Answered step by step

Verified Expert Solution

Question

1 Approved Answer

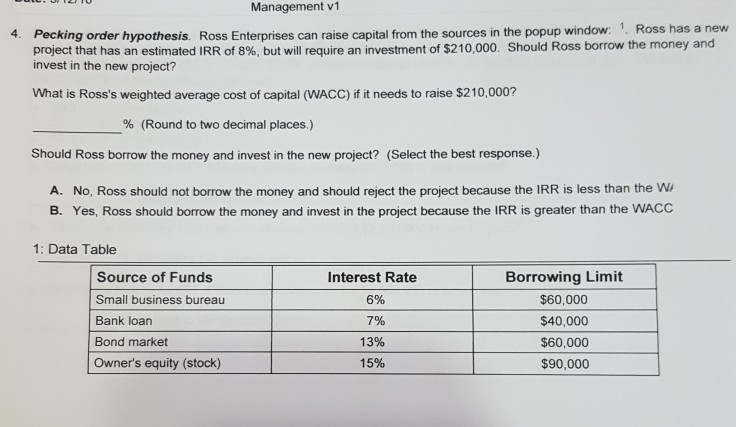

Management v1 4. Pecking order hypothesis. Ross Enterprises can raise capital from the sources in the popup window , Ross has a new project that

Management v1 4. Pecking order hypothesis. Ross Enterprises can raise capital from the sources in the popup window , Ross has a new project that has an estimated IRR of 8%, but will require an investment of $210,000. Should Ross borrow the money and invest in the new project? What is Ross's weighted average cost of capital (WACC) if it needs to raise $210,000? % (Round to two decimal places.) Should Ross borrow the money and invest in the new project? (Select the best response.) A. No, Ross should not borrow the money and should reject the project because the IRR is less than the Wi B. Yes, Ross should borrow the money and invest in the project because the IRR is greater than the WACC 1: Data Table Source of Funds Small business bureau Bank loan Bond market Owner's equity (stock) Interest Rate 6% 7% 13% 15% Borrowing Limit $60,000 $40,000 $60,000 $90,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started