using at least three supporting details. 4. What should Eric do to be a responsible borrower? What should he do if he is unable to make his loan payments? What are some downsides of late payments? 5. Does Eric have any other options besides the ones presented here? Try to think of at least two other options