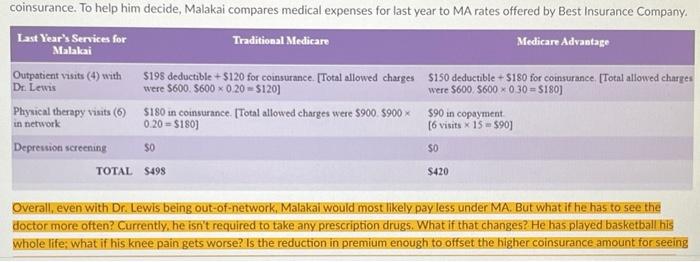

Malakai is a 68-year-old male who is enrolled in Medicare. Malakai is enrolled in traditional Medicare Part A and has purchased Parts B and D. Malakai's Part B premium is $150 per month. His Part D premium is $30 per month. As discussed earlier in this module, the tables provide cost sharing amounts applicable for Medicare beneficiaries in 2020. Malakai's friend Zach is enrolled in a Medicare Advantage (MA) plan through Best Insurance Company. Zach told Malakai that he only pays $50 per month for his Medicare premium. Remember that MA (Medicare Part C) includes Medicare Parts A, B, and D and is a managed care option. Zach helps Malakai arrange a meeting with his Best Insurance Company representative to discuss his options for the next open election period. Malakai decides to investigate why he is paying so much more in premium for traditional Medicare and wants to understand the impact of switching to a MA plan prior to his meeting. To begin, Malakai researches the costs for MA plans on the Medicare.gov website. Here he finds there are several qualifiers for how much it actually costs a beneficiary in a MA plan. This information leads Malakai to list out the following questions for his meeting with a Best Insurance Company representative: - Does the MA plan offered by Best Insurance Company have a yearly deductible? - How much do beneficiaries pay for each visit or service (copayment or coinsurance)? - Do you limit the physicians that I can see? Can I only see certain doctors? - What extra benefits are offered? How much do Thave to pay for these benefits? Malakai's biggest concerns are being able to continue to see his long-term primary care physician and how much he will have to pay for each visit. During his meeting with Best Insurance Company he finds out the following: - He has to pay more to see out-of-network providers. - Office visits and physical therapy will have a copayment amount of $15 for the upcoming year. - There is one annual deductible amount of $150 for all types of services (inpatient, outpatient, and pharmacy). Malakai's physician, Dr. Lewis, is not included in the Best Insurance Company's network of providers. So instead of a $15 copayment, Malakai will have to pay a 30 percent coinsurance amount to see Dr. Lewis. Currently, Malakai only pays 20 percent coinsurance. To help him decide, Malakai compares medical expenses for last year to MA rates offered by Best Insurance Company. \begin{tabular}{|c|c|c|} \hline LastYearsServicesforMalalai & Traditional Medicare & Medicare Advantage \\ \hline Outpotientvisits(4)withDrLewis & $198deductible+$120forcoinsurance.[Totalallowedchargeswere$600.$6000.20=$120] & $150deductible+$180forcoinsurance.[Totalallowedchargeswere$600,$6000.30=$180] \\ \hline Physicaltherapyvisits(6)innetwork & $180incoinsurance.[Totalallowedchargeswere$900.59000.20=$180] & $90incopayment[6visits15=$90] \\ \hline Depresion scteening & \$o & so \\ \hline TOTAL & 5498 & $420 \\ \hline \end{tabular} Overall, even with Dr. Lewis being out-of-network, Malakai would most likely pay less under MA. But what if he has to see the doctor more often? Currently, he isn't required to take any prescription drugs. What if that changes? He has played basketball his Whole life: what if his knee pain gets worse? Is the reduction in premium enough to offset the higher coinsurance amount for seeing Dr. Lewis? Malakai has four more months to decide if he wants to switch, so he decides to do more research and give his decision more thought: View Rubric