Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Managerial accounting . . 1. Capital Hotels and Restaurants Incorporated recently hired a new accounting clerk. She has compiled the following information to prepare the

Managerial accounting .

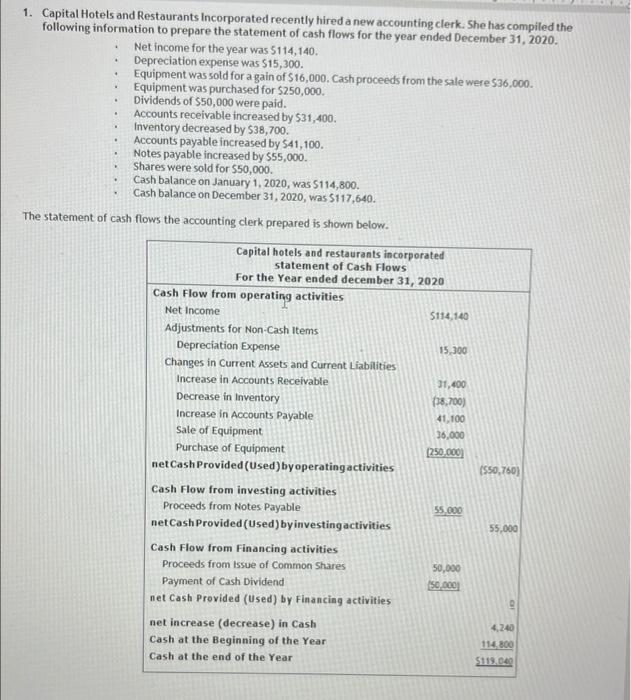

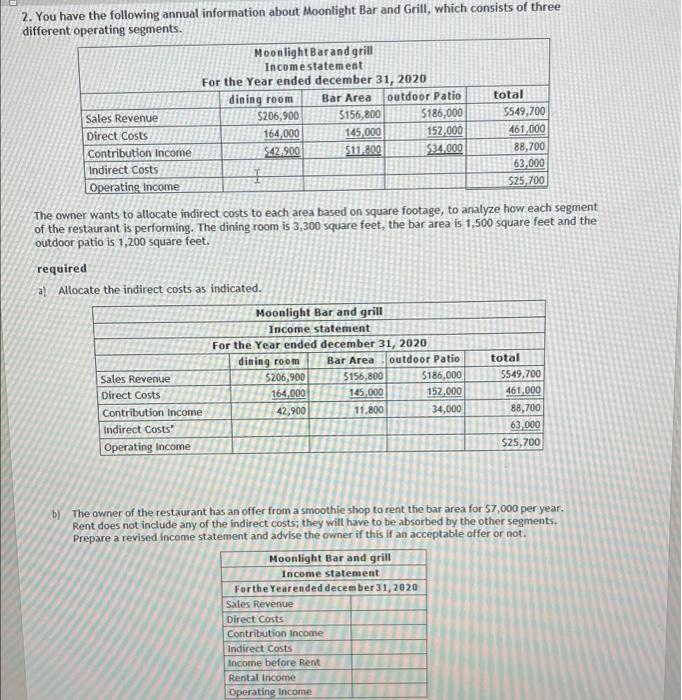

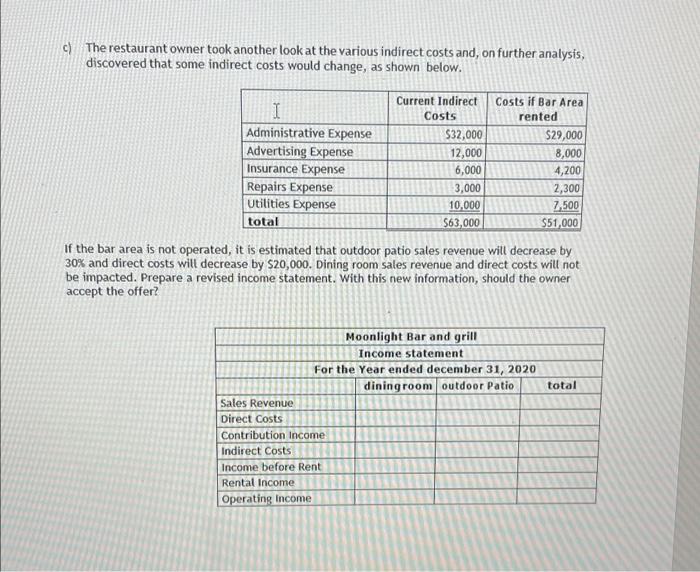

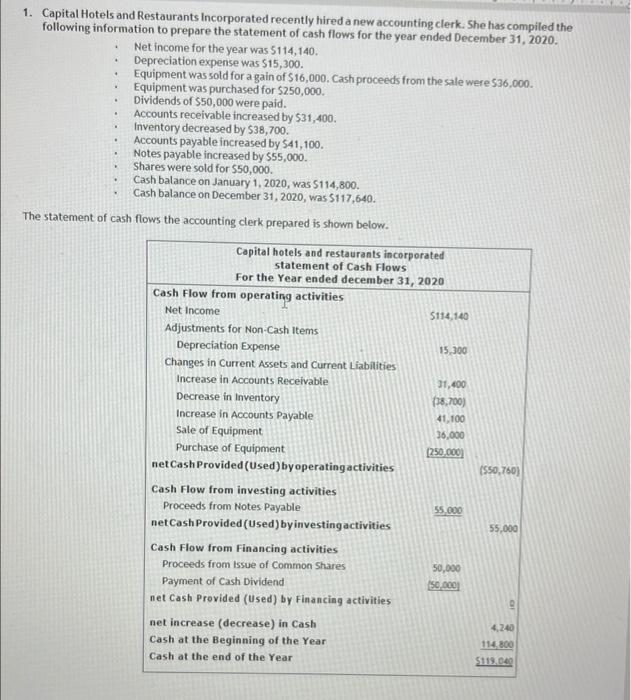

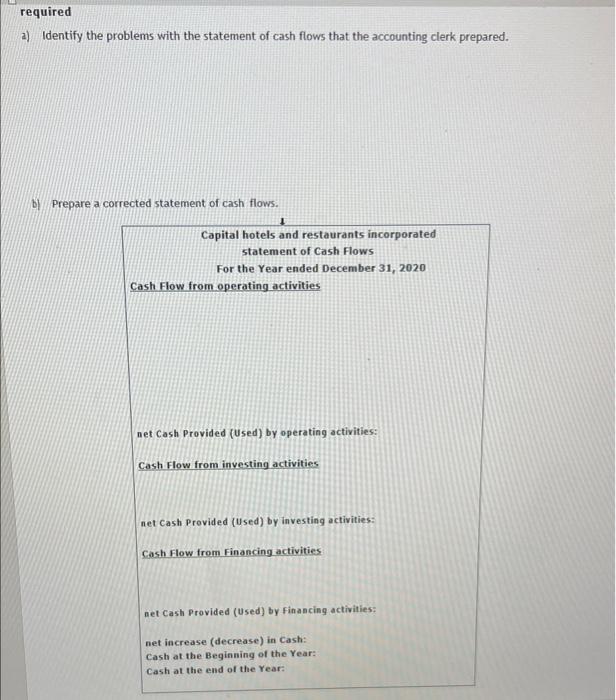

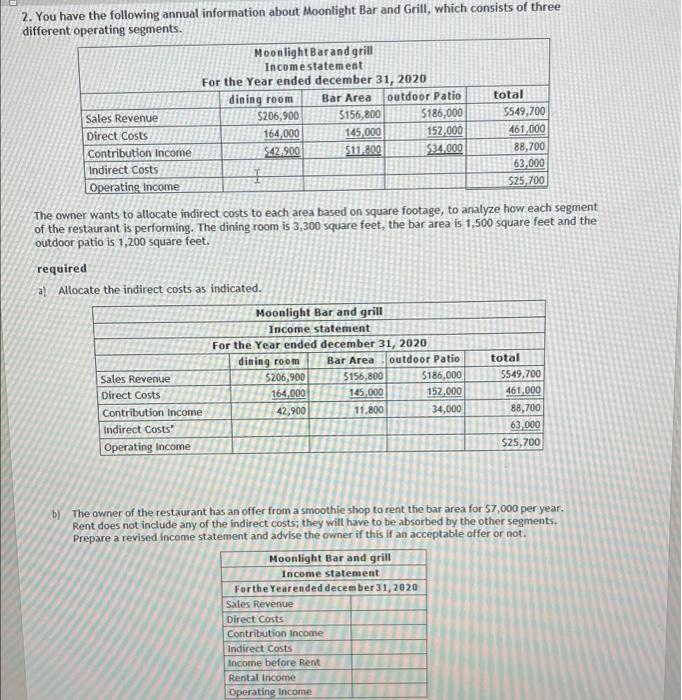

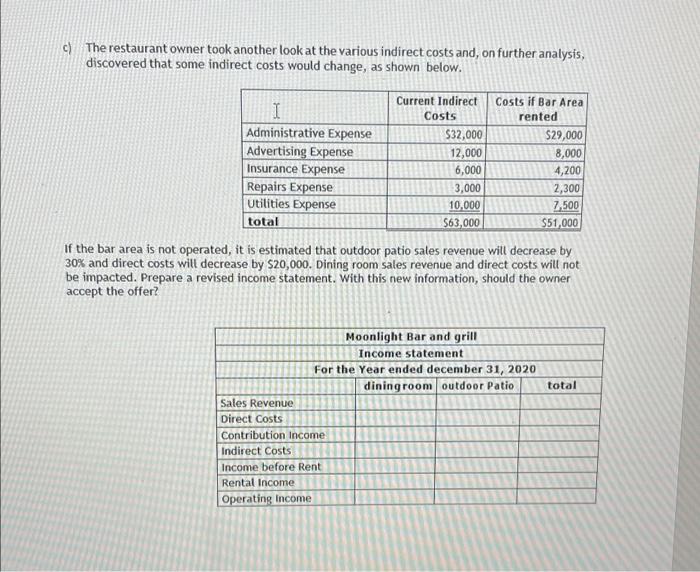

. 1. Capital Hotels and Restaurants Incorporated recently hired a new accounting clerk. She has compiled the following information to prepare the statement of cash flows for the year ended December 31, 2020. Net income for the year was 5114,140. Depreciation expense was 515,300. Equipment was sold for a gain of $16,000. Cash proceeds from the sale were 536,000. Equipment was purchased for $250,000 Dividends of $50,000 were paid. Accounts receivable increased by $31,400. Inventory decreased by 538,700. Accounts payable increased by 541,100. Notes payable increased by $55,000. Shares were sold for 550,000. Cash balance on January 1, 2020, was 5114,800. Cash balance on December 31, 2020, was 5117,640. The statement of cash flows the accounting clerk prepared is shown below. Capital hotels and restaurants incorporated statement of Cash Flows For the Year ended december 31, 2020 Cash Flow from operating activities Net Income 5114,140 Adjustments for Non-Cash Items Depreciation Expense 15.300 Changes in Current Assets and Current Liabilities Increase in Accounts Receivable 31,400 Decrease in Inventory (18,700) Increase in Accounts Payable 41.100 Sale of Equipment 36.000 Purchase of Equipment [250,000 net Cash Provided (Used) by operating activities (550.760) Cash Flow from investing activities Proceeds from Notes Payable 55.000 net Cash Provided (Used) by investing activities 55,000 Cash Flow from Financing activities Proceeds from Issue of Common Shares 50,000 Payment of Cash Dividend 50.000 net Cash Provided (Used) by Financing activities net increase (decrease) in Cash 4,240 Cash at the Beginning of the Year 114800 Cash at the end of the Year $119.040 required a) Identify the problems with the statement of cash flows that the accounting clerk prepared. Prepare a corrected statement of cash flows. 1 Capital hotels and restaurants incorporated statement of Cash Flows For the Year ended December 31, 2020 Cash Flow from operating activities net Cash Provided (Used) by operating activities: Cash Flow from investing activities net Cash Provided (Used) by investing activities: Cash Flow from Financing activities net Cash Provided (Used) by Financing activities: net increase (decrease) in Cash: Cash at the Beginning of the Year: Cash at the end of the Year: 2. You have the following annual information about Moonlight Bar and Grill, which consists of three different operating segments. Moonlight Barand grill Income statement For the Year ended december 31, 2020 dining room Bar Area outdoor Patio total Sales Revenue $206,900 5156,800 5186,000 $549,700 Direct Costs 164,000 145,000 152,000 461,000 Contribution Income $42.900 $11 800 534.000 88,700 Indirect costs 63,000 1 Operating Income $25,700 The owner wants to allocate indirect costs to each area based on square footage, to analyze how each segment of the restaurant is performing. The dining room is 3,300 square feet, the bar area is 1,500 square feet and the outdoor patio is 1,200 square feet. required a) Allocate the indirect costs as indicated. Moonlight Bar and grill Income statement For the Year ended december 31, 2020 dining room Bar Area outdoor Patio total Sales Revenue $206,900 $156,800 5186,000 5549,700 Direct Costs 164,000 145.000 152,000 461,000 Contribution Income 42,900 11,800 34,000 88,700 Indirect Costs 63000 Operating Income $25,700 b) The owner of the restaurant has an offer from a smoothie shop to rent the bar area for $7,000 per year. Rent does not include any of the indirect costs; they will have to be absorbed by the other segments. Prepare a revised income statement and advise the owner if this if an acceptable offer or not. Moonlight Bar and grill Income statement Forthe Yearended december 31, 2020 Sales Revenue Direct Costs Contribution Income Indirect costs Income before Rent Rental income Operating Income c) The restaurant owner took another look at the various indirect costs and, on further analysis, discovered that some indirect costs would change, as shown below. Current Indirect costs if Bar Area 1 Costs rented Administrative Expense $32,000 $29,000 Advertising Expense 12,000 8,000 Insurance Expense 6,000 4,200 Repairs Expense 3,000 2,300 Utilities Expense 10,000 2500 total $63,000 $51,000 If the bar area is not operated, it is estimated that outdoor patio sales revenue will decrease by 30% and direct costs will decrease by $20,000. Dining room sales revenue and direct costs will not be impacted. Prepare a revised income statement. With this new information, should the owner accept the offer? total Moonlight Bar and grill Income statement For the Year ended december 31, 2020 dining room outdoor Patio Sales Revenue Direct Costs Contribution Income Indirect Costs Income before Rent Rental Income Operating Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started