Answered step by step

Verified Expert Solution

Question

1 Approved Answer

malaysian tax system Question 2 Mr Ron purchased a house for RM2.7 million from Setia Eco Bhd. The details are as follows: a. A deposit

malaysian tax system

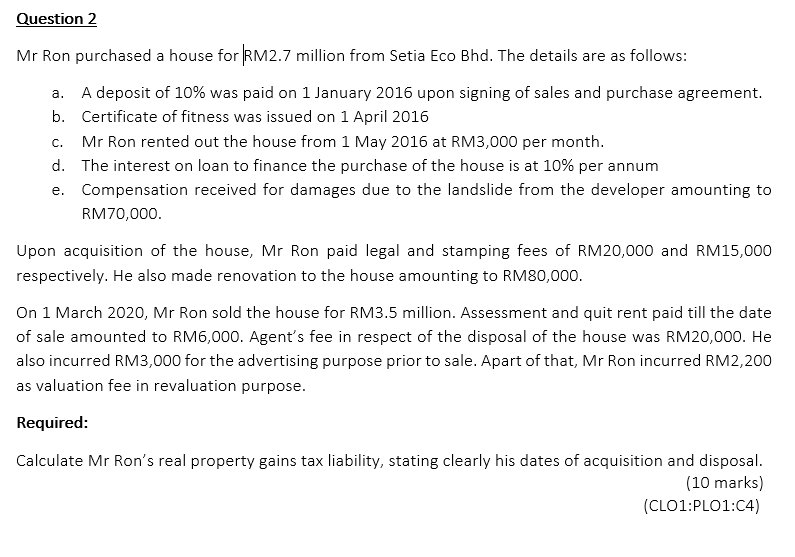

Question 2 Mr Ron purchased a house for RM2.7 million from Setia Eco Bhd. The details are as follows: a. A deposit of 10% was paid on 1 January 2016 upon signing of sales and purchase agreement. b. Certificate of fitness was issued on 1 April 2016 Mr Ron rented out the house from 1 May 2016 at RM3,000 per month. d. The interest on loan to finance the purchase of the house is at 10% per annum e. Compensation received for damages due to the landslide from the developer amounting to RM70,000 C. Upon acquisition of the house, Mr Ron paid legal and stamping fees of RM20,000 and RM15,000 respectively. He also made renovation to the house amounting to RM80,000. On 1 March 2020, Mr Ron sold the house for RM3.5 million. Assessment and quit rent paid till the date of sale amounted to RM6,000. Agent's fee in respect of the disposal of the house was RM20,000. He also incurred RM3,000 for the advertising purpose prior to sale. Apart of that, Mr Ron incurred RM2,200 as valuation fee in revaluation purpose. Required: Calculate Mr Ron's real property gains tax liability, stating clearly his dates of acquisition and disposal. (10 marks) (CLO1:PLO1:04)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started