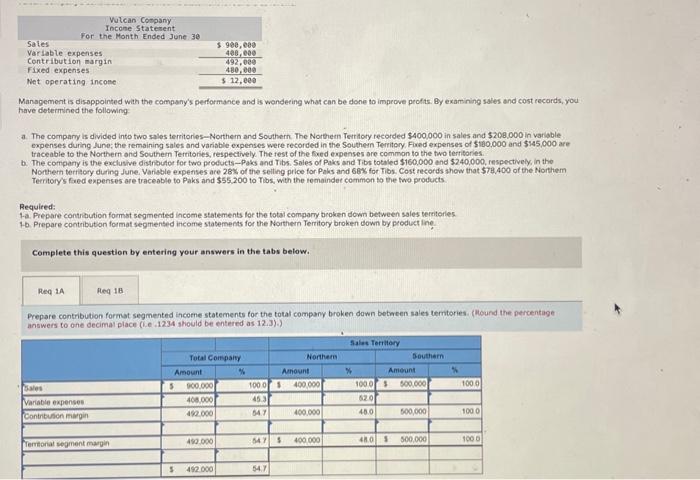

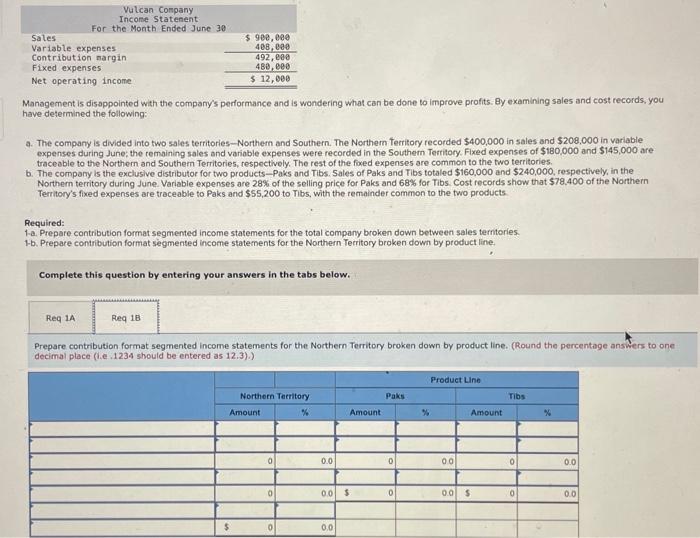

Management is disappointed wath the company's performance and is wandering what can be done to improve peofits. By examining sales and cost records, you have determined the following: a. The compary is divided into two sales territories - Northern and Southern. The Northem Territory recorded $400,000 in $ales and $208,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southesn Territory. Fixed expenses of 5100,000 and $145,000 are traceable to the Northern ond Southein Tertitories, respectively. The fest of the ficed expenses ore common to the two territories. b. The company is the exclusive distrouter for two products - Paks and Tibs. Sales of Paiss and Tibs totaled $160,000 and $240,000, respectively, in the Northern teriacry during June. Variable expenses are 28s of the selting price for. Palks and 68s for Tibs. Cost records show that $78.400 of the Niorthem Territory's foed expenses are traceable to Paks and $55.200 to Tibs, with the remainder common to the two products. Required: 1-a. Prepare contribution formst segmented income statements for the total compary broken down between sales verritories. 10. Prepare contribution format segmensed income statements for the Northern Territory broken down by product ine. Complete this question by estering your answers in the tabs below. Prepare contribution format segmented income statements for the total company broken down between sales terntories: (llound the percentage answers to one decimal place (i.e .1234 should be entered as 12.3 ). ) Management is disappointed with the company's performance and is wondering what can be done to improve profits: By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories - Northern and Southern. The Northern Territory recorded $400,000 in sales and $208,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southem Territory. Fixed expenses of $180,000 and $145,000 are traceable to the Northern and Southem Territories, respectively. The rest of the fored expenses are common to the two territories. b. The company is the exclusive distributor for two products - Paks and Tibs. Sales of Paks and Tibs totaled $160,000 and $240,000, respectively, in the Northern territory during June. Variable expenses are 28% of the selling price for Paks and 68% for Tibs. Cost records show that $78,400 of the Northern Territory's fixed expenses are traceable to Paks and \$\$5,200 to Tibs, with the remainder common to the two products. Required: 1-a. Prepare contribution format segmented income statements for the total company broken down between sales terntories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. (Round the percentage answers to one decimal place (i.e .1234 should be entered as 12.3).)