Managerial Accounting

Ratios: Liquidity, Solvency, Profitability, Market.

I need help finding the Profitability for this company and I'm not sure how to do it. Below is the company's income statement and balance sheet. Please show work.

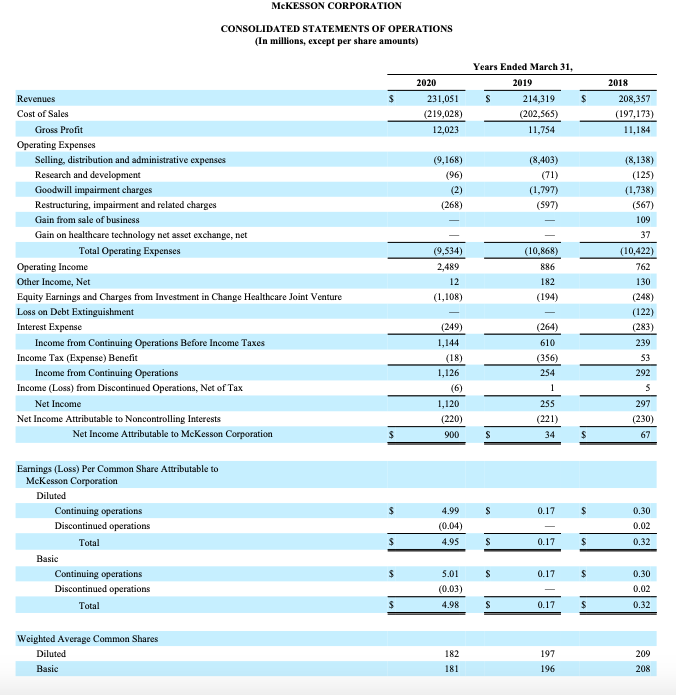

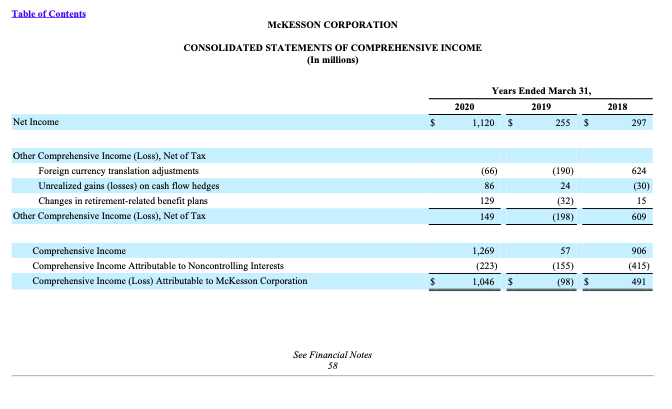

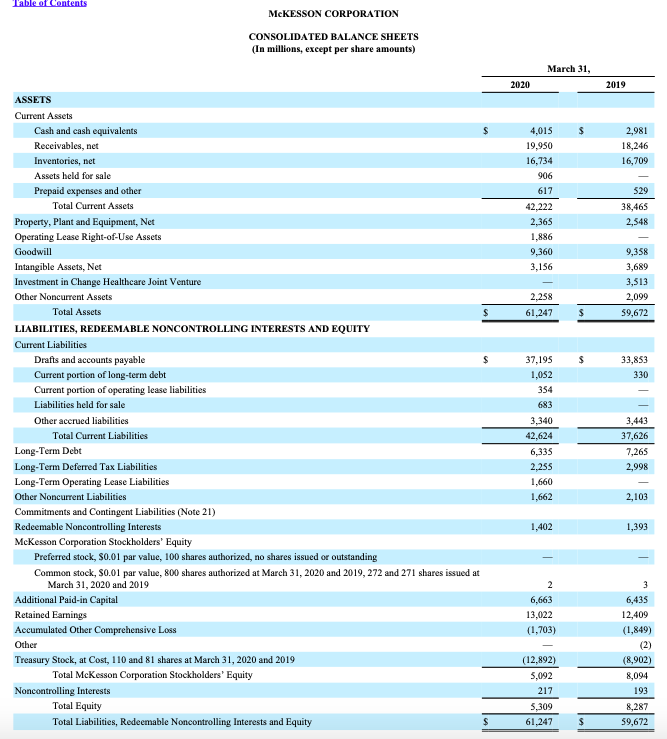

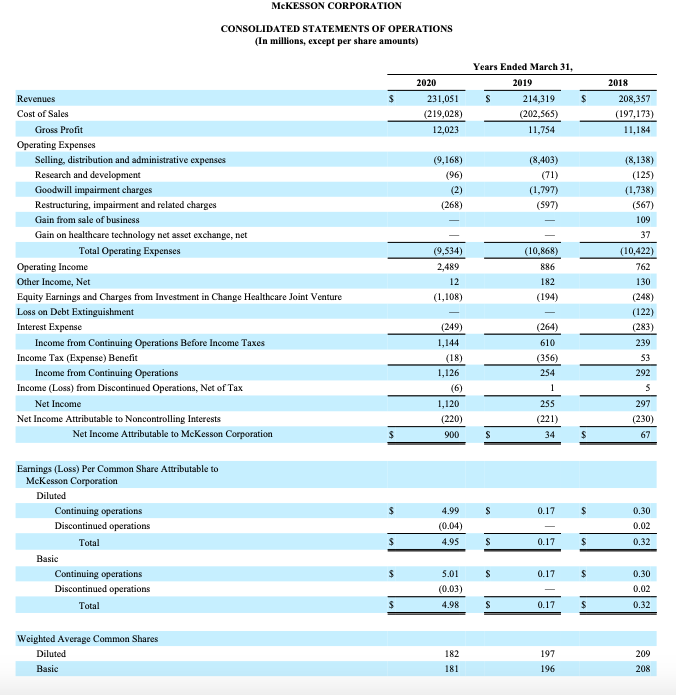

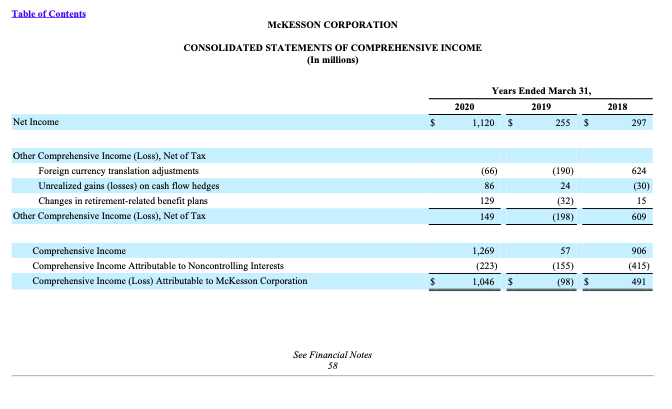

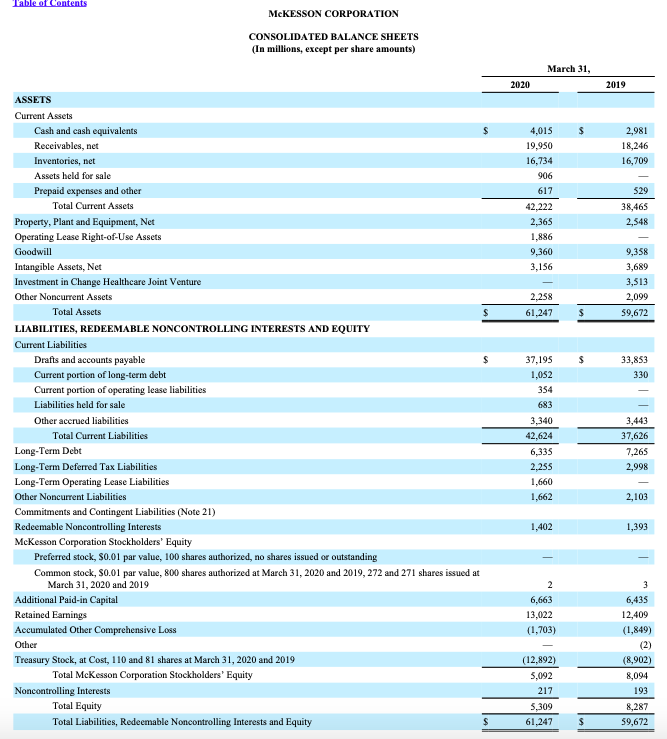

McKESSON CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) $ Years Ended March 31, 2019 214,319 (202,565) 11,754 2020 231,051 (219,028) 12,023 $ 2018 208,357 (197,173) 11,184 (8,403) (9,168) (96) (2) (268) (1,797) (597) Revenues Cost of Sales Gross Profit Operating Expenses Selling, distribution and administrative expenses Research and development Goodwill impairment charges Restructuring, impairment and related charges Gain from sale of business Gain on healthcare technology net asset exchange, net Total Operating Expenses Operating Income Other Income, Net Equity Earnings and Charges from Investment in Change Healthcare Joint Venture Loss on Debt Extinguishment Interest Expense Income from Continuing Operations Before Income Taxes Income Tax (Expense) Benefit Income from Continuing Operations Income (Loss) from Discontinued Operations, Net of Tax Net Income Net Income Attributable to Noncontrolling Interests Net Income Attributable to McKesson Corporation (9,534) 2,489 12 (1,108) (10,868) 886 182 (194) (8,138) (125) (1,738) (567) 109 37 (10,422) 762 130 (248) (122) (283) 239 53 292 5 (249) (264) 610 (356) 254 1 (18) 1,126 (6) 1,120 (220) 900 297 255 (221) 34 (230) $ S $ $ S 0.17 $ 0.30 4.99 (0.04) Earnings (Loss) Per Common Share Attributable to McKesson Corporation Diluted Continuing operations Discontinued operations Total Basic Continuing operations Discontinued operations Total 0.02 0.32 $ 4.95 S 0.17 $ $ S 0.17 $ 5.01 (0.03) 4.98 0.30 0.02 0.32 S 0.17 $ Weighted Average Common Shares Diluted Basic 182 181 197 196 209 208 Table of Contents McKESSON CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years Ended March 31, 2020 2019 1,120 $ 255 $ 2018 Net Income $ 297 Other Comprehensive Income (Loss), Net of Tax Foreign currency translation adjustments Unrealized gains (losses) on cash flow hedges Changes in retirement-related benefit plans Other Comprehensive Income (Loss), Net of Tax (66) 86 (190) 24 (32) (198) 624 (30) 15 609 129 149 Comprehensive Income Comprehensive Income Attributable to Noncontrolling Interests Comprehensive Income (Loss) Attributable to McKesson Corporation 1,269 (223) 1,046 57 (155) (98) $ 906 (415) 491 $ See Financial Notes 58 Table of Contents McKESSON CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share amounts) March 31, 2020 2019 $ 4,015 19,950 16,734 906 2,981 18,246 16,709 617 529 38,465 2,548 42,222 2,365 1,886 9,360 3,156 9,358 3,689 3,513 2,099 59,672 2,258 61,247 $ $ s $ 33,853 330 37,195 1,052 354 683 ASSETS Current Assets Cash and cash equivalents Receivables, net Inventories, net Assets held for sale Prepaid expenses and other Total Current Assets Property, Plant and Equipment, Net Operating Lease Right-of-Use Assets Goodwill Intangible Assets, Net Investment in Change Healthcare Joint Venture Other Noncurrent Assets Total Assets LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY Current Liabilities Drafts and accounts payable Current portion of long-term debt Current portion of operating lease liabilities Liabilities held for sale Other accrued liabilities Total Current Liabilities Long-Term Debt Long-Term Deferred Tax Liabilities Long-Term Operating Lease Liabilities Other Noncurrent Liabilities Commitments and Contingent Liabilities (Note 21) Redeemable Noncontrolling Interests McKesson Corporation Stockholders' Equity Preferred stock, 30.01 par value, 100 shares authorized, no shares issued or outstanding Common stock, 30.01 par value, 800 shares authorized at March 31, 2020 and 2019, 272 and 271 shares issued at March 31, 2020 and 2019 Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Loss Other Treasury Stock, at Cost, 110 and 81 shares at March 31, 2020 and 2019 Total McKesson Corporation Stockholders' Equity Noncontrolling Interests Total Equity Total Liabilities, Redeemable Noncontrolling Interests and Equity 3,443 37.626 7,265 3,340 42,624 6,335 2.255 1,660 1,662 2,998 2,103 1,402 1,393 2 6,663 13,022 (1,703) 3 6,435 12,409 (1,849) (2) (8,902) 8,094 (12.892) 5,092 217 5,309 61,247 193 $ 8,287 59,672 $ McKESSON CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share amounts) $ Years Ended March 31, 2019 214,319 (202,565) 11,754 2020 231,051 (219,028) 12,023 $ 2018 208,357 (197,173) 11,184 (8,403) (9,168) (96) (2) (268) (1,797) (597) Revenues Cost of Sales Gross Profit Operating Expenses Selling, distribution and administrative expenses Research and development Goodwill impairment charges Restructuring, impairment and related charges Gain from sale of business Gain on healthcare technology net asset exchange, net Total Operating Expenses Operating Income Other Income, Net Equity Earnings and Charges from Investment in Change Healthcare Joint Venture Loss on Debt Extinguishment Interest Expense Income from Continuing Operations Before Income Taxes Income Tax (Expense) Benefit Income from Continuing Operations Income (Loss) from Discontinued Operations, Net of Tax Net Income Net Income Attributable to Noncontrolling Interests Net Income Attributable to McKesson Corporation (9,534) 2,489 12 (1,108) (10,868) 886 182 (194) (8,138) (125) (1,738) (567) 109 37 (10,422) 762 130 (248) (122) (283) 239 53 292 5 (249) (264) 610 (356) 254 1 (18) 1,126 (6) 1,120 (220) 900 297 255 (221) 34 (230) $ S $ $ S 0.17 $ 0.30 4.99 (0.04) Earnings (Loss) Per Common Share Attributable to McKesson Corporation Diluted Continuing operations Discontinued operations Total Basic Continuing operations Discontinued operations Total 0.02 0.32 $ 4.95 S 0.17 $ $ S 0.17 $ 5.01 (0.03) 4.98 0.30 0.02 0.32 S 0.17 $ Weighted Average Common Shares Diluted Basic 182 181 197 196 209 208 Table of Contents McKESSON CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years Ended March 31, 2020 2019 1,120 $ 255 $ 2018 Net Income $ 297 Other Comprehensive Income (Loss), Net of Tax Foreign currency translation adjustments Unrealized gains (losses) on cash flow hedges Changes in retirement-related benefit plans Other Comprehensive Income (Loss), Net of Tax (66) 86 (190) 24 (32) (198) 624 (30) 15 609 129 149 Comprehensive Income Comprehensive Income Attributable to Noncontrolling Interests Comprehensive Income (Loss) Attributable to McKesson Corporation 1,269 (223) 1,046 57 (155) (98) $ 906 (415) 491 $ See Financial Notes 58 Table of Contents McKESSON CORPORATION CONSOLIDATED BALANCE SHEETS (In millions, except per share amounts) March 31, 2020 2019 $ 4,015 19,950 16,734 906 2,981 18,246 16,709 617 529 38,465 2,548 42,222 2,365 1,886 9,360 3,156 9,358 3,689 3,513 2,099 59,672 2,258 61,247 $ $ s $ 33,853 330 37,195 1,052 354 683 ASSETS Current Assets Cash and cash equivalents Receivables, net Inventories, net Assets held for sale Prepaid expenses and other Total Current Assets Property, Plant and Equipment, Net Operating Lease Right-of-Use Assets Goodwill Intangible Assets, Net Investment in Change Healthcare Joint Venture Other Noncurrent Assets Total Assets LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY Current Liabilities Drafts and accounts payable Current portion of long-term debt Current portion of operating lease liabilities Liabilities held for sale Other accrued liabilities Total Current Liabilities Long-Term Debt Long-Term Deferred Tax Liabilities Long-Term Operating Lease Liabilities Other Noncurrent Liabilities Commitments and Contingent Liabilities (Note 21) Redeemable Noncontrolling Interests McKesson Corporation Stockholders' Equity Preferred stock, 30.01 par value, 100 shares authorized, no shares issued or outstanding Common stock, 30.01 par value, 800 shares authorized at March 31, 2020 and 2019, 272 and 271 shares issued at March 31, 2020 and 2019 Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Loss Other Treasury Stock, at Cost, 110 and 81 shares at March 31, 2020 and 2019 Total McKesson Corporation Stockholders' Equity Noncontrolling Interests Total Equity Total Liabilities, Redeemable Noncontrolling Interests and Equity 3,443 37.626 7,265 3,340 42,624 6,335 2.255 1,660 1,662 2,998 2,103 1,402 1,393 2 6,663 13,022 (1,703) 3 6,435 12,409 (1,849) (2) (8,902) 8,094 (12.892) 5,092 217 5,309 61,247 193 $ 8,287 59,672 $