Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Managerial accounting. Can someone help? Process Costing Our company manufactures Chemical x. Assume the company US weighted average. Separate direct materials and conversion costs. Chemical

Managerial accounting.

Can someone help?

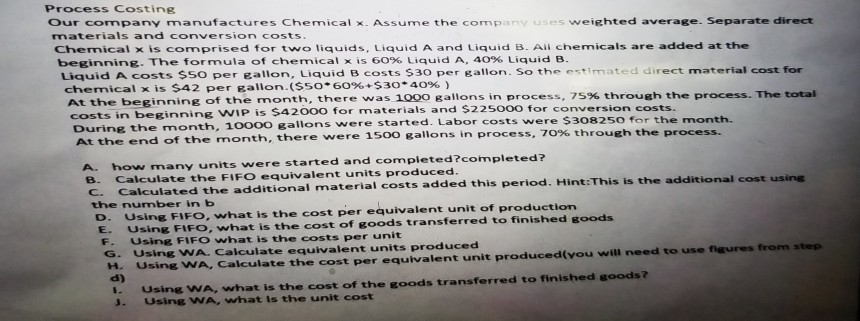

Process Costing Our company manufactures Chemical x. Assume the company US weighted average. Separate direct materials and conversion costs. Chemical x is comprised for two liquids, Liquid A and Liquid B. All chemicals are added at the beginning. The formula of chemical x is 60% Liquid A, 40% Liquid B. Liquid A Costs $50 per gallon, Liquid B costs $30 per gallon. So the estimated direct material cost for chemical x is $42 per Ballon.($50*60% +$30*40%) At the beginning of the month, there was 1000 gallons in process, 75% through the process. The total costs in beginning WIP is $42000 for materials and $225000 for conversion costs. During the month, 10000 gallons were started. Labor costs were $308250 for the month. At the end of the month, there were 1500 gallons in process, 70% through the process. A how many units were started and completed?completed? B. Calculate the FIFO equivalent units produced. C. Calculated the additional material costs added this period. Hint: This is the additional cost using the number in b D. Using FIFO, what is the cost per equivalent unit of production Using FIFO, what is the cost of goods transferred to finished goods F. Using FIFO what is the costs per unit G. Using WA. Calculate equivalent units produced H . Using WA, Calculate the cost per equivalent unit produced you will need to use fleures from 1. Using WA, what is the cost of the goods transferred to finished goods? 3. Using WA, what is the unit cost E. d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started