Answered step by step

Verified Expert Solution

Question

1 Approved Answer

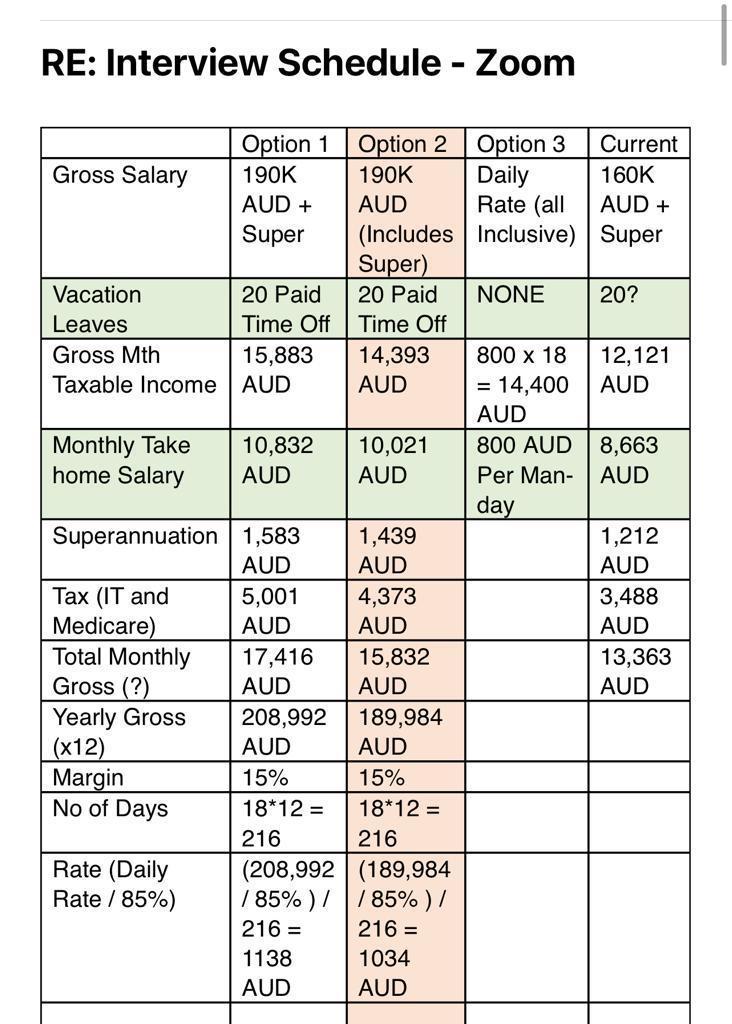

Two things : based on 195 AUD annual (includes super) a) what is the total cost to the company B) what is the net payable

Two things: based on 195 AUD annual (includes super)

a) what is the total cost to the company

B) what is the net payable to the consultant (take home)

Please answer both parts, additionally from option 2, why is the Gross Mth Taxable income AUD 14,393 and why is the total monthly cost AUD 15,832? please help to provide potential reasons.

RE: Interview Schedule - Zoom Gross Salary Vacation Leaves Gross Mth Taxable Income Monthly Take home Salary Superannuation Tax (IT and Medicare) Total Monthly Gross (?) Yearly Gross (x12) Margin No of Days Rate (Daily Rate / 85%) Option 1 190K AUD + Super 20 Paid Time Off 15,883 AUD 10,832 AUD 1,583 AUD 5,001 AUD 17,416 AUD 208,992 AUD 15% 18*12= 216 Option 2 Option 3 190K Daily AUD Rate (all Inclusive) (Includes Super) 20 Paid Time Off 14,393 AUD 10,021 AUD 1,439 AUD 4,373 AUD 15,832 AUD 189,984 AUD 15% 18*12= 216 (208,992 (189,984 / 85%) // 85% ) / 216= 216= 1138 AUD 1034 AUD NONE 800 x 18 = 14,400 AUD 800 AUD Per Man- day Current 160K AUD + Super 20? 12,121 AUD 8,663 AUD 1,212 AUD 3,488 AUD 13,363 AUD

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Two things based on 195 AUD annual includes super what is the total cost to the company The first thing you need to do is to find out the total cost to the company This includes the cost of the employ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started