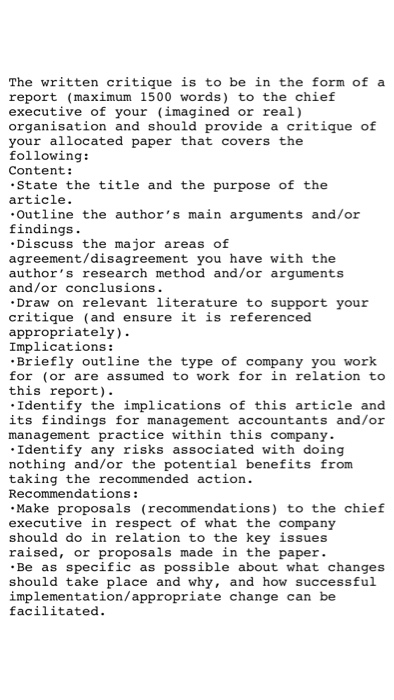

Question: Management accounting assignment: Write a critique with reference list. Please help me write something as much as you could. Analysing technology investmentsfrom NPV to Strategic

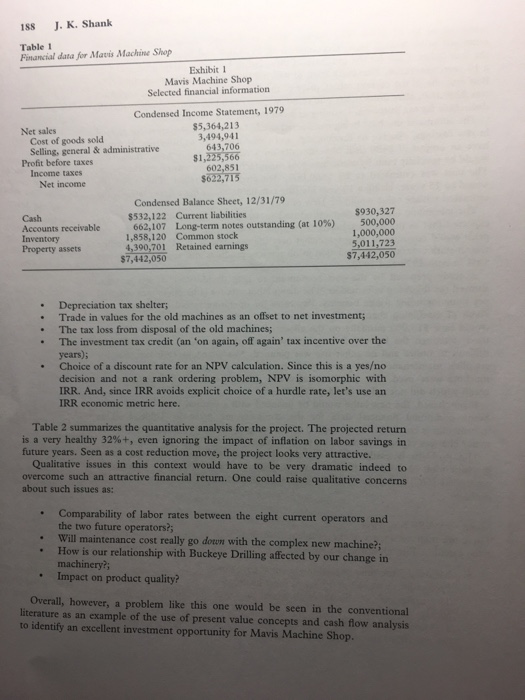

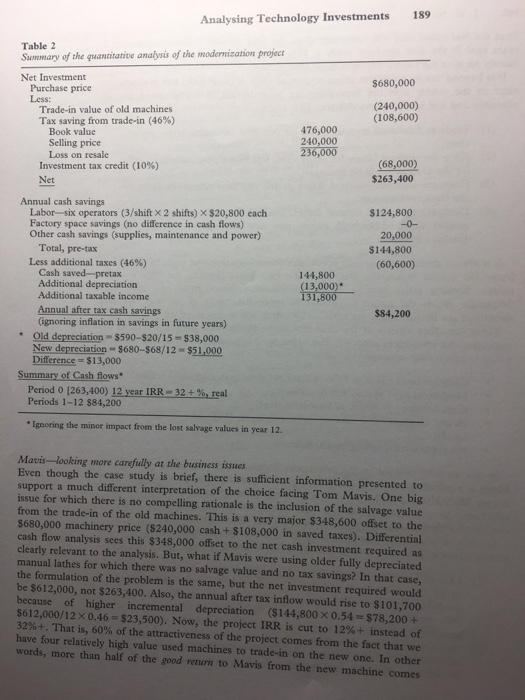

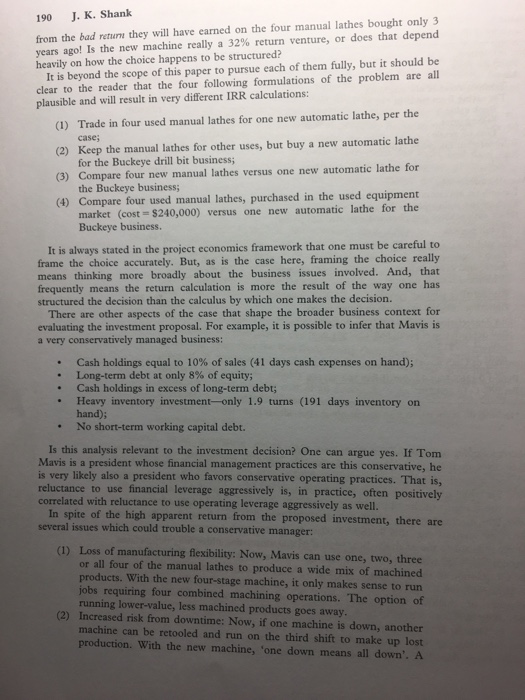

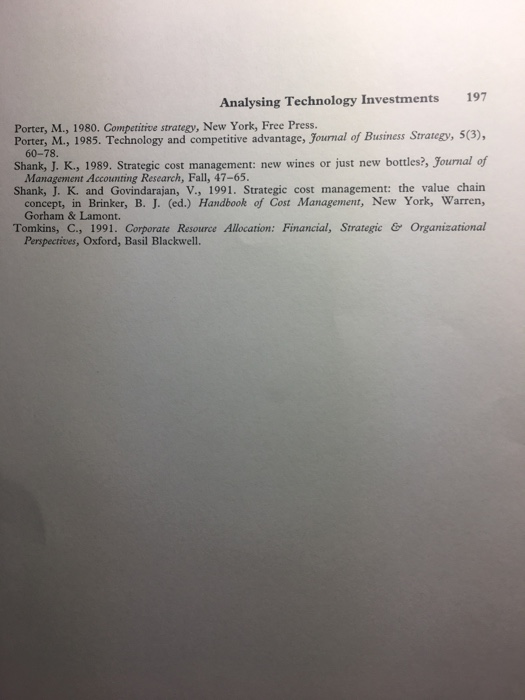

Analysing technology investmentsfrom NPV to Strategic Cost Management (SCM) John K. Shank* This paper considers the very difficult managerial challenge of evaluating potential investments in new manufacturing technology. A U.S. based case study is used to demonstrate the limitations of the conventional NPV framework and to demonstrate the role of explicit strategic analysis through the SCM framework. 1996 Academic Press Limited Key words: strategy; cost management; investment; net present value; strategic cost management; technology. 1. Introduction A frequent charge in recent years has been that many firms fall behind in global markets because they are too slow in implementing the new manufacturing technologies--CIM (Computer Integrated Manufacturing), FMS (Flexible Manu- facturing Systems), AMT (Advanced Manufacturing Technology), or the more familiar CAD, CAE, and CAM Jaikumar, 1986). A popular argument is that conventional methods of capital investment analysis do not capture the full impact of the technology-change decision. A project-level net present value (NPV) framework, it is argued, places such a premium on short-term financial results, and so little emphasis on difficult to quantify issues, such as quality enhancement or manufacturing flexibility, that major manufacturing breakthroughs do not pass the NPV test (Hayes and Abernathy, 1980). Conversely, projects which pass the test may fail a broader business strategy test. It is easy to infer from looking at the coverage afforded the topic in most textbooks that the prescribed process for evaluating capital expenditures proposals is heavily quantitative. There are clearly four steps in the process: (1) Identifying spending proposals; (2) Quantitative analysis of the incremental cash flows; (3) Qualitative issues which cannot be fitted into the cash flows calculus; and (4) Making the decision, yes or no. Step one receives virtually no attention in the formal literature proposals just appear, somehow. Step two gets nearly all of the attention. Step three is a step-child, always made to feel guilty because it can't fit into step two. Step four is assumed to flow logically out of step two. There is due consideration for the 'soft' issues in step three, but the decisions, as described in textbooks, derive largely from the quantitative analysis. * The Amos Tuck School of Business Administration, Dartmouth College, Hanover, NH 03755, U.S.A. 1044-5005/96/020185+ 13 $18.00/0 1996 Academic Press Limited 186 J. K. Shank It is the contention of this paper that judgmental issues---call them strategic considerations, if you like almost always play a far more important role than conventional frameworks allow. Often, the decision calculus at step four seems to precede step two. It is poorly articulated and seems highly subjective. Then, step two is called forth to justify and rationalize the decision which has already been made. It is widely acknowledged in the finance literature that pure NPV analysis often misses the richness of business problems (Logue and Tapley, 1985). To say that the decision seems more often to drive the choice of numbers, and not the other way around does not help us to do better. This is, of course, anathema to the analyst who wants to help make decisions, not help rationalise them. The challenge for the analyst is to frame the problem so that the strategic issues can be evaluated as explicitly and formally as the conventional cash flows. One approach is what has been called 'Strategic Cost Management (SCM)' (Shank and Govindarajan, 1991). One good way to demonstrate the SCM framework is to contrast it with the now conventional framework in a specific problem setting. The Mavis Machine Shop case works well for this purpose. 2. Mavis Machine Shop The case is set in a metalworking job shop in West Virginia, one of whose products is drill bits for oil exploration. The time is 1980, in the midst of an oil drilling boom resulting from the oil crises of 1973 and 1979. Early in 1980, Tom Mavis, President of Mavis Machine Shop was considering a project to modernize his plant facilities. The company operated out of a large converted warehouse in Salem, West Virginia. It produced assorted machined metal parts for the oil and gas drilling and production industry in the surrounding area. One of Mavis' major customers was Buckeye Drilling, Inc., which purchased specialized drill bits and replacement parts for its operations. Mavis had negotiated an annual contract with Buckeye to supply its drill bit requirements and related spare parts in each of the past 8 years. In 1978 and 1979 the requirements had been about 8400 bits per year. All Buckeye's rigs were busy. Mavis knew there were 30 rigs operating in the state in 1979, up from 17 in 1972. Wells drilled was up even more, from 679 in 1972 to 1474 last year. The arrangement of the machine shop included four large manual lathes currently devoted to the Buckeye business. Each lathe was operated by a skilled worker, and each bit required machining at all four lathes. Mavis was considering replacing these manual lathes with an automatic machine, capable of performing all four machining operations necessary for a drill bit. This machine would produce drill bits at the same rate as the four existing lathes, and would only require one operator. Instead of skill in metalworking, the job would now involve more skill in computerized automation The four existing manual lathes were 3-years-old and had cost a total of $590,000. Together they could produce 8400 drill bits on a two-shift, 5-day/week basis. The useful life of these lathes, calculated on a two-shift/day, 5-day/week basis, was This case was written by Tom Graham at the Ohio State University under the supervision of Professor John Shank. Analysing Technology Investments 187 estimated to be 15 years. The salvage value at the end of their useful life was estimated to be $5,000 each. Depreciation of $114,000 had been accumulated on the four lathes. Cash for the purchase of these lathes had been partially supplied by a 10-year, unsecured, 10% bank loan, of which $180,000 was still outstanding. The best estimate of the current selling price of the four lathes in their present condition was $240,000, after dismantling and removal costs. The loss from the sale would be deductible for tax purposes, resulting in a tax savings of 46% of the loss. The automatic machine being considered needed only one skilled operator to feed in raw castings, observe its functioning, and make necessary adjustments. It would have an output of 8400 drill bits annually on a two-shift, 5-day basis. Because it would be specially built by a machine tool manufacturer, there was no catalog price. The cost was estimated to be $680,000, delivered and installed. The useful life would be 15 years. Using a 12-year life (the remaining life of the current lathes), the estimated salvage value would be 10% of cost. The automatic lathe was first introduced in 1975 at a cost of $750,000. It was expected that as the manufacturing techniques became more generally familiar, the price would continue to drop somewhat over the next few years. This price decline was in stark contrast to the inflation in oil services products and supplies which was 18% in both 1978 and 1979. A study prepared by the cost accountant to help decide what action to take, showed the following information. The direct labor rate for lathe operations was $10 per hour including fringe benefits. Pay rates for operators would not change as a result of machining changes. The new machine would use less floor space, which would save $15,000 annually on the allocated charges for square footage of space used, although the layout of the plant was such that the freed space would be difficult to utilize and no other use was planned. Miscellaneous cash expenses for supplies, maintenance, and power would be $20,000 less per year if the automatic machine were used. The purchase price was subject to the 10% investment tax credit which did not reduce the depreciable cost. If purchased, the new lathe would be financed with a secured bank loan at 14%. Some additional financial data for the company are given in Table 1. This information is considered to be typical of the company's financial condition, with no major changes expected in the foreseeable future. The problem is easily stated should Mavis stay with the four hand-loaded machine tools or switch to the automatic machine, an early version of a numerically controlled (NC) lathe? Let's first consider the project economics approach to the problem. Marisan NPV perspective There are many elements of the problem when it is seen as an exercise in present value calculus. But, all of the elements are well known and tractable. They include: Measuring the time-phased incremental cash flows; Project life (here, 12 or 15 years, most likely); The irrelevance of the allocated space costs (no differential cash flow effect); The irrelevance of specific financing terms for the specific project (both the old 10% loan and the new 14% loan); . . Analysing Technology Investments 189 $680,000 Table 2 Summary of the quantitative analysis of the modernization project Net Investment Purchase price Less: Trade-in value of old machines Tax saving from trade-in (46%) Book value Selling price Loss on resale Investment tax credit (10%) Net (240,000) (108,600) 476,000 240,000 236,000 (68,000) $263,400 $124,800 -0- 20,000 $144,800 (60,600) Annual cash savings Labor-six operators (3/shift x 2 shifts) X $20,800 each Factory space savings (no difference in cash flows) Other cash savings (supplies, maintenance and power) Total, pre-tax Less additional taxes (46%) Cash saved-pretas Additional depreciation Additional taxable income Annual after tax cash savings (ignoring inflation in savings in future years) Old depreciation - $590-$20/15 - $38,000 New depreciation - $680-$68/12 - $51,000 Difference = $13,000 Summary of Cash flows Period 0 (263,400) 12 year IRR - 32+%, real Periods 1-12 $84,200 144,800 (13,000) 131,800 $84,200 Ignoring the minor impact from the lost salvage values in year 12. Mavis-looking more carefully at the business issues Even though the case study is brief, there is sufficient information presented to support a much different interpretation of the choice facing Tom Mavis. One big issue for which there is no compelling rationale is the inclusion of the salvage value from the trade-in of the old machines. This is a very major $348,600 offset to the $680,000 machinery price ($240,000 cash + $108,000 in saved taxes). Differential cash flow analysis sees this $348,000 offset to the net cash investment required as clearly relevant to the analysis. But, what if Mavis were using older fully depreciated manual lathes for which there was no salvage value and no tax savings? In that case, the formulation of the problem is the same, but the net investment required would be $612,000, not $263,400. Also, the annual after tax inflow would rise to $101,700 because of higher incremental depreciation ($144,800 X 0.54 = $78,200 + $612,000/12 X 0.46 = $23,500). Now, the project IRR is cut to 12% + instead of 32%+. That is, 60% of the attractiveness of the project comes from the fact that we have four relatively high value used machines to trade-in on the new one. In other words, more than half of the good rearn to Mavis from the new machine comes 190 J. K. Shank from the bad return they will have earned on the four manual lathes bought only 3 years ago! Is the new machine really a 32% return venture, or does that depend heavily on how the choice happens to be structured? It is beyond the scope of this paper to pursue each of them fully, but it should be clear to the reader that the four following formulations of the problem are all plausible and will result in very different IRR calculations: (1) Trade in four used manual lathes for one new automatic lathe, per the case; (2) Keep the manual lathes for other uses, but buy a new automatic lathe for the Buckeye drill bit business; (3) Compare four new manual lathes versus one new automatic lathe for the Buckeye business; (4) Compare four used manual lathes, purchased in the used equipment market (cost=$240,000) versus one new automatic lathe for the Buckeye business. It is always stated in the project economics framework that one must be careful to frame the choice accurately. But, as is the case here, framing the choice really means thinking more broadly about the business issues involved. And, that frequently means the return calculation is more the result of the way one has structured the decision than the calculus by which one makes the decision. There are other aspects of the case that shape the broader business context for evaluating the investment proposal. For example, it is possible to infer that Mavis is a very conservatively managed business: Cash holdings equal to 10% of sales (41 days cash expenses on hand); Long-term debt at only 8% of equity; Cash holdings in excess of long-term debt; Heavy inventory investment-only 1.9 turns (191 days inventory on hand); No short-term working capital debt. Is this analysis relevant to the investment decision? One can argue yes. If Tom Mavis is a president whose financial management practices are this conservative, he is very likely also a president who favors conservative operating practices. That is, reluctance to use financial leverage aggressively is, in practice, often positively correlated with reluctance to use operating leverage aggressively as well. In spite of the high apparent return from the proposed investment, there are several issues which could trouble a conservative manager: (1) Loss of manufacturing flexibility: Now, Mavis can use one, two, three or all four of the manual lathes to produce a wide mix of machined products. With the new four-stage machine, it only makes sense to run jobs requiring four combined machining operations. The option of running lower-value, less machined products goes away. (2) Increased risk from downtime: Now, if one machine is down, another machine can be retooled and run on the third shift to make up lost production. With the new machine, "one down means all down'. A 191 Analysing Technology Investments lost shift of production is much more difficult to make up. Thus the shop becomes much more dependent on its maintenance crew, with little room for problems. And, the maintenance job changes from a mechanical focus to an electronic focus. (3) Changed emphasis in the 'selling' job. With the new machine, Mavis will no longer have the option to sell a wide mix of simpler or more complex machining jobs, depending on business conditions. In the future, it must sell complex machining jobs that require four combined operations in order to fully utilize the new technology. (4) A forced reduction in the workforce: Mavis must fire at least six employees out of a workforce that probably includes no more than 50 or 60 machinists (industry averages are 20% of sales in labor cost, at $20,800 per machinist). Perhaps Mavis must fire eight and then add two new computer-trained operators. What is the impact of this move on labor morale? What is the resulting impact on manufacturing quality and productivity? (5) Negative impact on reported financial results: The proposal involves an after-tax loss of $127,000 on the disposal of the four manual lathes. This is clearly irrelevant in the project economics context. But, many managers worry more about such 'sunk costs' than economists believe they should. Reported profit is the best benchmark we have of the overall success of the business from year to year. Mr Mavis must sell $1,100,000 worth of new business (20% of current sales) to make up that loss, at current margins. Growth trends in profitability will be destroyed. (6) Why now and not 3 years ago?: Isn't it likely that Mr Mavis was also responsible for purchasing the four manual lathes 3 years ago? It isn't necessarily clear that the loss from selling them now, much earlier than planned, is 'irrelevant in judging his managerial acumen. Why has he changed his mind so quickly about an appropriate machinery con- figuration? What was the cost of an automatic lathe 3 years ago when $590,000 was invested? Weren't the same labor savings available then, if labor is seen as fungible? Has anything really changed in the intervening 3 years? Overall, these qualitative issues can be considered a 'strategic context' for evaluating the investment proposal. Mavis must balance the excellent expected financial return, based on the project economics perspective, against the change in his strategic position and in his strategic capabilities as depicted in Figure 1. This choice is clearly a 'strategic desision for Tom Mavis. Perhaps the company does need a strategic reassessment, given its low ROE and its poorly managed balance sheet: Excess inventory accumulation (1.9 inventory turn versus a world class figure of 15 or more); Low utilization of plant assets (the sales to net property assets ratio of 1.25 is well below industry norms); Underutilization of debt, according to modern theories of financial leverage, considering the full tax deductibility of interest in the U.S. . 192 J. K. Shank Loss of manufacturing flexibility Heaver reliance on maintenance Chage from mechanical to electronic maintenance .lange to a different selling emphasis Fire & workers, out of a small workforce Publicly acknowledge an investment mistake 3 years ago Excellent financial return, per assumptions made in the case Figure 1. The strategic calculus for the proposal But, a strategic realignment should be addressed directly, rather than obliquely in the guise of a proposal masquerading as a cost saving tactical move. The key strategic issue here is to decide which is more critical for the future of Mavis Machine Shop: Keeping up with the moving cutting edge of technology in machine tools-NC machines; Staying with 'lower tech' machines but a higher skilled workforce for special machining jobs, with more flexibility, In the context of this case, the NC machine is much less flexible because it performs four machining functions at once. Typically, when functionality is not an issue, NC machines are much more flexible than manual machines because of the virtual elimination of costly set-up and re-tooling time. Should Tom Mavis begin to experiment with NC machines, cutting back his labor force and focusing on more complex machining jobs? Or, should he stick with his less complicated manual machines and his cadre of skilled machinists and tool makers, seeking a niche in labor-intensive special machining jobs? This was a very real choice for a small job-order machine shop in 1980. Tom Mavis' business was earning very high margins (23% of sales, pretax, fully absorbed) with its labor-intensive, manual machine tools. Its ROE, at 10%, was only modest. But, this was largely due to a very conservative financial structure. If Mavis were to borrow $2.5 million at 12% and pay a comparable dividend out of retained earnings, he would boost the ROE to a much more respectable 13.1% (5623,000 - $300,000 x 0.54)/(6,012,000 - 2,500,000) - $461,000/$3,512,000). Staying with the current strategy might well be the best idea for him. But, the times (1980) were certainly conducive to earning unusually high returns in a small machine shop like his. The boom in the oil drilling business in West Virginia meant fat margins for suppliers to the drilling industry. Even though prices for drilling supplies and equipment were rising at 18% per year, drillers were eager to pay the higher prices because oil revenues were rising even faster. Perhaps this 193 Analysing Technology Investments was an excellent time for Tom Mavis to move upscale, technologically, and reduce his reliance on labor costs which were sure to rise steadily with the booming oil economy. Changing Inis strategy now might well be the best idea for him. There is an obvious contrast between these two conclusions, both of which are based on plausible interpretation of case 'facts'. The problem with the line of reasoning presented here is that it does not seem to yield any clear conclusion. It is much richer in business logic and strategic context than the project economics perspective in the preceding section. But, it lacks a clear overarching theme. As Tomkins (1991, p. 165) has argued: A checklist of some strategic factors which may be relevant is not good enough. The appropriate factors and their relative weights can only be determined through a conceptual model of the marketplace." The final section of the paper presents a framework directed at this challenge- SCM Matis-the SCM perspective The SCM perspective, first proposed by Shank (1989), involves three key themes that are taken from the strategic management literature: (1) Value chain analysis; (2) Cost driver analysis; (3) Competitive advantage analysis. Each of the three represents a stream of research and analysis about strategy in which cost information is viewed differently from the way it is viewed in conventional management accounting. Blending the three themes represents the most powerful way to focus cost analysis for strategic choices-Strategic Cost Management. Each is a necessary component of the SCM analysis, but a sufficient analysis must involve all three. Let's consider in turn each of the three components of the SCM perspective as it applies to Mavis' choice of machining technology, starting with the value chain component. Value chain analysis. In the SCM framework, managing costs effectively requires a broad focus, external to the firm. Porter (1985) has termed this perspective the value chain. The value chain for any firm in any business is the linked set of value-creating activities from basic raw materials (starting ultimately with the periodic table of the elements) through to component suppliers, to the ultimate end-use product delivered to the consumers, and perhaps through recycling to the beginning of a new value chain cycle. The external focus sees each firm in the context of the overall chain of value-creating activities of which it is only a part. There are no firms that span the entire value chain in which they participate. Value chain analysis is contrasted with value-added analysis, which starts with payments to suppliers (purchases) and stops with charges to customers (sales), while focusing on maximizing the difference, the value added (sales minus purchases) for the firm. Value-added analysis starts too late and stops too soon. It is far too narrow a view because it misses the importance of linkages upstream and downstream in the value chain. In the CIM context, the principal benefits of new investment may well fall elsewhere in the value chain than where the investment itself takes place. 194 J. K. Shank For Mavis, the NC machine basically ties the firm more closely to its principal customer (Buckeye Drilling). Unless Mavis is prepared to drop Buckeye and seek other customers who need parts requiring four linked machining operations, it will become more dependent on Buckeye's orders. It is thus likely that Buckeye will capture part of the cost savings via lower selling prices. Also, when dealing with other customers, Mavis will have much less flexibility, as noted earlier. Also, the reduction in labor intensity with the NC machine means Mavis will be tied more closely to its principle castings suppliers. Quality of incoming raw castings is now more critical because of the automation of the machining process. In short, a value chain perspective clearly suggests that Mavis loses both buyer power and seller power as a result of the new investment. The firm becomes more dependent both up and down its value chain. For a small job-shop which relies heavily on its ability to change product mix as business conditions change, this is one major weakness in the NC machine proposal. But, does the impact on cost drivers offset this concern? Cost driver analysis. In conventional management accounting, there is only one cost driver. Unit cost changes are seen largely as a function of volume changes. Examples of management accounting concepts that hinge on volume as the cost driver include fixed versus variable cost, average versus marginal cost, cost-volume- profit analysis, break-even analysis, flexible budgets, and contribution margin, to name a few. In SCM, output volume per se is seen to capture very little of the richness of cost 'behavior'. In this regard, SCM draws much less on the simple models of basic microeconomics and much more on the richer models of the economics of industrial organization. There are 'structural cost drivers that relate to the firm's explicit strategic choices regarding economic structure such as scale, product-line complexity, scope of operations (vertical integration), or experience (learning). Technology investments also represent structural choices about how to compete. There are also executional cost drivers that are major determinants of a firm's cost position and hinge on its ability to execute successfully within the economic structure it chooses. Whereas structural cost drivers are not monotonically scaled with performance, executional cost drivers typically are. That is, for each of the structural drivers more is not always better. There are potential diseconomies of scale and vertical scope, as well as potential economies. A more complex product line is not necessarily better or worse than a less complex line. Too much experience can be as bad as too little in a dynamic environment. For example, Texas Instruments emphasized the learning curve and became the world's lowest-cost producer of obsolete 8K microchips! Technological 'leadership' versus 'follower- ship' is a legitimate choice for most firms. In contrast, for each of the executional drivers, more is almost always better. The list of potentially important executional drivers includes at least these: Workforce involvement (participative management); Workforce commitment to continuous improvement (kaizen); Adherence to Total Quality Management concepts; Utilization of effective capacity (given the scale choices on plant construction); Efficiency of production flow layout; Effectiveness of product design or formulation; . 195 Analysing Technology Investments Exploiting linkages with suppliers and customers all along the value chain. While it may not always be true that a higher level for these executional factors improves cost position, the examples of diseconomies are far less frequent than for structural drivers. Does explicit attention to the underlying cost drivers support or refute the new investment for Mavis? That is, in addition to value chain issues, is technology choice an important enough cost driver for Mavis to justify a basic change in manufactur- ing? How important is technology choice compared to other cost drivers? Of the structural drivers, scale does not prove to be very important in this context. Minimum efficient scale for job shops is quite small. It is an industry of many small players. Vertical scope also yields no economies in this context. In fact, because the small job shop avoids the wage rates and work practices in larger firms, there are actually diseconomies of vertical scope. Learning, however, is a major cost driver with conventional machining. Workers learn the job very slowly and high labor turnover generates a significant cost disadvantage. Learning is a very important issue with conventional machines because high labor turnover can destroy many of the benefits of the specialty niche. In fact, in cost driver terms, the choice for Mavis can be dramatized as technology versus 'learning'. This contrast dominates the other structural drivers. The executional drivers are not really impacted by the choice. To see which driver should dominate Mavis' strategy, let's turn to the third major SCM theme. Competitive advantage analysis. In the SCM perspective, understanding the implica- tions of how the firm chooses to compete is fully as important for cost analysis as understanding the value chain and the key strategic cost drivers at critical steps in the chain. As discussed by Porter (1980), the basic choice on how to compete is between cost leadership and differentiation. (1) Low cost. The primary focus in this strategy is to achieve low cost relative to competitors. Cost leadership can be achieved through approaches such as economies of scale in production, learning curve effects, tight cost control, or cost minimization in areas such as R&D, service, sales force, or advertising. Examples of firms that have followed this strategy include: Texas Instruments in consumer electron- ics, Emerson Electric in electric motors, Hyundai in automobiles, Briggs & Stratton in gasoline engines, Black & Decker in machine tools, and Commodore in business machines. (2) Differentiation. The primary focus in this strategy is to differentiate the product offering of the business unit, creating something that is perceived by customers unique. Approaches to product differentiation include: brand loyalty (Coca-Cola in soft drinks), superior customer service (Nordstrom in retailing), dealer network (Caterpillar in construction equipment), product design and product features (Hecolett-Packard in instruments), and product technology (Coleman in camping equipment). as How this choice affects cost management for a firm is discussed by Shank 196 J. K. Shank (1989). Current thinking presumes that cost position and differentiation are more complementary than competing strategies. And, certainly, competition is dynamic as business conditions change. But, explicit attention to competitive positioning in cost analysis is still as critical today as it was when Porter wrote 15 years ago. Because of Mavis' small size, it is very unlikely to achieve cost leadership for high volume business. Cost leadership is very likely to be won by much larger firms that move from a job shop framework to batch manufacturing for higher volume products. The trick for Mavis is to compete in small niches where special features, high quality, and quick turnaround (tied to low fixed asset utilization, as a policy) dominate the buyers' choice process. In this context, trading off labor expertise for the lower cost (but also lower flexibility) of the four-state automatic lathe seems clearly unwise. Thus, competitive positioning arguments here seem to reinforce the value chain arguments in supporting learning as a more critical cost driver for Mavis than NC technology. The conclusion is that the SCM view does present a clear vision of the impact of the proposed investment on Mavis' position in its marketplace. In contrast to the positive conclusion from the project economics perspective, and the ambivalent conclusion from a general discussion of strategic issues, the SCM perspective clearly suggests a negative response. 3. Conclusion This paper is based on only one example a sample of one'. In that sense it does not really permit any systematic generalizations. And, no generalizations will be asserted. Rather, the intent is to illustrate a different framework and to show one example in which that framework is argued to be superior. The Mavis case demonstrates the limitations of conventional financial analysis for evaluating technology investment opportunities. The project economics paradigm does not really catch the richness of the problem. By definition, no one should invest in negative present value projects. But we see NPV more as a constraint than a decision tool. Also, NPV is more often driven by the way the decision is framed, rather than being the driver of the decision. The study is a useful example of how the Strategic Cost Management framework provides a more comprehensive way to apply the power of cost analysis concepts to technology investment opportunities within a fully articulated strategic context. Clearly, one essential step in the effective management of technology change is effective analysis of the investment opportunities. It is argued here that Strategic Cost Management is a useful way to structure the analysis of such opportunities for Mavis Machine Shop and thus represents an important component of technology management for this firm. References Hayes, R. and Abernathy, W., 1980. Managing our way to economic decline, Harvard Business Revietu, 58(4), 67-77. Jaikumar, R., 1986. Postindustrial manufacturing, Harvard Business Review, 86(6), 69-76. Logue, D. and Tapley, C. T., 1985. Performance monitoring and the timing of cash flows, Financial Management, 14(3), 34-39. Analysing Technology Investments 197 Porter, M., 1980. Competitive strategy, New York, Free Press. Porter, M., 1985. Technology and competitive advantage, Journal of Business Strategy, 5(3), 60-78. Shank, J. K., 1989. Strategic cost management: new wines or just new bottles?, Journal of Management Accounting Research, Fall, 47-65. Shank, J. K. and Govindarajan, V., 1991. Strategic cost management: the value chain concept, in Brinker, B. J. (ed.) Handbook of Cost Management, New York, Warren, Gorham & Lamont. Tomkins, C., 1991. Corporate Resource Allocation: Financial, Strategic & Organizational Perspectives, Oxford, Basil Blackwell, Analysing technology investmentsfrom NPV to Strategic Cost Management (SCM) John K. Shank* This paper considers the very difficult managerial challenge of evaluating potential investments in new manufacturing technology. A U.S. based case study is used to demonstrate the limitations of the conventional NPV framework and to demonstrate the role of explicit strategic analysis through the SCM framework. 1996 Academic Press Limited Key words: strategy; cost management; investment; net present value; strategic cost management; technology. 1. Introduction A frequent charge in recent years has been that many firms fall behind in global markets because they are too slow in implementing the new manufacturing technologies--CIM (Computer Integrated Manufacturing), FMS (Flexible Manu- facturing Systems), AMT (Advanced Manufacturing Technology), or the more familiar CAD, CAE, and CAM Jaikumar, 1986). A popular argument is that conventional methods of capital investment analysis do not capture the full impact of the technology-change decision. A project-level net present value (NPV) framework, it is argued, places such a premium on short-term financial results, and so little emphasis on difficult to quantify issues, such as quality enhancement or manufacturing flexibility, that major manufacturing breakthroughs do not pass the NPV test (Hayes and Abernathy, 1980). Conversely, projects which pass the test may fail a broader business strategy test. It is easy to infer from looking at the coverage afforded the topic in most textbooks that the prescribed process for evaluating capital expenditures proposals is heavily quantitative. There are clearly four steps in the process: (1) Identifying spending proposals; (2) Quantitative analysis of the incremental cash flows; (3) Qualitative issues which cannot be fitted into the cash flows calculus; and (4) Making the decision, yes or no. Step one receives virtually no attention in the formal literature proposals just appear, somehow. Step two gets nearly all of the attention. Step three is a step-child, always made to feel guilty because it can't fit into step two. Step four is assumed to flow logically out of step two. There is due consideration for the 'soft' issues in step three, but the decisions, as described in textbooks, derive largely from the quantitative analysis. * The Amos Tuck School of Business Administration, Dartmouth College, Hanover, NH 03755, U.S.A. 1044-5005/96/020185+ 13 $18.00/0 1996 Academic Press Limited 186 J. K. Shank It is the contention of this paper that judgmental issues---call them strategic considerations, if you like almost always play a far more important role than conventional frameworks allow. Often, the decision calculus at step four seems to precede step two. It is poorly articulated and seems highly subjective. Then, step two is called forth to justify and rationalize the decision which has already been made. It is widely acknowledged in the finance literature that pure NPV analysis often misses the richness of business problems (Logue and Tapley, 1985). To say that the decision seems more often to drive the choice of numbers, and not the other way around does not help us to do better. This is, of course, anathema to the analyst who wants to help make decisions, not help rationalise them. The challenge for the analyst is to frame the problem so that the strategic issues can be evaluated as explicitly and formally as the conventional cash flows. One approach is what has been called 'Strategic Cost Management (SCM)' (Shank and Govindarajan, 1991). One good way to demonstrate the SCM framework is to contrast it with the now conventional framework in a specific problem setting. The Mavis Machine Shop case works well for this purpose. 2. Mavis Machine Shop The case is set in a metalworking job shop in West Virginia, one of whose products is drill bits for oil exploration. The time is 1980, in the midst of an oil drilling boom resulting from the oil crises of 1973 and 1979. Early in 1980, Tom Mavis, President of Mavis Machine Shop was considering a project to modernize his plant facilities. The company operated out of a large converted warehouse in Salem, West Virginia. It produced assorted machined metal parts for the oil and gas drilling and production industry in the surrounding area. One of Mavis' major customers was Buckeye Drilling, Inc., which purchased specialized drill bits and replacement parts for its operations. Mavis had negotiated an annual contract with Buckeye to supply its drill bit requirements and related spare parts in each of the past 8 years. In 1978 and 1979 the requirements had been about 8400 bits per year. All Buckeye's rigs were busy. Mavis knew there were 30 rigs operating in the state in 1979, up from 17 in 1972. Wells drilled was up even more, from 679 in 1972 to 1474 last year. The arrangement of the machine shop included four large manual lathes currently devoted to the Buckeye business. Each lathe was operated by a skilled worker, and each bit required machining at all four lathes. Mavis was considering replacing these manual lathes with an automatic machine, capable of performing all four machining operations necessary for a drill bit. This machine would produce drill bits at the same rate as the four existing lathes, and would only require one operator. Instead of skill in metalworking, the job would now involve more skill in computerized automation The four existing manual lathes were 3-years-old and had cost a total of $590,000. Together they could produce 8400 drill bits on a two-shift, 5-day/week basis. The useful life of these lathes, calculated on a two-shift/day, 5-day/week basis, was This case was written by Tom Graham at the Ohio State University under the supervision of Professor John Shank. Analysing Technology Investments 187 estimated to be 15 years. The salvage value at the end of their useful life was estimated to be $5,000 each. Depreciation of $114,000 had been accumulated on the four lathes. Cash for the purchase of these lathes had been partially supplied by a 10-year, unsecured, 10% bank loan, of which $180,000 was still outstanding. The best estimate of the current selling price of the four lathes in their present condition was $240,000, after dismantling and removal costs. The loss from the sale would be deductible for tax purposes, resulting in a tax savings of 46% of the loss. The automatic machine being considered needed only one skilled operator to feed in raw castings, observe its functioning, and make necessary adjustments. It would have an output of 8400 drill bits annually on a two-shift, 5-day basis. Because it would be specially built by a machine tool manufacturer, there was no catalog price. The cost was estimated to be $680,000, delivered and installed. The useful life would be 15 years. Using a 12-year life (the remaining life of the current lathes), the estimated salvage value would be 10% of cost. The automatic lathe was first introduced in 1975 at a cost of $750,000. It was expected that as the manufacturing techniques became more generally familiar, the price would continue to drop somewhat over the next few years. This price decline was in stark contrast to the inflation in oil services products and supplies which was 18% in both 1978 and 1979. A study prepared by the cost accountant to help decide what action to take, showed the following information. The direct labor rate for lathe operations was $10 per hour including fringe benefits. Pay rates for operators would not change as a result of machining changes. The new machine would use less floor space, which would save $15,000 annually on the allocated charges for square footage of space used, although the layout of the plant was such that the freed space would be difficult to utilize and no other use was planned. Miscellaneous cash expenses for supplies, maintenance, and power would be $20,000 less per year if the automatic machine were used. The purchase price was subject to the 10% investment tax credit which did not reduce the depreciable cost. If purchased, the new lathe would be financed with a secured bank loan at 14%. Some additional financial data for the company are given in Table 1. This information is considered to be typical of the company's financial condition, with no major changes expected in the foreseeable future. The problem is easily stated should Mavis stay with the four hand-loaded machine tools or switch to the automatic machine, an early version of a numerically controlled (NC) lathe? Let's first consider the project economics approach to the problem. Marisan NPV perspective There are many elements of the problem when it is seen as an exercise in present value calculus. But, all of the elements are well known and tractable. They include: Measuring the time-phased incremental cash flows; Project life (here, 12 or 15 years, most likely); The irrelevance of the allocated space costs (no differential cash flow effect); The irrelevance of specific financing terms for the specific project (both the old 10% loan and the new 14% loan); . . Analysing Technology Investments 189 $680,000 Table 2 Summary of the quantitative analysis of the modernization project Net Investment Purchase price Less: Trade-in value of old machines Tax saving from trade-in (46%) Book value Selling price Loss on resale Investment tax credit (10%) Net (240,000) (108,600) 476,000 240,000 236,000 (68,000) $263,400 $124,800 -0- 20,000 $144,800 (60,600) Annual cash savings Labor-six operators (3/shift x 2 shifts) X $20,800 each Factory space savings (no difference in cash flows) Other cash savings (supplies, maintenance and power) Total, pre-tax Less additional taxes (46%) Cash saved-pretas Additional depreciation Additional taxable income Annual after tax cash savings (ignoring inflation in savings in future years) Old depreciation - $590-$20/15 - $38,000 New depreciation - $680-$68/12 - $51,000 Difference = $13,000 Summary of Cash flows Period 0 (263,400) 12 year IRR - 32+%, real Periods 1-12 $84,200 144,800 (13,000) 131,800 $84,200 Ignoring the minor impact from the lost salvage values in year 12. Mavis-looking more carefully at the business issues Even though the case study is brief, there is sufficient information presented to support a much different interpretation of the choice facing Tom Mavis. One big issue for which there is no compelling rationale is the inclusion of the salvage value from the trade-in of the old machines. This is a very major $348,600 offset to the $680,000 machinery price ($240,000 cash + $108,000 in saved taxes). Differential cash flow analysis sees this $348,000 offset to the net cash investment required as clearly relevant to the analysis. But, what if Mavis were using older fully depreciated manual lathes for which there was no salvage value and no tax savings? In that case, the formulation of the problem is the same, but the net investment required would be $612,000, not $263,400. Also, the annual after tax inflow would rise to $101,700 because of higher incremental depreciation ($144,800 X 0.54 = $78,200 + $612,000/12 X 0.46 = $23,500). Now, the project IRR is cut to 12% + instead of 32%+. That is, 60% of the attractiveness of the project comes from the fact that we have four relatively high value used machines to trade-in on the new one. In other words, more than half of the good rearn to Mavis from the new machine comes 190 J. K. Shank from the bad return they will have earned on the four manual lathes bought only 3 years ago! Is the new machine really a 32% return venture, or does that depend heavily on how the choice happens to be structured? It is beyond the scope of this paper to pursue each of them fully, but it should be clear to the reader that the four following formulations of the problem are all plausible and will result in very different IRR calculations: (1) Trade in four used manual lathes for one new automatic lathe, per the case; (2) Keep the manual lathes for other uses, but buy a new automatic lathe for the Buckeye drill bit business; (3) Compare four new manual lathes versus one new automatic lathe for the Buckeye business; (4) Compare four used manual lathes, purchased in the used equipment market (cost=$240,000) versus one new automatic lathe for the Buckeye business. It is always stated in the project economics framework that one must be careful to frame the choice accurately. But, as is the case here, framing the choice really means thinking more broadly about the business issues involved. And, that frequently means the return calculation is more the result of the way one has structured the decision than the calculus by which one makes the decision. There are other aspects of the case that shape the broader business context for evaluating the investment proposal. For example, it is possible to infer that Mavis is a very conservatively managed business: Cash holdings equal to 10% of sales (41 days cash expenses on hand); Long-term debt at only 8% of equity; Cash holdings in excess of long-term debt; Heavy inventory investment-only 1.9 turns (191 days inventory on hand); No short-term working capital debt. Is this analysis relevant to the investment decision? One can argue yes. If Tom Mavis is a president whose financial management practices are this conservative, he is very likely also a president who favors conservative operating practices. That is, reluctance to use financial leverage aggressively is, in practice, often positively correlated with reluctance to use operating leverage aggressively as well. In spite of the high apparent return from the proposed investment, there are several issues which could trouble a conservative manager: (1) Loss of manufacturing flexibility: Now, Mavis can use one, two, three or all four of the manual lathes to produce a wide mix of machined products. With the new four-stage machine, it only makes sense to run jobs requiring four combined machining operations. The option of running lower-value, less machined products goes away. (2) Increased risk from downtime: Now, if one machine is down, another machine can be retooled and run on the third shift to make up lost production. With the new machine, "one down means all down'. A 191 Analysing Technology Investments lost shift of production is much more difficult to make up. Thus the shop becomes much more dependent on its maintenance crew, with little room for problems. And, the maintenance job changes from a mechanical focus to an electronic focus. (3) Changed emphasis in the 'selling' job. With the new machine, Mavis will no longer have the option to sell a wide mix of simpler or more complex machining jobs, depending on business conditions. In the future, it must sell complex machining jobs that require four combined operations in order to fully utilize the new technology. (4) A forced reduction in the workforce: Mavis must fire at least six employees out of a workforce that probably includes no more than 50 or 60 machinists (industry averages are 20% of sales in labor cost, at $20,800 per machinist). Perhaps Mavis must fire eight and then add two new computer-trained operators. What is the impact of this move on labor morale? What is the resulting impact on manufacturing quality and productivity? (5) Negative impact on reported financial results: The proposal involves an after-tax loss of $127,000 on the disposal of the four manual lathes. This is clearly irrelevant in the project economics context. But, many managers worry more about such 'sunk costs' than economists believe they should. Reported profit is the best benchmark we have of the overall success of the business from year to year. Mr Mavis must sell $1,100,000 worth of new business (20% of current sales) to make up that loss, at current margins. Growth trends in profitability will be destroyed. (6) Why now and not 3 years ago?: Isn't it likely that Mr Mavis was also responsible for purchasing the four manual lathes 3 years ago? It isn't necessarily clear that the loss from selling them now, much earlier than planned, is 'irrelevant in judging his managerial acumen. Why has he changed his mind so quickly about an appropriate machinery con- figuration? What was the cost of an automatic lathe 3 years ago when $590,000 was invested? Weren't the same labor savings available then, if labor is seen as fungible? Has anything really changed in the intervening 3 years? Overall, these qualitative issues can be considered a 'strategic context' for evaluating the investment proposal. Mavis must balance the excellent expected financial return, based on the project economics perspective, against the change in his strategic position and in his strategic capabilities as depicted in Figure 1. This choice is clearly a 'strategic desision for Tom Mavis. Perhaps the company does need a strategic reassessment, given its low ROE and its poorly managed balance sheet: Excess inventory accumulation (1.9 inventory turn versus a world class figure of 15 or more); Low utilization of plant assets (the sales to net property assets ratio of 1.25 is well below industry norms); Underutilization of debt, according to modern theories of financial leverage, considering the full tax deductibility of interest in the U.S. . 192 J. K. Shank Loss of manufacturing flexibility Heaver reliance on maintenance Chage from mechanical to electronic maintenance .lange to a different selling emphasis Fire & workers, out of a small workforce Publicly acknowledge an investment mistake 3 years ago Excellent financial return, per assumptions made in the case Figure 1. The strategic calculus for the proposal But, a strategic realignment should be addressed directly, rather than obliquely in the guise of a proposal masquerading as a cost saving tactical move. The key strategic issue here is to decide which is more critical for the future of Mavis Machine Shop: Keeping up with the moving cutting edge of technology in machine tools-NC machines; Staying with 'lower tech' machines but a higher skilled workforce for special machining jobs, with more flexibility, In the context of this case, the NC machine is much less flexible because it performs four machining functions at once. Typically, when functionality is not an issue, NC machines are much more flexible than manual machines because of the virtual elimination of costly set-up and re-tooling time. Should Tom Mavis begin to experiment with NC machines, cutting back his labor force and focusing on more complex machining jobs? Or, should he stick with his less complicated manual machines and his cadre of skilled machinists and tool makers, seeking a niche in labor-intensive special machining jobs? This was a very real choice for a small job-order machine shop in 1980. Tom Mavis' business was earning very high margins (23% of sales, pretax, fully absorbed) with its labor-intensive, manual machine tools. Its ROE, at 10%, was only modest. But, this was largely due to a very conservative financial structure. If Mavis were to borrow $2.5 million at 12% and pay a comparable dividend out of retained earnings, he would boost the ROE to a much more respectable 13.1% (5623,000 - $300,000 x 0.54)/(6,012,000 - 2,500,000) - $461,000/$3,512,000). Staying with the current strategy might well be the best idea for him. But, the times (1980) were certainly conducive to earning unusually high returns in a small machine shop like his. The boom in the oil drilling business in West Virginia meant fat margins for suppliers to the drilling industry. Even though prices for drilling supplies and equipment were rising at 18% per year, drillers were eager to pay the higher prices because oil revenues were rising even faster. Perhaps this 193 Analysing Technology Investments was an excellent time for Tom Mavis to move upscale, technologically, and reduce his reliance on labor costs which were sure to rise steadily with the booming oil economy. Changing Inis strategy now might well be the best idea for him. There is an obvious contrast between these two conclusions, both of which are based on plausible interpretation of case 'facts'. The problem with the line of reasoning presented here is that it does not seem to yield any clear conclusion. It is much richer in business logic and strategic context than the project economics perspective in the preceding section. But, it lacks a clear overarching theme. As Tomkins (1991, p. 165) has argued: A checklist of some strategic factors which may be relevant is not good enough. The appropriate factors and their relative weights can only be determined through a conceptual model of the marketplace." The final section of the paper presents a framework directed at this challenge- SCM Matis-the SCM perspective The SCM perspective, first proposed by Shank (1989), involves three key themes that are taken from the strategic management literature: (1) Value chain analysis; (2) Cost driver analysis; (3) Competitive advantage analysis. Each of the three represents a stream of research and analysis about strategy in which cost information is viewed differently from the way it is viewed in conventional management accounting. Blending the three themes represents the most powerful way to focus cost analysis for strategic choices-Strategic Cost Management. Each is a necessary component of the SCM analysis, but a sufficient analysis must involve all three. Let's consider in turn each of the three components of the SCM perspective as it applies to Mavis' choice of machining technology, starting with the value chain component. Value chain analysis. In the SCM framework, managing costs effectively requires a broad focus, external to the firm. Porter (1985) has termed this perspective the value chain. The value chain for any firm in any business is the linked set of value-creating activities from basic raw materials (starting ultimately with the periodic table of the elements) through to component suppliers, to the ultimate end-use product delivered to the consumers, and perhaps through recycling to the beginning of a new value chain cycle. The external focus sees each firm in the context of the overall chain of value-creating activities of which it is only a part. There are no firms that span the entire value chain in which they participate. Value chain analysis is contrasted with value-added analysis, which starts with payments to suppliers (purchases) and stops with charges to customers (sales), while focusing on maximizing the difference, the value added (sales minus purchases) for the firm. Value-added analysis starts too late and stops too soon. It is far too narrow a view because it misses the importance of linkages upstream and downstream in the value chain. In the CIM context, the principal benefits of new investment may well fall elsewhere in the value chain than where the investment itself takes place. 194 J. K. Shank For Mavis, the NC machine basically ties the firm more closely to its principal customer (Buckeye Drilling). Unless Mavis is prepared to drop Buckeye and seek other customers who need parts requiring four linked machining operations, it will become more dependent on Buckeye's orders. It is thus likely that Buckeye will capture part of the cost savings via lower selling prices. Also, when dealing with other customers, Mavis will have much less flexibility, as noted earlier. Also, the reduction in labor intensity with the NC machine means Mavis will be tied more closely to its principle castings suppliers. Quality of incoming raw castings is now more critical because of the automation of the machining process. In short, a value chain perspective clearly suggests that Mavis loses both buyer power and seller power as a result of the new investment. The firm becomes more dependent both up and down its value chain. For a small job-shop which relies heavily on its ability to change product mix as business conditions change, this is one major weakness in the NC machine proposal. But, does the impact on cost drivers offset this concern? Cost driver analysis. In conventional management accounting, there is only one cost driver. Unit cost changes are seen largely as a function of volume changes. Examples of management accounting concepts that hinge on volume as the cost driver include fixed versus variable cost, average versus marginal cost, cost-volume- profit analysis, break-even analysis, flexible budgets, and contribution margin, to name a few. In SCM, output volume per se is seen to capture very little of the richness of cost 'behavior'. In this regard, SCM draws much less on the simple models of basic microeconomics and much more on the richer models of the economics of industrial organization. There are 'structural cost drivers that relate to the firm's explicit strategic choices regarding economic structure such as scale, product-line complexity, scope of operations (vertical integration), or experience (learning). Technology investments also represent structural choices about how to compete. There are also executional cost drivers that are major determinants of a firm's cost position and hinge on its ability to execute successfully within the economic structure it chooses. Whereas structural cost drivers are not monotonically scaled with performance, executional cost drivers typically are. That is, for each of the structural drivers more is not always better. There are potential diseconomies of scale and vertical scope, as well as potential economies. A more complex product line is not necessarily better or worse than a less complex line. Too much experience can be as bad as too little in a dynamic environment. For example, Texas Instruments emphasized the learning curve and became the world's lowest-cost producer of obsolete 8K microchips! Technological 'leadership' versus 'follower- ship' is a legitimate choice for most firms. In contrast, for each of the executional drivers, more is almost always better. The list of potentially important executional drivers includes at least these: Workforce involvement (participative management); Workforce commitment to continuous improvement (kaizen); Adherence to Total Quality Management concepts; Utilization of effective capacity (given the scale choices on plant construction); Efficiency of production flow layout; Effectiveness of product design or formulation; . 195 Analysing Technology Investments Exploiting linkages with suppliers and customers all along the value chain. While it may not always be true that a higher level for these executional factors improves cost position, the examples of diseconomies are far less frequent than for structural drivers. Does explicit attention to the underlying cost drivers support or refute the new investment for Mavis? That is, in addition to value chain issues, is technology choice an important enough cost driver for Mavis to justify a basic change in manufactur- ing? How important is technology choice compared to other cost drivers? Of the structural drivers, scale does not prove to be very important in this context. Minimum efficient scale for job shops is quite small. It is an industry of many small players. Vertical scope also yields no economies in this context. In fact, because the small job shop avoids the wage rates and work practices in larger firms, there are actually diseconomies of vertical scope. Learning, however, is a major cost driver with conventional machining. Workers learn the job very slowly and high labor turnover generates a significant cost disadvantage. Learning is a very important issue with conventional machines because high labor turnover can destroy many of the benefits of the specialty niche. In fact, in cost driver terms, the choice for Mavis can be dramatized as technology versus 'learning'. This contrast dominates the other structural drivers. The executional drivers are not really impacted by the choice. To see which driver should dominate Mavis' strategy, let's turn to the third major SCM theme. Competitive advantage analysis. In the SCM perspective, understanding the implica- tions of how the firm chooses to compete is fully as important for cost analysis as understanding the value chain and the key strategic cost drivers at critical steps in the chain. As discussed by Porter (1980), the basic choice on how to compete is between cost leadership and differentiation. (1) Low cost. The primary focus in this strategy is to achieve low cost relative to competitors. Cost leadership can be achieved through approaches such as economies of scale in production, learning curve effects, tight cost control, or cost minimization in areas such as R&D, service, sales force, or advertising. Examples of firms that have followed this strategy include: Texas Instruments in consumer electron- ics, Emerson Electric in electric motors, Hyundai in automobiles, Briggs & Stratton in gasoline engines, Black & Decker in machine tools, and Commodore in business machines. (2) Differentiation. The primary focus in this strategy is to differentiate the product offering of the business unit, creating something that is perceived by customers unique. Approaches to product differentiation include: brand loyalty (Coca-Cola in soft drinks), superior customer service (Nordstrom in retailing), dealer network (Caterpillar in construction equipment), product design and product features (Hecolett-Packard in instruments)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts