Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Malaysian Taxation, Chapter Partnership someone help me pls 1. Lee and Peter entered into an agreement for the purpose of joint-tender in a construction project

Malaysian Taxation, Chapter Partnership

someone help me pls

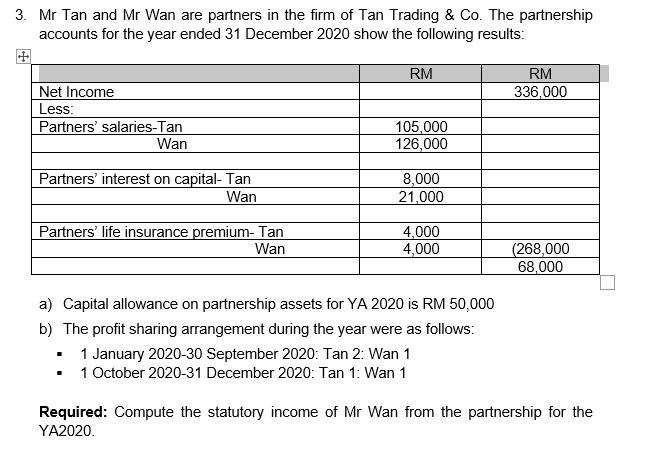

1. Lee and Peter entered into an agreement for the purpose of joint-tender in a construction project worth RM 8 million. They were successful in obtaining the contract. In the agreement between Lee and Peter, the contract sum of RM8 million is to be split equally between them. The scope of work to be carried out by each party is clearly identified. The agreement also provides that each of them shall be responsible for the cost incurred in carrying out their respective scope of work. 2. Ali and Nasrudio are jointly in the business of selling hamburgers. Each of them contributed Rm10,000 to start off the business. Their business was not registered with the registrar of business. Whilst there is no written agreement between them, it has been verbally agreed that they will share equally the profits/losses from the business. A bank account is maintained in their joint name and all cheques issued have to be signed by both of them. 3. Mr Tan and Mr Wan are partners in the firm of Tan Trading & Co. The partnership accounts for the year ended 31 December 2020 show the following results: RM RM 336,000 Net Income Less: Partners' salaries-Tan Wan 105,000 126,000 Partners' interest on capital- Tan Wan 8,000 21,000 Partners' life insurance premium-Tan Wan 4,000 4,000 (268,000 68,000 a) Capital allowance on partnership assets for YA 2020 is RM 50,000 b) The profit sharing arrangement during the year were as follows: 1 January 2020-30 September 2020: Tan 2: Wan 1 1 October 2020-31 December 2020: Tan 1: Wan 1 Required: Compute the statutory income of Mr Wan from the partnership for the YA2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started