Answered step by step

Verified Expert Solution

Question

1 Approved Answer

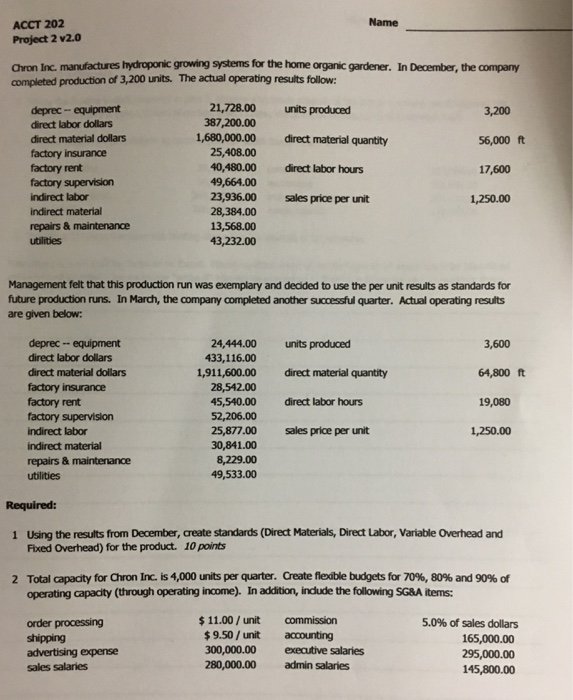

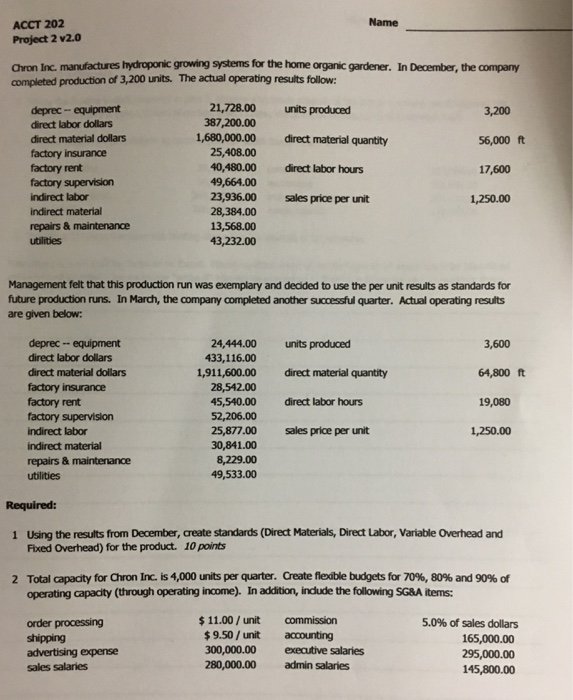

Managerial Accounting question Name ACCT 202 Project 2 v2.0 Chron Inc. manufactures hydroponic growing systems for the home organic gardener. In December, the company completed

Managerial Accounting question

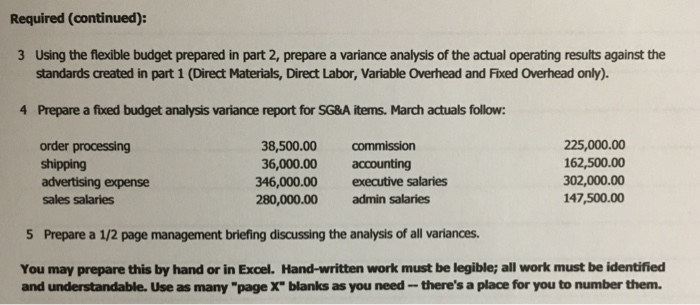

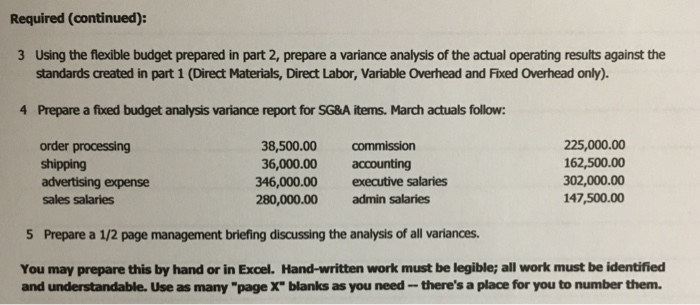

Name ACCT 202 Project 2 v2.0 Chron Inc. manufactures hydroponic growing systems for the home organic gardener. In December, the company completed production of 3,200 units. The actual operating results follow: 21,728.00 units produced deprec- equipment direct labor dollars direct material dollars factory insurance factory rent factory supervision indirect labor indirect material repairs& maintenance 3,200 56,000 ft 17,600 387,200.00 ,680,000.00 direct material quantity 25,408.00 40,480.00 direct labor hours 49,664.00 23,936.00 sales price per unit 1,250.00 13,568.00 43,232.00 Management felt that this production run was exemplary and deaided to use the per unit results as standards for future production runs. In March, the company completed another successful quarter. Actual operating results are given below deprec - equipment direct labor dollars direct material dollars factory insurance factory rent factory supervision indirect labor indirect material repairs & maintenance utilities 24,444.00 units produced 3,600 64,800 ft 19,080 433,116.00 ,911,600.00 direct material quantity 28,542.00 45,540.00 52,206.00 25,877.00 30,841.00 8,229.00 49,533.00 direct labor hours sales price per unit 1,250.00 Required: 1 Using the results from December, create standards (Direct Materials, Direct Labor, Variable Overhead and Fixed Overhead) for the product. 10 points 2 apacity for aron Inc. is 4,000 units perquarter, Create fexble budgets for 70%, 80% and 90% of Total operating capacity (through operating income). In addition, indlude the following SG&A items: order processing shipping advertising expense sales salaries 11.00/unit commission $9.50/unit accounting 300,000.00 executive salaries 280,000.00 admin salaries 5.0% of sales dollars 165,000.00 295,000.00 145,800.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started