Answered step by step

Verified Expert Solution

Question

1 Approved Answer

managerial accounting in excel please 18 Finished goods 9,000 19 20 Instructions. Please prepare the following reports in the assigned tabs of the excel file:

managerial accounting

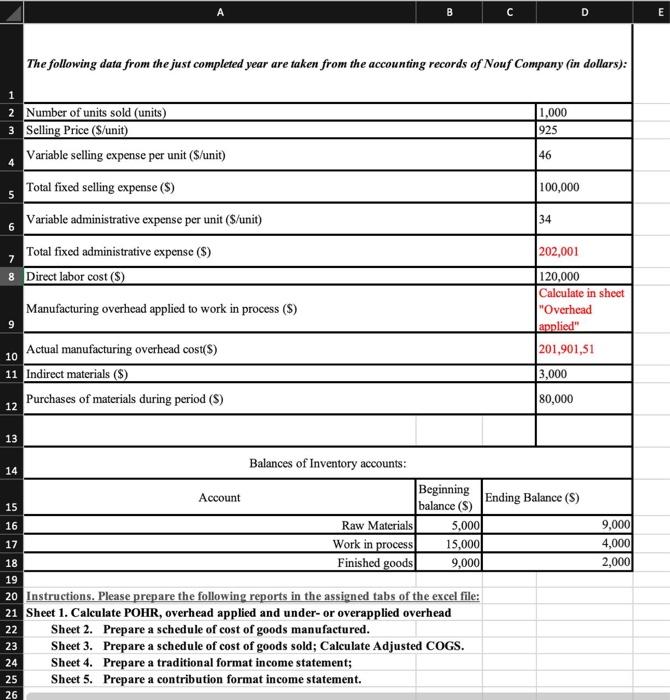

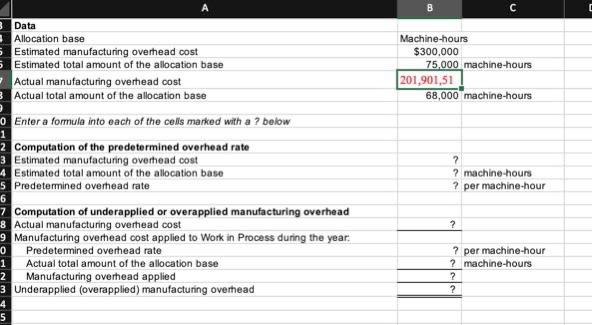

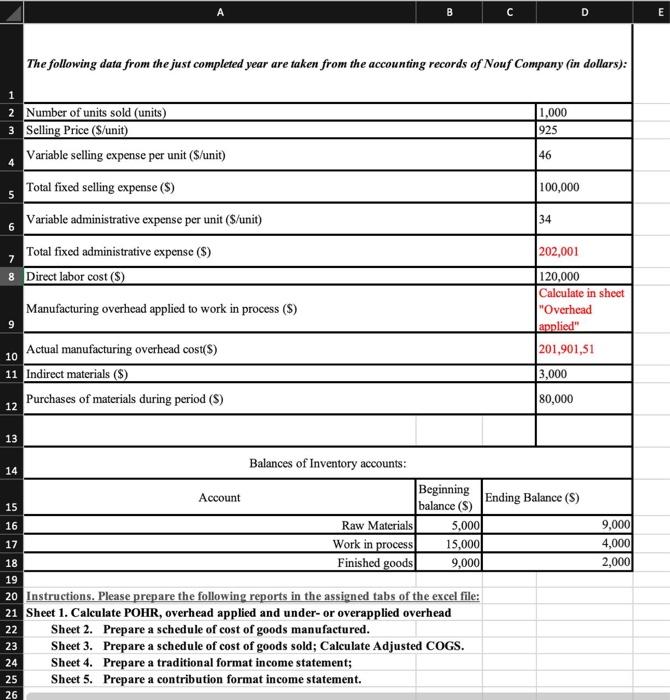

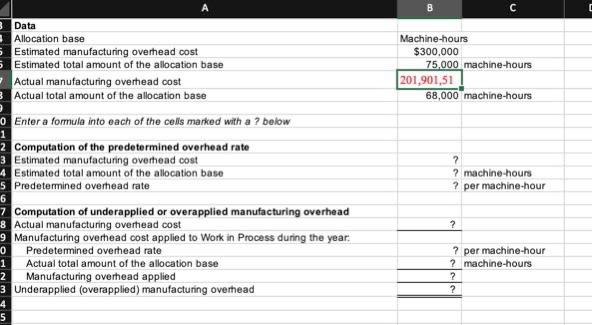

The following data from the just completed year are taken from the accounting records of Nouf Company (in dollars): Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A B C Data Allocation base Machine-hours Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Actual manufacturing overhead cost Actual total amount of the allocation base 68,000201,901,51 machine-hours Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate 3 Estimated manufacturing overhead cost 7 Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine+hour Computation of underapplied or overapplied manufacturing overhead 8 Actual manufacturing overhead cost 9 Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead ?? The following data from the just completed year are taken from the accounting records of Nouf Company (in dollars): Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A B C Data Allocation base Machine-hours Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Actual manufacturing overhead cost Actual total amount of the allocation base 68,000201,901,51 machine-hours Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate 3 Estimated manufacturing overhead cost 7 Estimated total amount of the allocation base ? machine-hours Predetermined overhead rate ? per machine+hour Computation of underapplied or overapplied manufacturing overhead 8 Actual manufacturing overhead cost 9 Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate ? per machine-hour Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead in excel please

18

Finished goods

9,000

19

20 Instructions. Please prepare the following reports in the assigned tabs of the excel file:

21 Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead

22

Sheet 2. Prepare a schedule of cost of goods manufactured.

23

Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS.

24

Sheet 4. Prepare a traditional format income statement;

25

Sheet 5. Prepare a contribution format income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started