Managerial Accounting

Please answer all 8 questions could really use the help!! Thank you

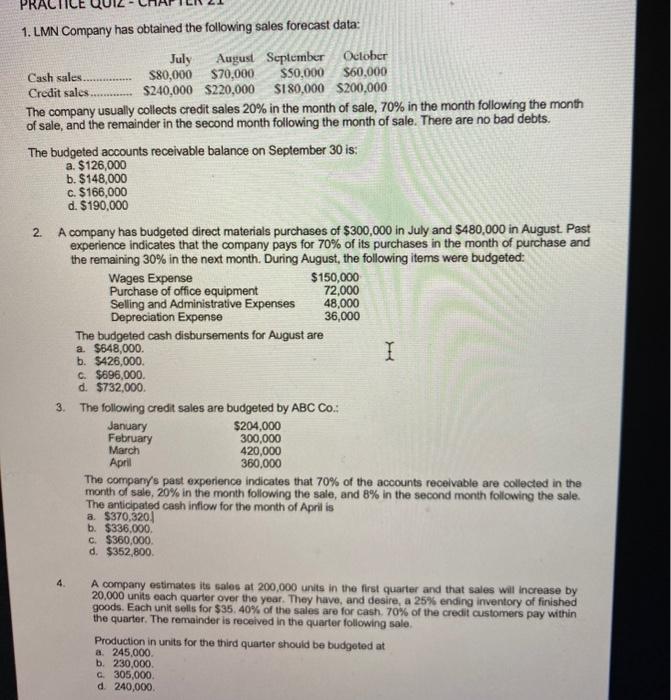

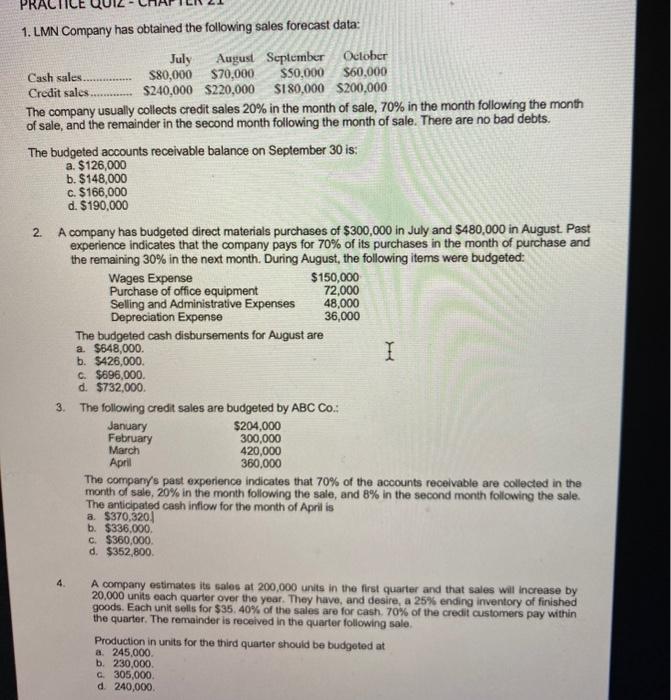

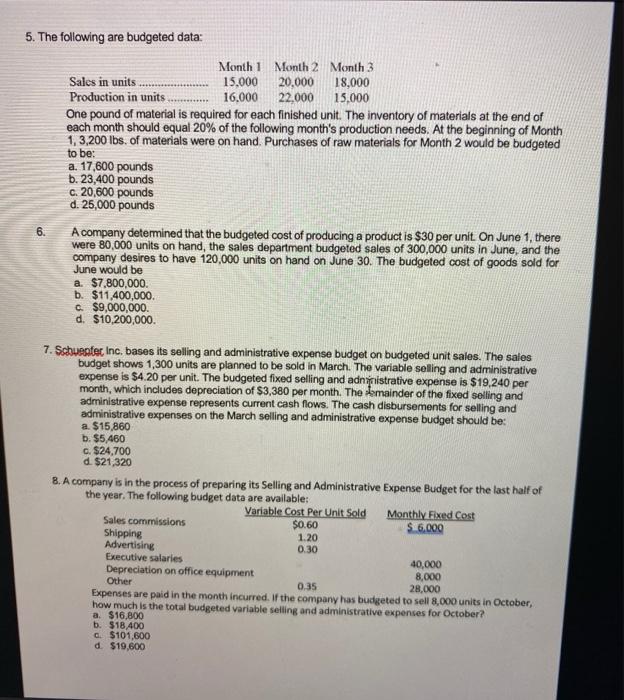

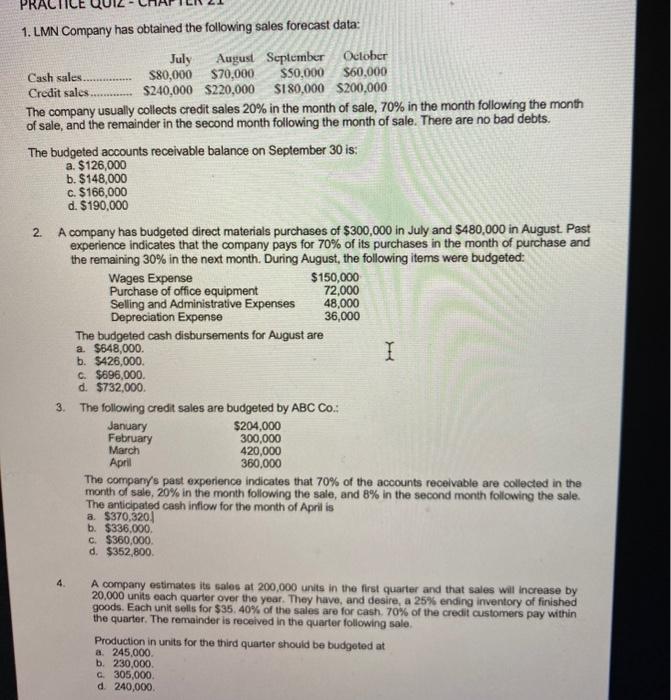

PRAC 1. LMN Company has obtained the following sales forecast data: July August September October Cash sales $80,000 $70,000 $50,000 $60,000 Credit sales $240,000 $220,000 $180,000 $200,000 The company usually collects credit sales 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted accounts receivable balance on September 30 is: a. $126,000 b. $148,000 c. $166,000 d. $190,000 2 A company has budgeted direct materials purchases of $300,000 in July and $480,000 in August. Past experience indicates that the company pays for 70% of its purchases in the month of purchase and the remaining 30% in the next month. During August, the following items were budgeted: Wages Expense $150,000 Purchase of office equipment 72,000 Selling and Administrative Expenses 48,000 Depreciation Expense 36,000 The budgeted cash disbursements for August are a. $648,000 I b. $426,000 C. $696,000 d. $732,000 3 The following credit sales are budgeted by ABC Co.: January $204,000 February 300,000 March 420,000 April 360,000 The company's past experience indicates that 70% of the accounts receivable are collected in the month of sale, 20% in the month following the sale, and 8% in the second month following the sale. The anticipated cash inflow for the month of April is a $370,3201 b. $336,000 C. $360,000 d. $352,800 4. A company estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. They have, and desire, a 25% ending inventory of finished goods. Each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is received in the quarter following sale Production in units for the third quarter should be budgeted at a. 245,000. b. 230.000 G305,000 d. 240,000 5. The following are budgeted data: Month 1 Month 2 Month 3 Sales in units 15.000 20.000 18,000 Production in units 16.000 22.000 15,000 One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. At the beginning of Month 1, 3,200 lbs. of materials were on hand. Purchases of raw materials for Month 2 would be budgeted to be: a. 17,600 pounds b. 23,400 pounds c. 20,600 pounds d. 25,000 pounds A company determined that the budgeted cost of producing a product is $30 per unit. On June 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in June, and the company desires to have 120,000 units on hand on June 30. The budgeted cost of goods sold for June would be a. $7.800,000 b. $11,400,000 c. $9,000,000 d. $10,200,000 6. 7. Schuenter Inc. bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 1,300 units are planned to be sold in March. The variable selling and administrative expense is $4.20 per unit. The budgeted fixed selling and administrative expense is $19,240 per month, which includes depreciation of $3,380 per month. The mainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be: a $15,860 b. $5,460 c. $24,700 d. $21,320 8. A company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available: Variable Cost Per Unit Sold Monthly Fixed Cost Sales commissions $0.60 $ 6,000 Shipping 1.20 Advertising 0.30 Executive salaries 40,000 Depreciation on office equipment 8,000 Other 0.35 28,000 Expenses are paid in the month incurred. If the company has budgeted to sell 8,000 units in October, how much is the total budgeted variable selling and administrative expenses for October? a. $16,800 b. $18.400 $101,600 d. $19,600