Malvern Company has a net income in 2020 of $180,000, before considering the $130,000 payments to its owner, Melva Malvern. Melva is married to

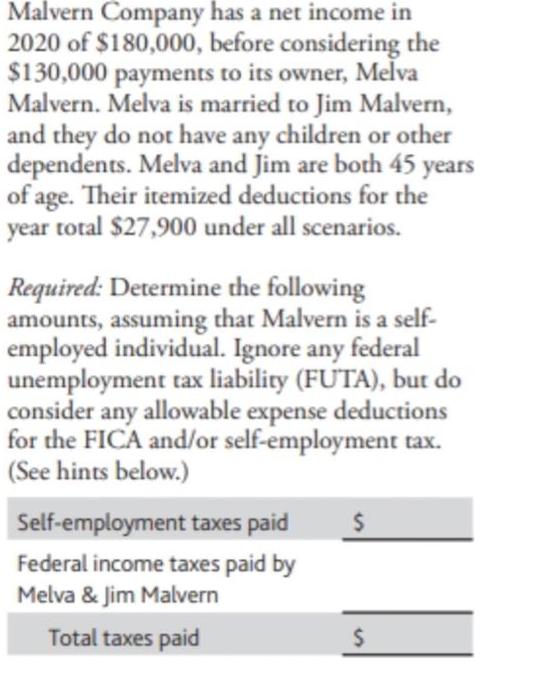

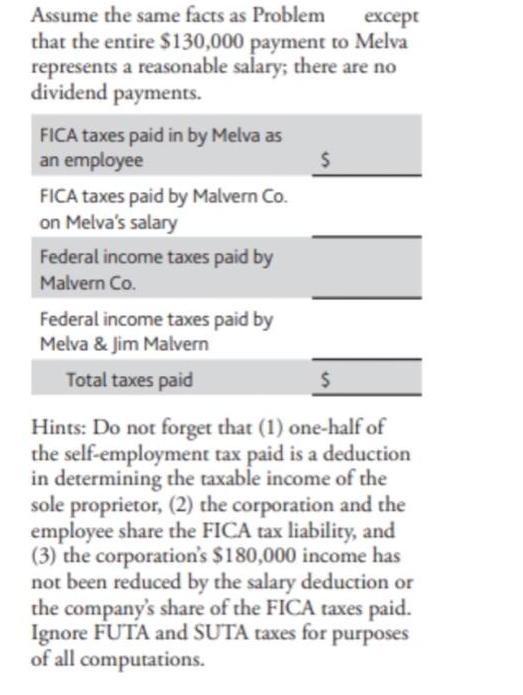

Malvern Company has a net income in 2020 of $180,000, before considering the $130,000 payments to its owner, Melva Malvern. Melva is married to Jim Malvern, and they do not have any children or other dependents. Melva and Jim are both 45 years of age. Their itemized deductions for the year total $27,900 under all scenarios. Required: Determine the following amounts, assuming that Malvern is a self- employed individual. Ignore any federal unemployment tax liability (FUTA), but do consider any allowable expense deductions for the FICA and/or self-employment tax. (See hints below.) Self-employment taxes paid $ Federal income taxes paid by Melva & Jim Malvern Total taxes paid $ Assume the same facts as Problem except that the entire $130,000 payment to Melva represents a reasonable salary; there are no dividend payments. FICA taxes paid in by Melva as an employee $ FICA taxes paid by Malvern Co. on Melva's salary Federal income taxes paid by Malvern Co. Federal income taxes paid by Melva & Jim Malvern Total taxes paid $ Hints: Do not forget that (1) one-half of the self-employment tax paid is a deduction in determining the taxable income of the sole proprietor, (2) the corporation and the employee share the FICA tax liability, and (3) the corporation's $180,000 income has not been reduced by the salary deduction or the company's share of the FICA taxes paid. Ignore FUTA and SUTA taxes for purposes of all computations.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Ans Net Income 180000 Payment to owner 130000 Income after p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started