Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Management of your company, Morrison Industries, came to you to ask you to do an analysis of whether they should account for an equity

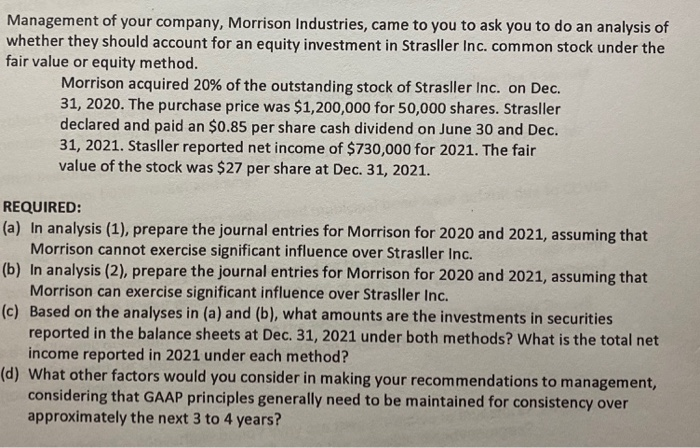

Management of your company, Morrison Industries, came to you to ask you to do an analysis of whether they should account for an equity investment in Strasller Inc. common stock under the fair value or equity method. Morrison acquired 20% of the outstanding stock of Strasller Inc. on Dec. 31, 2020. The purchase price was $1,200,000 for 50,000 shares. Strasller declared and paid an $0.85 per share cash dividend on June 30 and Dec. 31, 2021. Stasller reported net income of $730,000 for 2021. The fair value of the stock was $27 per share at Dec. 31, 2021. REQUIRED: (a) In analysis (1), prepare the journal entries for Morrison for 2020 and 2021, assuming that Morrison cannot exercise significant influence over Strasller Inc. (b) In analysis (2), prepare the journal entries for Morrison for 2020 and 2021, assuming that Morrison can exercise significant influence over Strasller Inc. (c) Based on the analyses in (a) and (b), what amounts are the investments in securities reported in the balance sheets at Dec. 31, 2021 under both methods? What is the total net income reported in 2021 under each method? (d) What other factors would you consider in making your recommendations to management, considering that GAAP principles generally need to be maintained for consistency over approximately the next 3 to 4 years?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started