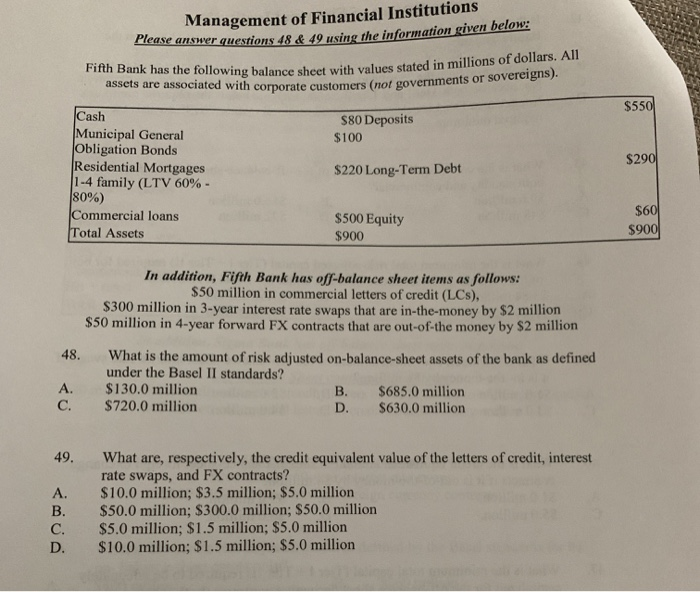

Management of Financial Institutions PIcas AnsNer guestions 48 & 49 using the information siven below s of dollars. All Fifth Bank has the following balance sheet with values stated in million assets are associated with corporate customers (not governments or sovereigns) $550 Cash Municipal General Obligation Bonds Residential Mortgages 1-4 family (LTV 60%- 80%) Commercial loans Total Assets $80 Deposits $100 $290 $220 Long-Term Debt $60 $900 $500 Equity $900 In addition, Fifth Bank has off-balance sheet items as follows $50 million in commercial letters of credit (LCs), S300 million in 3-year interest rate swaps that are in-the-money by $2 million $50 million in 4-year forward FX contracts that are out-of-the money by $2 million What is the amount of risk adjusted on-balance-sheet assets of the bank as defined under the Basel II standards? 48. A. $130.0 million C. $720.0 million B. $685.0 million D. $630.0 million 49. What are, respectively, the credit equivalent value of the letters of credit, interest rate swaps, and FX contracts? $10.0 million; $3.5 million; $5.0 million $50.0 million; $300.0 million; S50.0 million $5.0 million; $1.5 million; $5.0 million $10.0 million; $1.5 million; $5.0 million A. B. C. D. Management of Financial Institutions PIcas AnsNer guestions 48 & 49 using the information siven below s of dollars. All Fifth Bank has the following balance sheet with values stated in million assets are associated with corporate customers (not governments or sovereigns) $550 Cash Municipal General Obligation Bonds Residential Mortgages 1-4 family (LTV 60%- 80%) Commercial loans Total Assets $80 Deposits $100 $290 $220 Long-Term Debt $60 $900 $500 Equity $900 In addition, Fifth Bank has off-balance sheet items as follows $50 million in commercial letters of credit (LCs), S300 million in 3-year interest rate swaps that are in-the-money by $2 million $50 million in 4-year forward FX contracts that are out-of-the money by $2 million What is the amount of risk adjusted on-balance-sheet assets of the bank as defined under the Basel II standards? 48. A. $130.0 million C. $720.0 million B. $685.0 million D. $630.0 million 49. What are, respectively, the credit equivalent value of the letters of credit, interest rate swaps, and FX contracts? $10.0 million; $3.5 million; $5.0 million $50.0 million; $300.0 million; S50.0 million $5.0 million; $1.5 million; $5.0 million $10.0 million; $1.5 million; $5.0 million A. B. C. D