Answered step by step

Verified Expert Solution

Question

1 Approved Answer

> Mamed at the age of 18, Malthe and you are now is their [mid-Sixties Marthe having Contributed to her employer's DBPP for 32

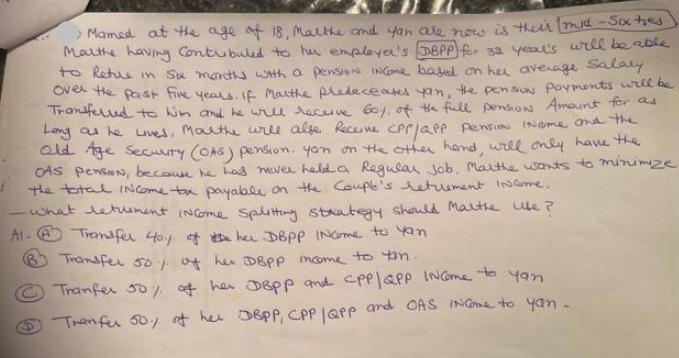

> Mamed at the age of 18, Malthe and you are now is their [mid-Sixties Marthe having Contributed to her employer's DBPP for 32 year's will be able to Reture in Six months with a pension Income based on her average Salary Over the past five years. If Marthe predeceases yan, the pension Payments will be Transferred to him and he will receive 60% of the full pension Amount for as Long as he lived. Marthe will also Receive CPP/QPP Pension income and the Old Age Security (OAS) pension, you on the other hand, will only have the OAS PensioN, because he had never held a Regular Job, Marthe wants to minimize the total income tax payable on the Couple's retirement Income. - what leturment Income Splitting strategy should Marthe life? Al-A Transfer 40% of the her DBPP INcome to yan B Transfer 50% of her DBPP income to tim. Tranfer 50% of her DBPP and CPP | QPP INCome to you. Tranfer 50% of her DBPP, CPP | QPP and OAS INCome to yan.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the taxable income for each income splitting strategy to determine which one would mini...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started