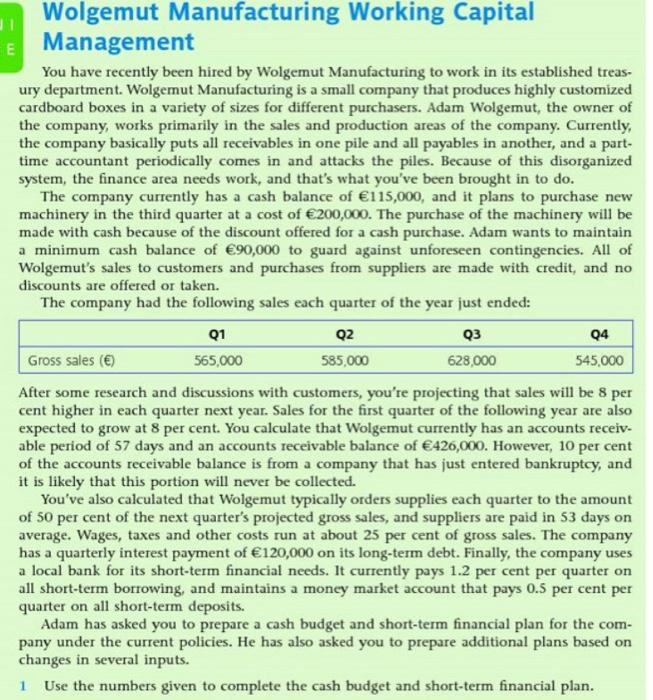

Management You have recently been hired by Wolgemut Manufacturing to work in its established treasury department. Wolgemut Manufacturing is a small company that produces highly customized cardboard boxes in a variety of sizes for different purchasers. Adam Wolgemut, the owner of the company, works primarily in the sales and production areas of the company. Currently, the company basically puts all receivables in one pile and all payables in another, and a parttime accountant periodically comes in and attacks the piles. Because of this disorganized system, the finance area needs work, and that's what you've been brought in to do. The company currently has a cash balance of 115,000, and it plans to purchase new machinery in the third quarter at a cost of 200,000. The purchase of the machinery will be made with cash because of the discount offered for a cash purchase. Adam wants to maintain a minimum cash balance of 90,000 to guard against unforeseen contingencies. All of Wolgemut's sales to customers and purchases from suppliers are made with credit, and no discounts are offered or taken. The company had the following sales each quarter of the year just ended: After some research and discussions with customers, you're projecting that sales will be 8 per cent higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8 per cent. You calculate that Wolgemut currently has an accounts receivable period of 57 days and an accounts receivable balance of 426,000. However, 10 per cent of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected. You've also calculated that Wolgemut typically orders supplies each quarter to the amount of 50 per cent of the next quarter's projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes and other costs run at about 25 per cent of gross sales. The company has a quarterly interest payment of 120,000 on its long-term debt. Finally, the company uses a local bank for its short-term financial needs. It currently pays 1.2 per cent per quarter on all short-term borrowing, and maintains a money market account that pays 0.5 per cent per quarter on all short-term deposits. Adam has asked you to prepare a cash budget and short-term financial plan for the company under the current policies. He has also asked you to prepare additional plans based on changes in several inputs. 1 Use the numbers given to complete the cash budget and short-term financial plan