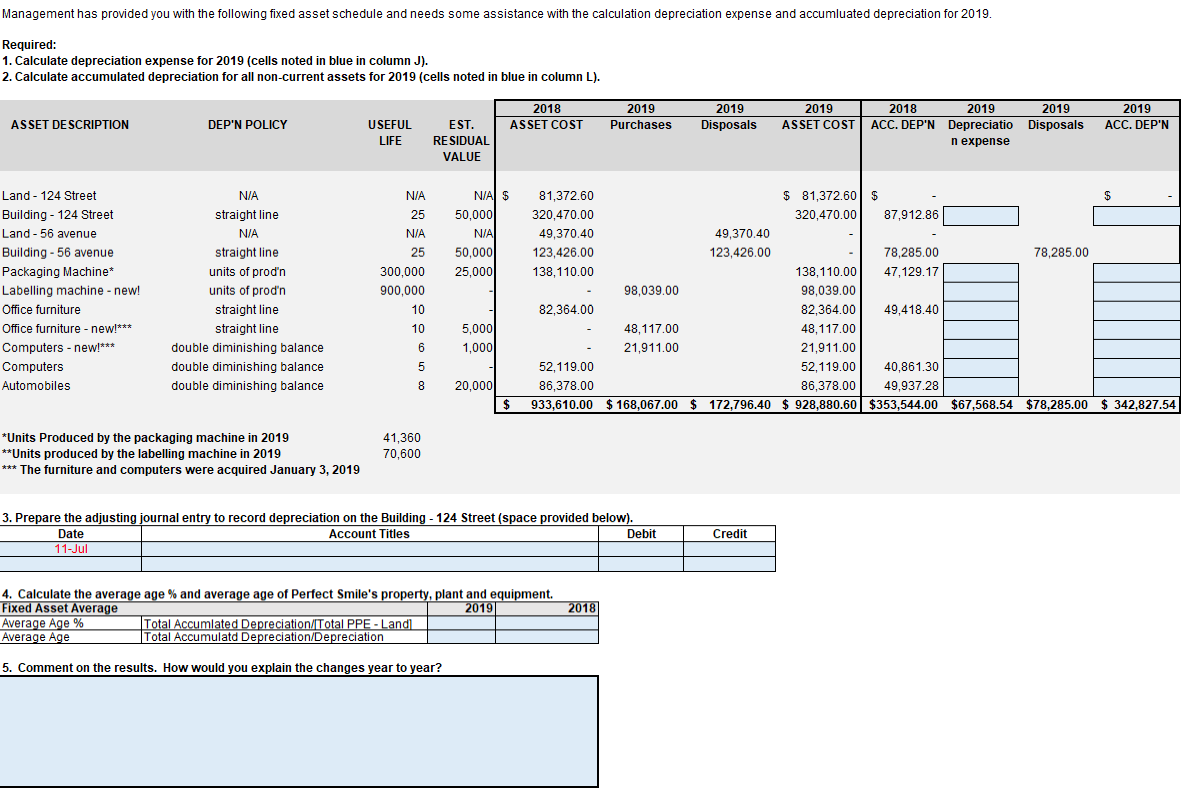

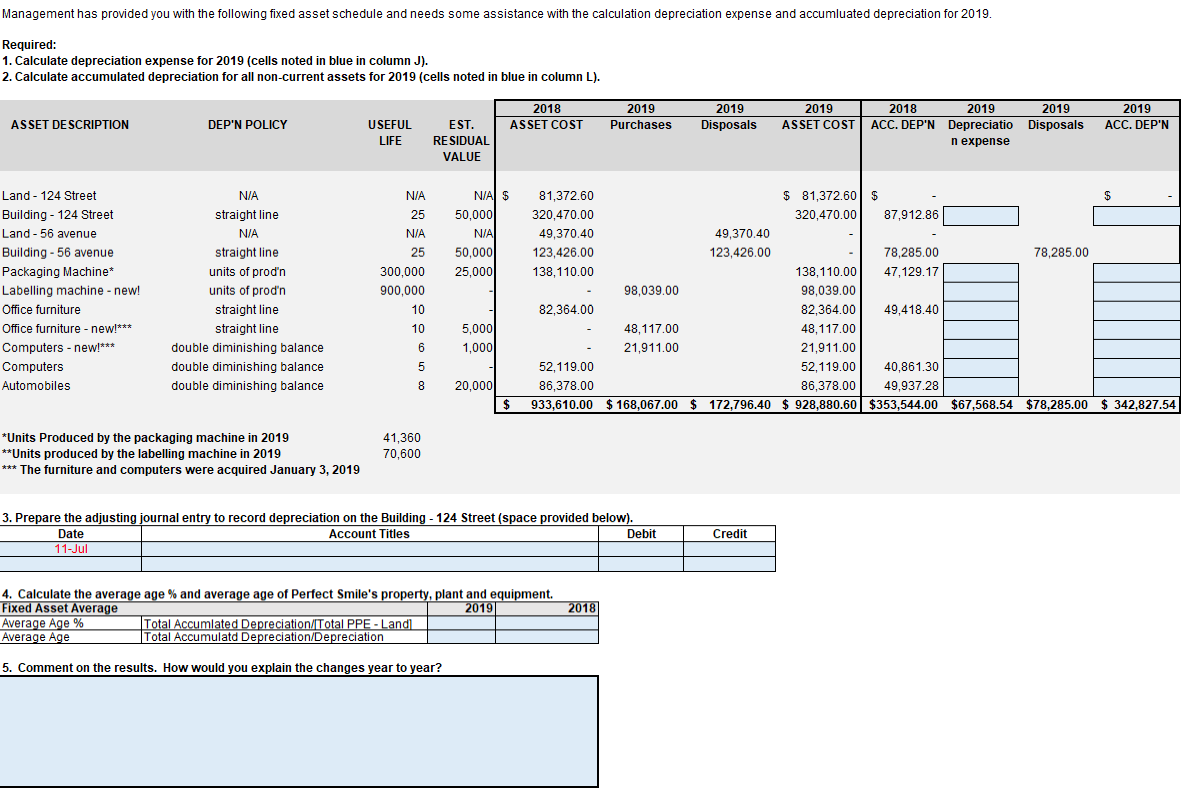

Management has provided you with the following fixed asset schedule and needs some assistance with the calculation depreciation expense and accumluated depreciation for 2019. Required: 1. Calculate depreciation expense for 2019 (cells noted in blue in column J). 2. Calculate accumulated depreciation for all non-current assets for 2019 (cells noted in blue in column L). ASSET DESCRIPTION DEP'N POLICY 2018 ASSET COST 2019 Purchases 2019 Disposals 2019 ACC. DEP'N USEFUL LIFE 2019 2018 2019 2019 ASSET COST ACC. DEP'N Depreciatio Disposals nexpense EST. RESIDUAL VALUE 50,000 N/AI 81,372.60 320,470.00 49,370.40 123,426.00 138, 110.00 NIA 25 N/A 25 300,000 900,000 78,285.00 Land - 124 Street Building - 124 Street Land - 56 avenue Building - 56 avenue Packaging Machine* Labelling machine - new! Office furniture Office furniture - new!*** Computers - new!*** Computers Automobiles 50,000 25,000 straight line N/A straight line units of prod'n units of prod'n straight line straight line double diminishing balance double diminishing balance double diminishing balance 98,039.00 $ 81,372.60 320,470.00 87,912.86 49,370.40 123,426.00 78,285.00 138,110.00 47,129.17 98,039.00 82,364.00 49,418.40 48,117.00 21,911.00 52, 119.00 40,861.30 86,378.00 49,937.28 172,796.40 $ 928,880.60 $353,544.00 82,364.00 5,000 1,000 48,117.00 21,911.00 com o 20,000 52,119.00 86,378.00 933,610.00 $ $ 168,067.00 $ $67,568.54 $78,285.00 $ 342,827.54 *Units Produced by the packaging machine in 2019 **Units produced by the labelling machine in 2019 *** The furniture and computers were acquired January 3, 2019 41,360 70,600 3. Prepare the adjusting journal entry to record depreciation on the Building - 124 Street (space provided below). Date Account Titles Debit 11-Jul Credit 4. Calculate the average age% and average age of Perfect Smile's property, plant and equipment. Fixed Asset Average 1 2019 Average Age % Total Accumlated Depreciation/Total PPE - Land Average Age Total Accumulatd Depreciation/Depreciation 5. Comment on the results. How would you explain the changes year to year? Management has provided you with the following fixed asset schedule and needs some assistance with the calculation depreciation expense and accumluated depreciation for 2019. Required: 1. Calculate depreciation expense for 2019 (cells noted in blue in column J). 2. Calculate accumulated depreciation for all non-current assets for 2019 (cells noted in blue in column L). ASSET DESCRIPTION DEP'N POLICY 2018 ASSET COST 2019 Purchases 2019 Disposals 2019 ACC. DEP'N USEFUL LIFE 2019 2018 2019 2019 ASSET COST ACC. DEP'N Depreciatio Disposals nexpense EST. RESIDUAL VALUE 50,000 N/AI 81,372.60 320,470.00 49,370.40 123,426.00 138, 110.00 NIA 25 N/A 25 300,000 900,000 78,285.00 Land - 124 Street Building - 124 Street Land - 56 avenue Building - 56 avenue Packaging Machine* Labelling machine - new! Office furniture Office furniture - new!*** Computers - new!*** Computers Automobiles 50,000 25,000 straight line N/A straight line units of prod'n units of prod'n straight line straight line double diminishing balance double diminishing balance double diminishing balance 98,039.00 $ 81,372.60 320,470.00 87,912.86 49,370.40 123,426.00 78,285.00 138,110.00 47,129.17 98,039.00 82,364.00 49,418.40 48,117.00 21,911.00 52, 119.00 40,861.30 86,378.00 49,937.28 172,796.40 $ 928,880.60 $353,544.00 82,364.00 5,000 1,000 48,117.00 21,911.00 com o 20,000 52,119.00 86,378.00 933,610.00 $ $ 168,067.00 $ $67,568.54 $78,285.00 $ 342,827.54 *Units Produced by the packaging machine in 2019 **Units produced by the labelling machine in 2019 *** The furniture and computers were acquired January 3, 2019 41,360 70,600 3. Prepare the adjusting journal entry to record depreciation on the Building - 124 Street (space provided below). Date Account Titles Debit 11-Jul Credit 4. Calculate the average age% and average age of Perfect Smile's property, plant and equipment. Fixed Asset Average 1 2019 Average Age % Total Accumlated Depreciation/Total PPE - Land Average Age Total Accumulatd Depreciation/Depreciation 5. Comment on the results. How would you explain the changes year to year