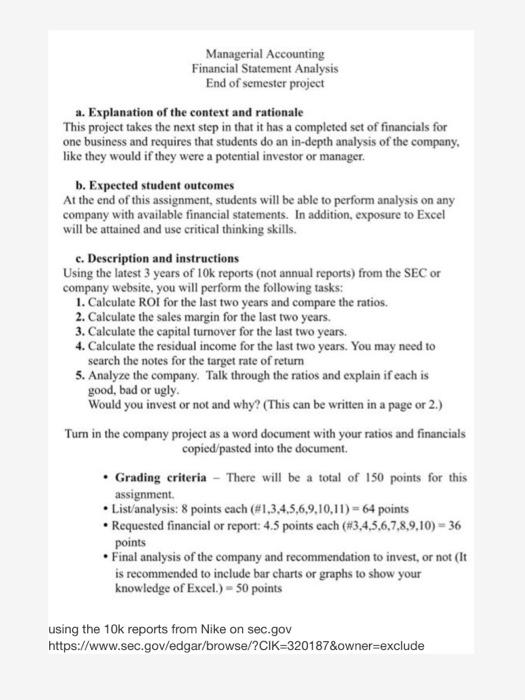

Managerial Accounting Financial Statement Analysis End of semester project a. Explanation of the context and rationale This project takes the next step in that it has a completed set of financials for one business and requires that students do an in-depth analysis of the company, like they would if they were a potential investor or manager. b. Expected student outcomes At the end of this assignment, students will be able to perform analysis on any company with available financial statements. In addition, exposure to Excel will be attained and use critical thinking skills. c. Description and instructions Using the latest 3 years of 10k reports (not annual reports) from the SEC or company website, you will perform the following tasks: 1. Calculate ROI for the last two years and compare the ratios. 2. Calculate the sales margin for the last two years. 3. Calculate the capital turnover for the last two years. 4. Calculate the residual income for the last two years. You may need to search the notes for the target rate of return 5. Analyze the company. Talk through the ratios and explain if each is good, bad or ugly Would you invest or not and why? (This can be written in a page or 2.) Turn in the company project as a word document with your ratios and financials copied/pasted into the document. Grading criteria - There will be a total of 150 points for this assignment List/analysis: 8 points cach (#1,3.4.5.6,9,10,11) = 64 points Requested financial or report: 4.5 points each (#3,4,5,6,7,8,9,10) = 36 points Final analysis of the company and recommendation to invest, or not (It is recommended to include bar charts or graphs to show your knowledge of Excel.) - 50 points using the 10k reports from Nike on sec.gov https://www.sec.gov/edgar/browse/?CIK-320187&owner=exclude Managerial Accounting Financial Statement Analysis End of semester project a. Explanation of the context and rationale This project takes the next step in that it has a completed set of financials for one business and requires that students do an in-depth analysis of the company, like they would if they were a potential investor or manager. b. Expected student outcomes At the end of this assignment, students will be able to perform analysis on any company with available financial statements. In addition, exposure to Excel will be attained and use critical thinking skills. c. Description and instructions Using the latest 3 years of 10k reports (not annual reports) from the SEC or company website, you will perform the following tasks: 1. Calculate ROI for the last two years and compare the ratios. 2. Calculate the sales margin for the last two years. 3. Calculate the capital turnover for the last two years. 4. Calculate the residual income for the last two years. You may need to search the notes for the target rate of return 5. Analyze the company. Talk through the ratios and explain if each is good, bad or ugly Would you invest or not and why? (This can be written in a page or 2.) Turn in the company project as a word document with your ratios and financials copied/pasted into the document. Grading criteria - There will be a total of 150 points for this assignment List/analysis: 8 points cach (#1,3.4.5.6,9,10,11) = 64 points Requested financial or report: 4.5 points each (#3,4,5,6,7,8,9,10) = 36 points Final analysis of the company and recommendation to invest, or not (It is recommended to include bar charts or graphs to show your knowledge of Excel.) - 50 points using the 10k reports from Nike on sec.gov https://www.sec.gov/edgar/browse/?CIK-320187&owner=exclude