Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mamba Ltd is a listed Australian company which operates in the mining industry. The firm started its operations as a prospecting firm up until

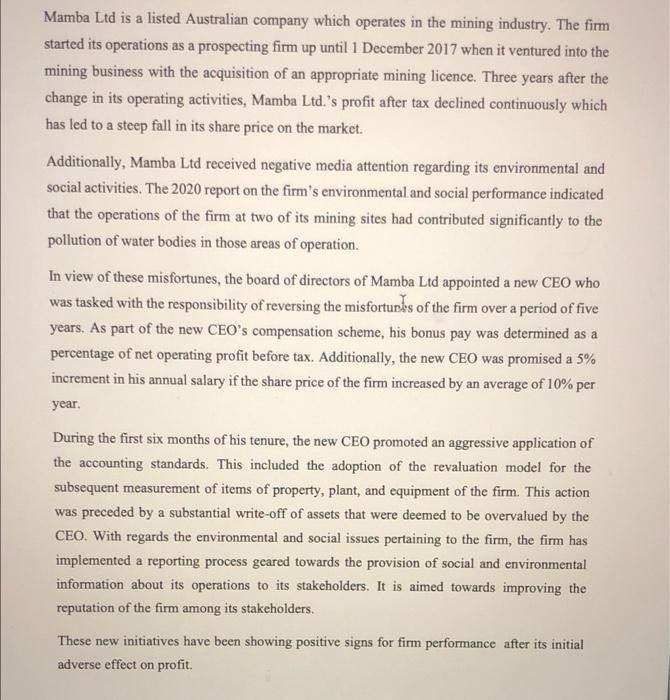

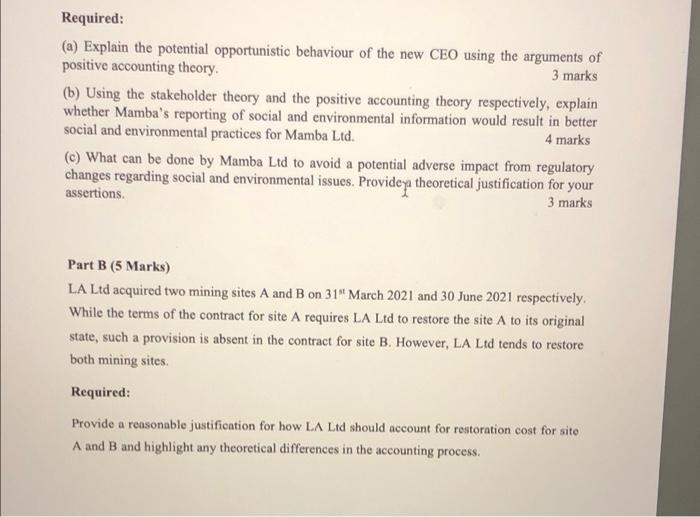

Mamba Ltd is a listed Australian company which operates in the mining industry. The firm started its operations as a prospecting firm up until 1 December 2017 when it ventured into the mining business with the acquisition of an appropriate mining licence. Three years after the change in its operating activities, Mamba Ltd.'s profit after tax declined continuously which has led to a steep fall in its share price on the market. Additionally, Mamba Ltd received negative media attention regarding its environmental and social activities. The 2020 report on the firm's environmental and social performance indicated that the operations of the firm at two of its mining sites had contributed significantly to the pollution of water bodies in those areas of operation. In view of these misfortunes, the board of directors of Mamba Ltd appointed a new CEO who was tasked with the responsibility of reversing the misfortunks of the firm over a period of five years. As part of the new CEO's compensation scheme, his bonus pay was determined as a percentage of net operating profit before tax. Additionally, the new CEO was promised a 5% increment in his annual salary if the share price of the firm increased by an average of 10% per year. During the first six months of his tenure, the new CEO promoted an aggressive application of the accounting standards. This included the adoption of the revaluation model for the subsequent measurement of items of property, plant, and equipment of the firm. This action was preceded by a substantial write-off of assets that were deemed to be overvalued by the CEO. With regards the environmental and social issues pertaining to the firm, the firm has implemented a reporting process geared towards the provision of social and environmental information about its operations to its stakcholders. It is aimed towards improving the reputation of the firm among its stakeholders. These new initiatives have been showing positive signs for firm performance after its initial adverse effect on profit. Required: (a) Explain the potential opportunistic behaviour of the new CEO using the arguments of positive accounting theory. 3 marks (b) Using the stakeholder theory and the positive accounting theory respectively, explain whether Mamba's reporting of social and environmental information would result in better social and environmental practices for Mamba Ltd. 4 marks (c) What can be done by Mamba Ltd to avoid a potential adverse impact from regulatory changes regarding social and environmental issues. Providey theoretical justification for your assertions. 3 marks Part B (5 Marks) LA Ltd acquired two mining sites A and B on 31" March 2021 and 30 June 2021 respectively. While the terms of the contract for site A requires LA Ltd to restore the site A to its original state, such a provision is absent in the contract for site B. However, LA Ltd tends to restore both mining sites. Required: Provide a reasonable justification for how LA Ltd should account for restoration cost for site A and B and highlight any theoretical differences in the accounting process.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part A a Explain the potential opportunistic behavior of the new CEO using the arguments of positive accounting theory 3 marks The potential opportunistic behavior of the new CEO can be explained by t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started