Managerial Accounting M:4 HW

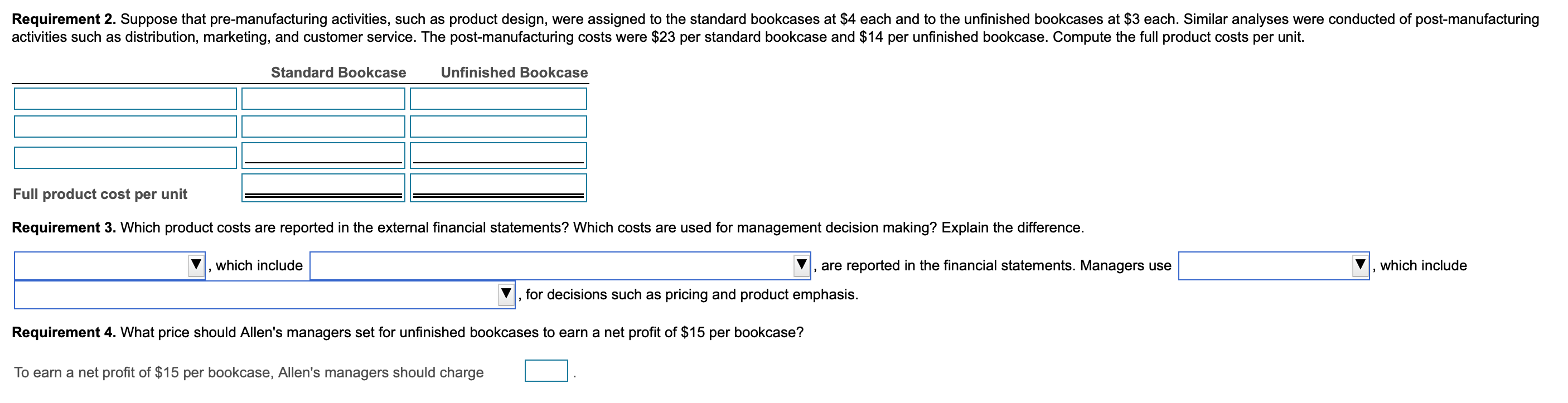

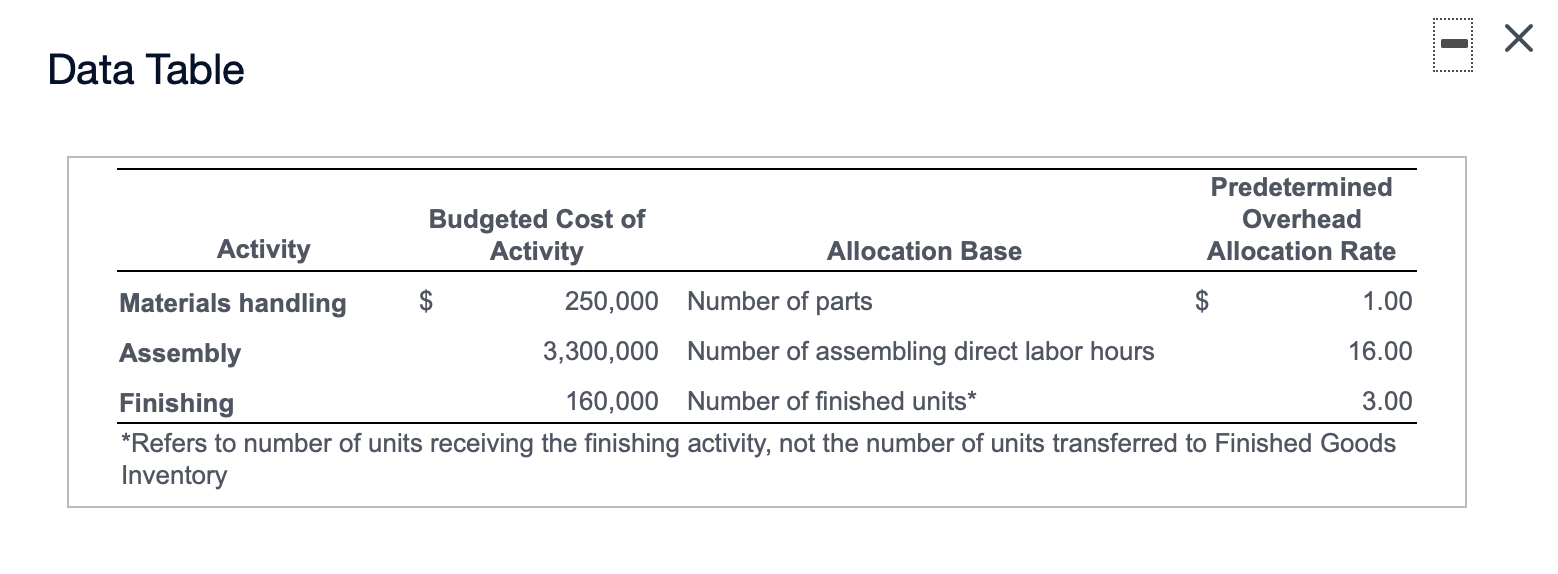

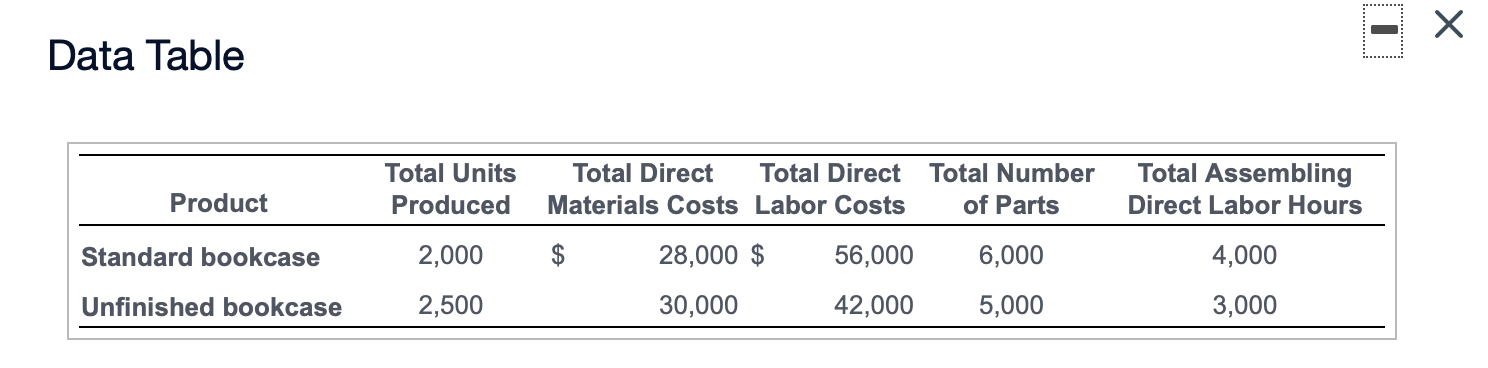

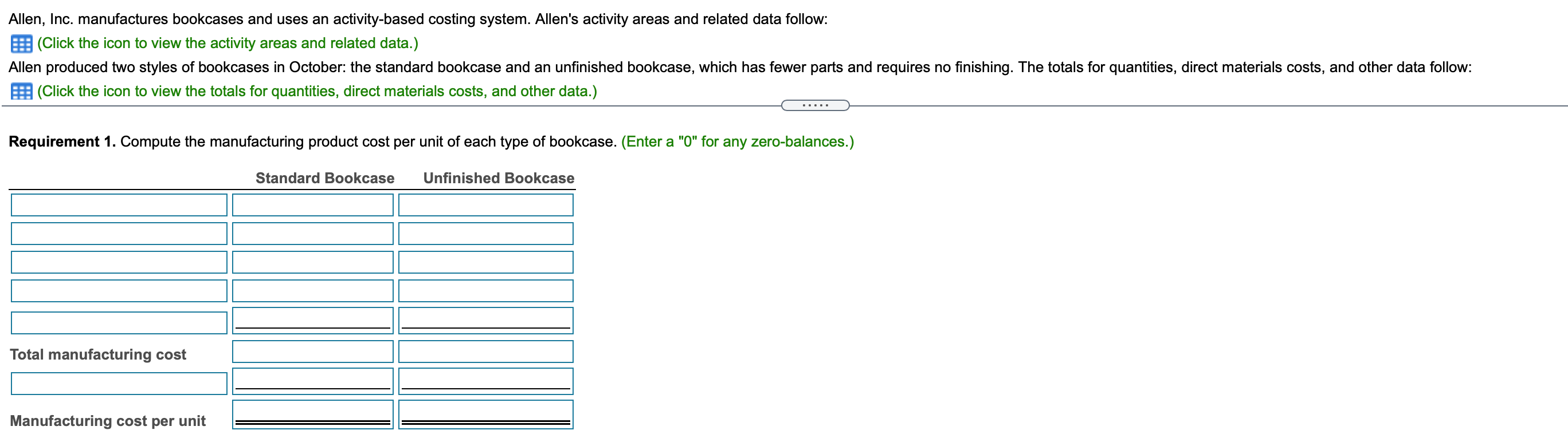

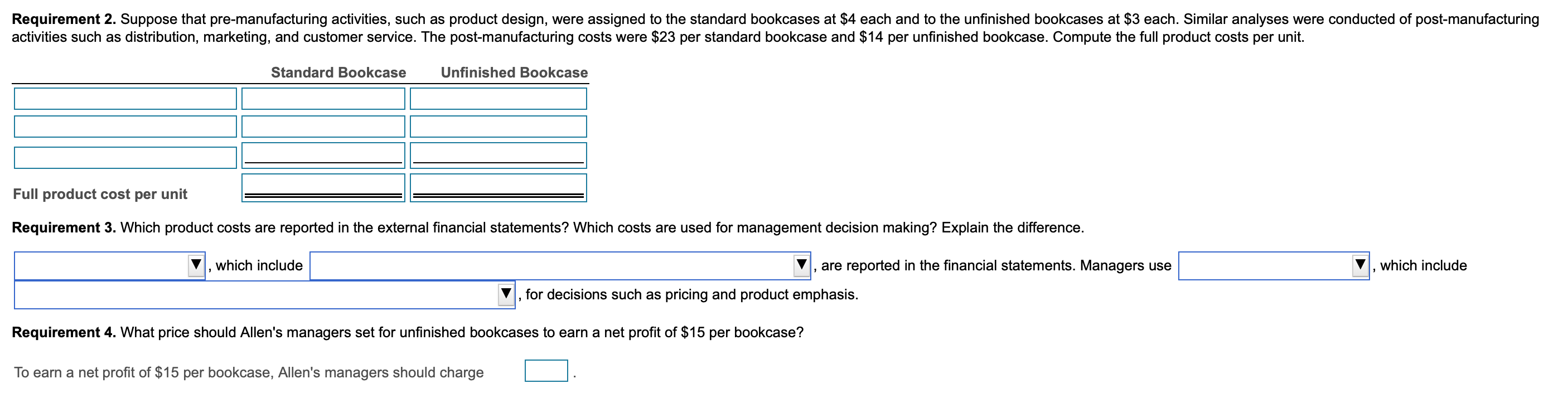

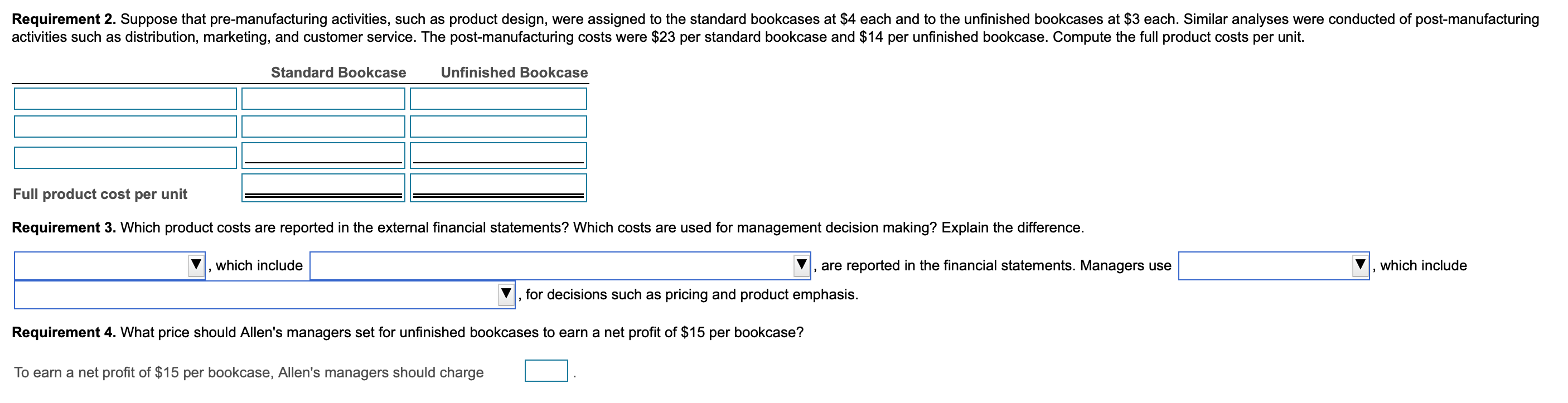

X Data Table Predetermined Budgeted Cost of Overhead Activity Activity Allocation Base Allocation Rate Materials handling $ 250,000 Number of parts $ 1.00 Assembly 3,300,000 Number of assembling direct labor hours 16.00 Finishing 160,000 Number of finished units* 3.00 *Refers to number of units receiving the finishing activity, not the number of units transferred to Finished Goods InventoryData Table Total Units Total Direct Total Direct Total Number Total Assembling Product Produced Materials Costs Labor Costs of Parts Direct Labor Hours Standard bookcase 2,000 $ 28,000 $ 56,000 6,000 4,000 Unfinished bookcase 2,500 30,000 42,000 5,000 3,000 Allen, Inc. manufactures bookcases and uses an activity-based costing system. Allen's activity areas and related data follow: (Click the icon to view the activity areas and related data.) Allen produced two styles of bookcases in October: the standard bookcase and an unfinished bookcase, which has fewer parts and requires no finishing. The totals for quantities, direct materials costs, and other data follow: (Click the icon to view the totals for quantities, direct materials costs, and other data.) Requirement 1. Compute the manufacturing product cost per unit of each type of bookcase. (Enter a "0" for any zero-balances.) Standard Bookcase Unfinished Bookcase Total manufacturing cost Manufacturing cost per unitRequirement 2. Suppose that pre-manufacturing activities, such as product design, were assigned to the standard bookcases at $4 each and to the unfinished bookcases at $3 each. Similar analyses were conducted of post-manufacturing activities such as distribution, marketing, and customer service. The post-manufacturing costs were $23 per standard bookcase and $14 per unfinished bookcase. Compute the full product costs per unit. Standard Bookcase Unfinished Bookcase Full product cost per unit Requirement 3. Which product costs are reported in the external financial statements? Which costs are used for management decision making? Explain the difference. V, which include 7, are reported in the financial statements. Managers use , which include V, for decisions such as pricing and product emphasis. Requirement 4. What price should Allen's managers set for unfinished bookcases to earn a net profit of $15 per bookcase? To earn a net profit of $15 per bookcase, Allen's managers should charge