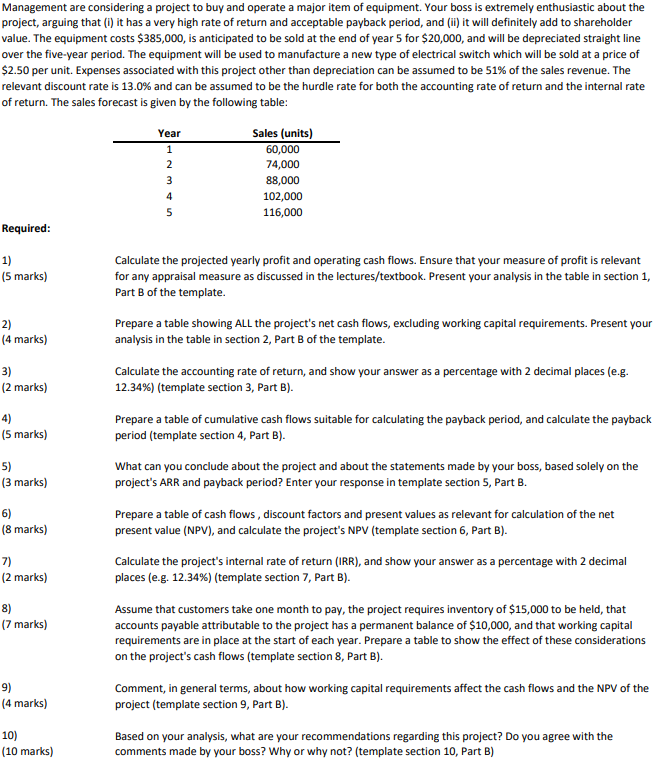

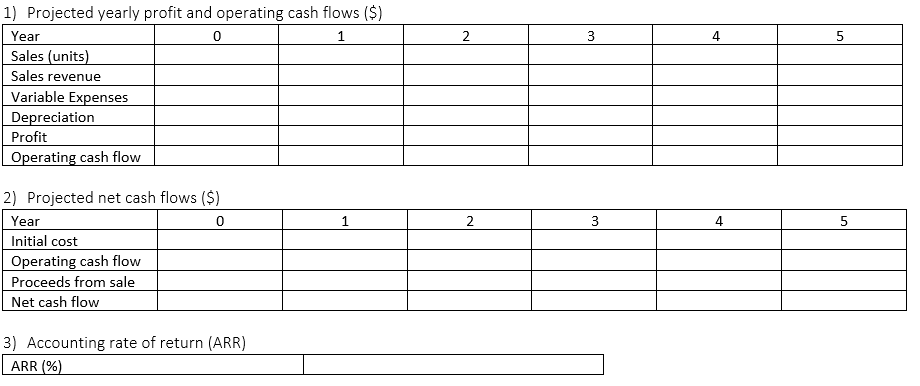

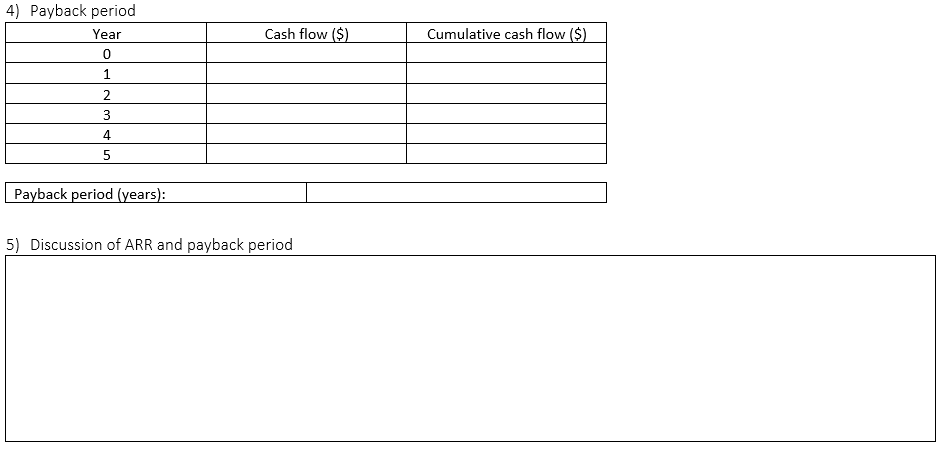

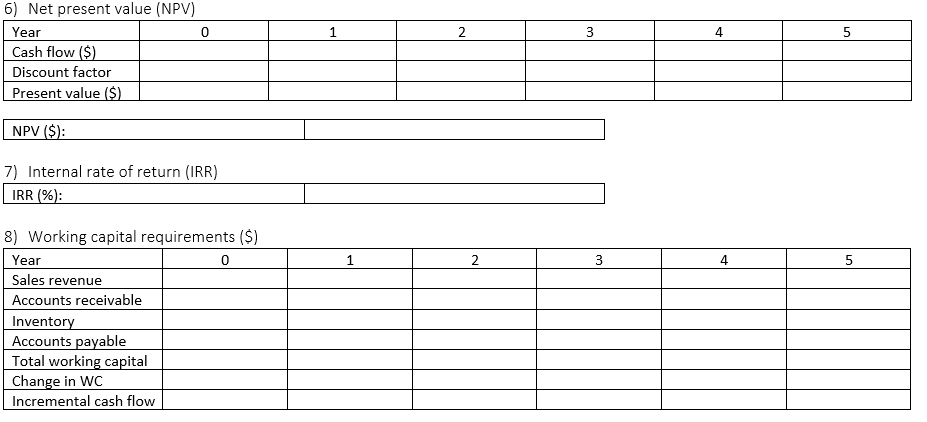

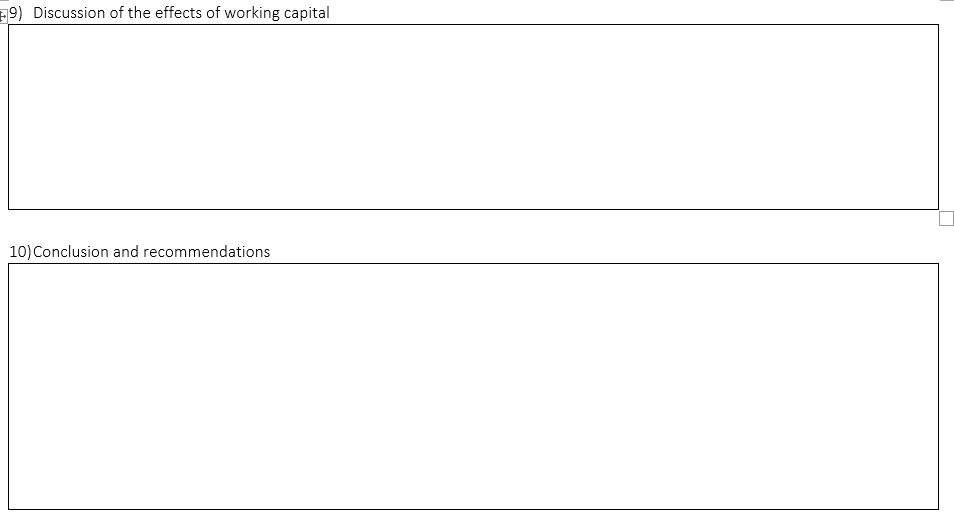

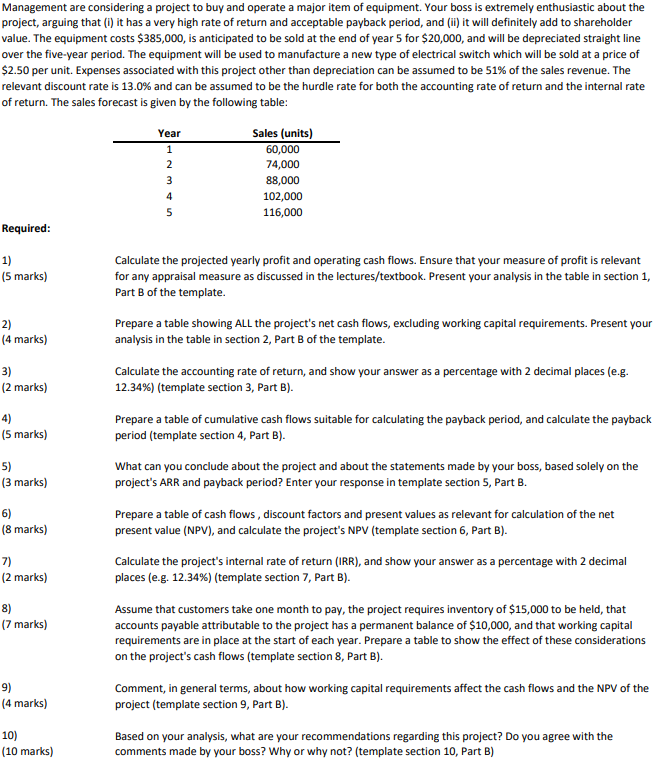

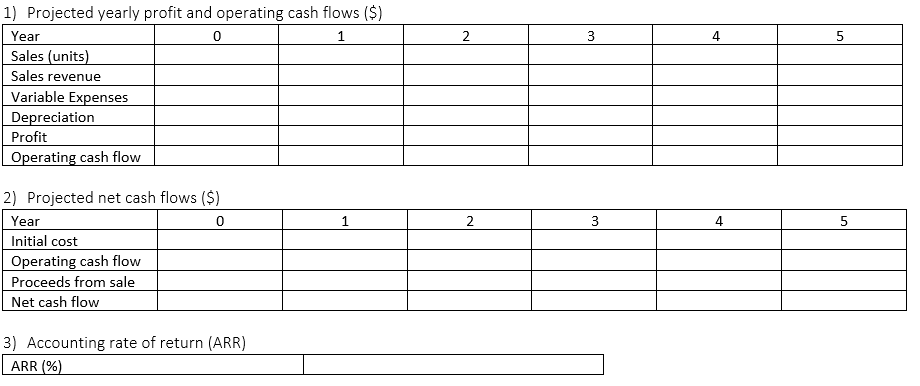

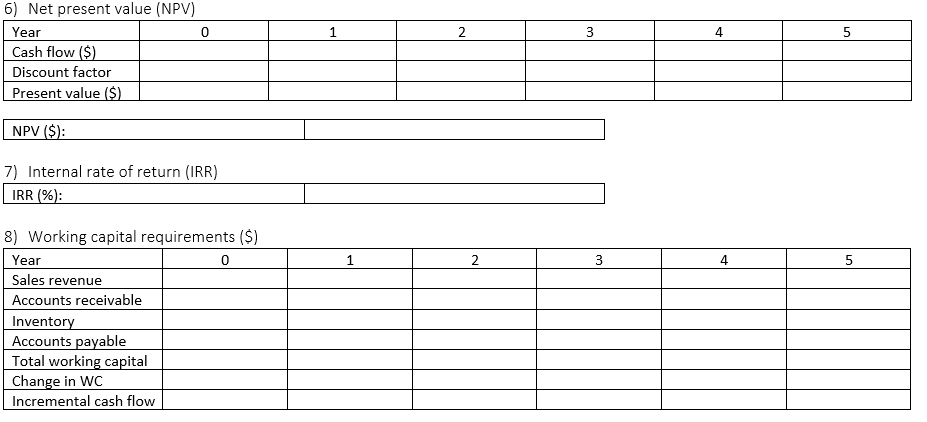

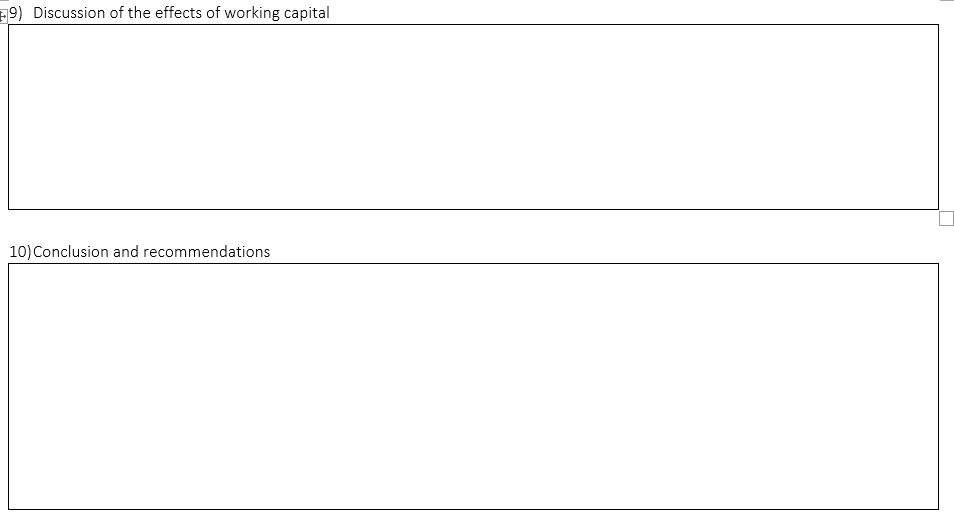

Management are considering a project to buy and operate a major item of equipment. Your boss is extremely enthusiastic about the project, arguing that (1) it has a very high rate of return and acceptable payback period, and (ii) it will definitely add to shareholder value. The equipment costs $385,000, is anticipated to be sold at the end of year 5 for $20,000, and will be depreciated straight line over the five-year period. The equipment will be used to manufacture a new type of electrical switch which will be sold at a price of $2.50 per unit. Expenses associated with this project other than depreciation can be assumed to be 51% of the sales revenue. The relevant discount rate is 13.0% and can be assumed to be the hurdle rate for both the accounting rate of return and the internal rate of return. The sales forecast is given by the following table: Year 1 2 3 4 5 Sales (units) 60,000 74,000 88,000 102,000 116,000 Required: 1) (5 marks) Calculate the projected yearly profit and operating cash flows. Ensure that your measure of profit is relevant for any appraisal measure as discussed in the lectures/textbook. Present your analysis in the table in section 1, Part B of the template. 2) (4 marks) 3) (2 marks) Prepare a table showing ALL the project's net cash flows, excluding working capital requirements. Present your analysis in the table in section 2, Part B of the template. Calculate the accounting rate of return, and show your answer as a percentage with 2 decimal places (e.g. 12.34%) (template section 3, Part B). Prepare a table of cumulative cash flows suitable for calculating the payback period, and calculate the payback period (template section 4, Part B). 4) (5 marks) 5) (3 marks) What can you conclude about the project and about the statements made by your boss, based solely on the project's ARR and payback period? Enter your response in template section 5, Part B. 6) (8 marks) Prepare a table of cash flows, discount factors and present values as relevant for calculation of the net present value (NPV), and calculate the project's NPV (template section 6, Part B). Calculate the project's internal rate of return (IRR), and show your answer as a percentage with 2 decimal places (eg. 12.34%) (template section 7, Part B). 7) (2 marks) 8) (7 marks) Assume that customers take one month to pay, the project requires inventory of $15,000 to be held, that accounts payable attributable to the project has a permanent balance of $10,000, and that working capital requirements are in place at the start of each year. Prepare a table to show the effect of these considerations on the project's cash flows (template section 8, Part B). 9) (4 marks) Comment, in general terms, about how working capital requirements affect the cash flows and the NPV of the project (template section 9, Part B). 10) Based on your analysis, what are your recommendations regarding this project? Do you agree with the comments made by your boss? Why or why not? (template section 10, Part B) (10 marks) 2 3 5 1) Projected yearly profit and operating cash flows ($) Year 0 1 Sales (units) Sales revenue Variable Expenses Depreciation Profit Operating cash flow 1 2 3 4 5 2) Projected net cash flows ($) Year 0 Initial cost Operating cash flow Proceeds from sale Net cash flow 3) Accounting rate of return (ARR) ARR (%) 4) Payback period Year Cash flow ($) Cumulative cash flow ($) 0 1 2 3 4 5 Payback period (years): 5) Discussion of ARR and payback period 1 2 3 4 5 6) Net present value (NPV) Year 0 Cash flow ($) Discount factor Present value ($) NPV ($): 7) Internal rate of return (IRR) IRR (%): 0 1 2 3 4 5 8) Working capital requirements ($) Year Sales revenue Accounts receivable Inventory Accounts payable Total working capital Change in WC Incremental cash flow 19) Discussion of the effects of working capital 10) Conclusion and recommendations