MANAGERIAL ACCOUNTING QUESTION GRP 2.1

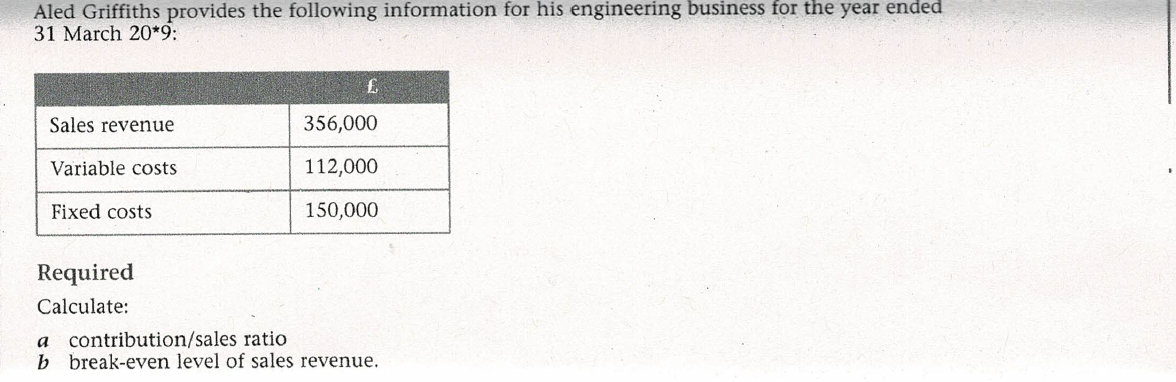

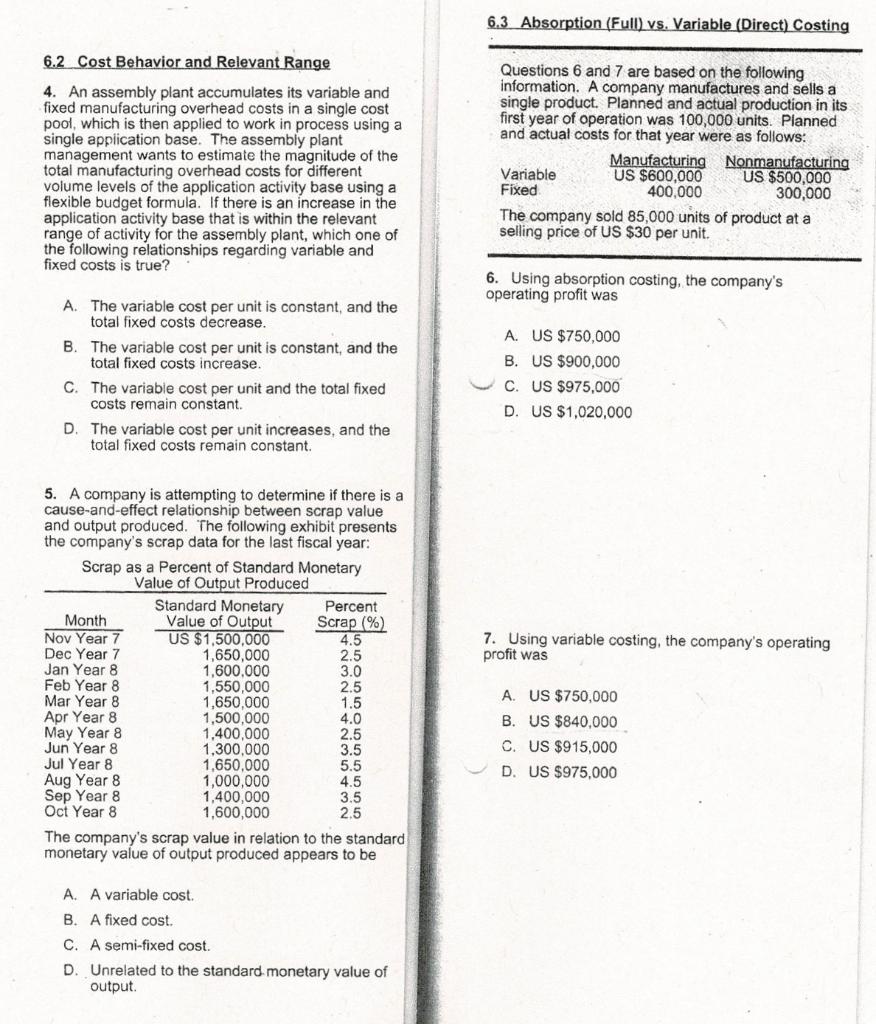

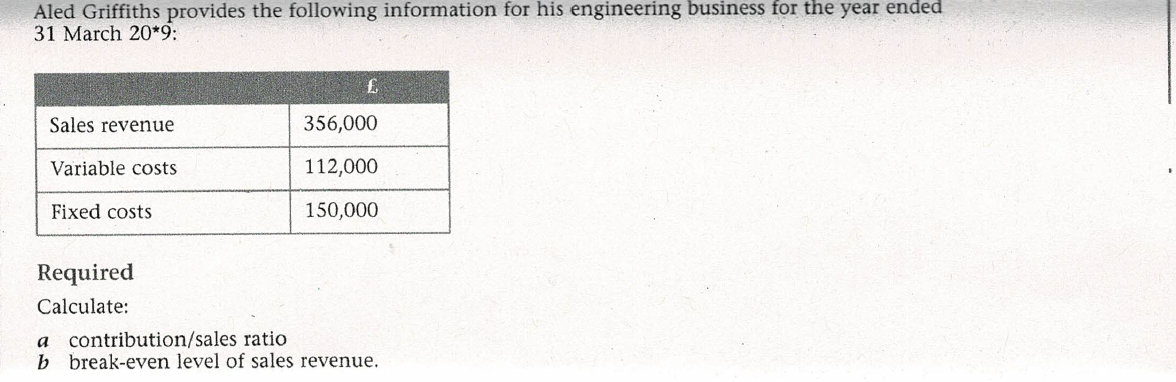

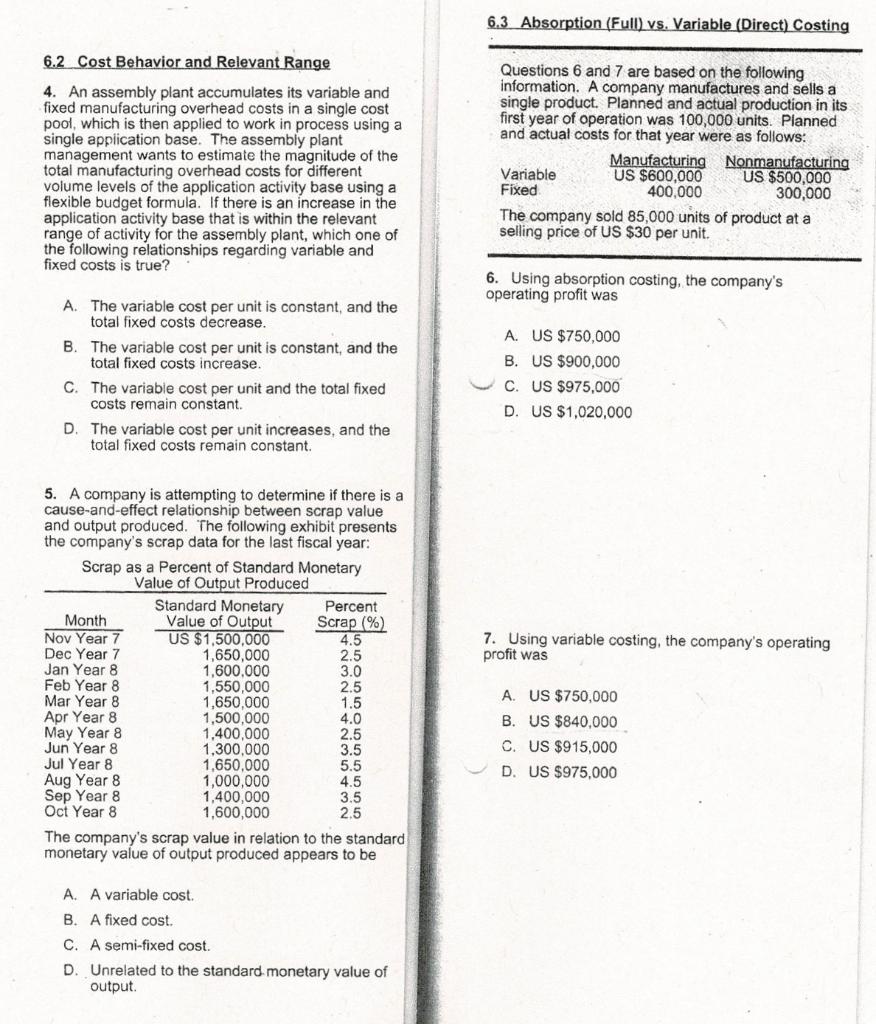

Aled Griffiths provides the following information for his engineering business for the year ended 31 March 20*9: Sales revenue 356,000 Variable costs 112,000 Fixed costs 150,000 Required Calculate: a contribution/sales ratio b break-even level of sales revenue. 6.2 Cost Behavior and Relevant Range 4. An assembly plant accumulates its variable and fixed manufacturing overhead costs in a single cost pool, which is then applied to work in process using a single application base. The assembly plant management wants to estimate the magnitude of the total manufacturing overhead costs f for different volume levels of the application activity base using a flexible budget formula. If there is an increase in the application activity base that is within the relevant range of activity for the assembly plant, which one of the following relationships regarding variable and fixed costs is true? A. The variable cost per unit is constant, and the total fixed costs decrease. B. The variable cost per unit is constant, and the total fixed costs increase. C. The variable cost per unit and the total fixed costs remain constant. D. The variable cost per unit increases, and the total fixed costs remain constant. 5. A company is attempting to determine if there is a cause-and-effect relationship between scrap value and output produced. The following exhibit presents the company's scrap data for the last fiscal year: Scrap as a Percent of Standard Monetary Value of Output Produced Percent Month Standard Monetary Value of Output US $1,500,000 Scrap (%) Nov Year 7 4.5 1,650,000 2.5 Dec Year 7 Jan Year 8 Feb Year 8 1,600,000 3.0 1,550,000 2.5 000 46 1,650,000 1.5 500.000 1:0 1,500,000 4.0 1,400,000 25 2.5 Mar Year 8 Apr Year 8 May Year 8 Jun Year 8 Jul Year 8 Aug Year 8 1,300,000 35 3.5 1,650,000 5.5 1,000,000 4.5 Sep Year 8 1,400,000 3.5 Oct Year 8 1,600,000 2.5 The company's scrap value in relation to the standard monetary value of output produced appears to be A. A variable cost. B. A fixed cost. C. A semi-fixed cost. D. Unrelated to the standard monetary value of output. 6.3 Absorption (Full) vs. Variable (Direct) Costing Questions 6 and 7 are based on the following information. A company manufactures and sells a single product. Planned and actual production in its first year of operation was 100,000 units. Planned and actual costs for that year were as follows: Variable Fixed Manufacturing Nonmanufacturing US $600,000 US $500,000 400,000 300,000 The company sold 85,000 units of product at a selling price of US $30 per unit. 6. Using absorption costing, the company's operating profit was A. US $750,000 B. US $900,000 C. US $975,000 D. US $1,020,000 7. Using variable costing, the company's operating profit was A. US $750,000 B. US $840,000 C. US $915,000 D. US $975,000