Answered step by step

Verified Expert Solution

Question

1 Approved Answer

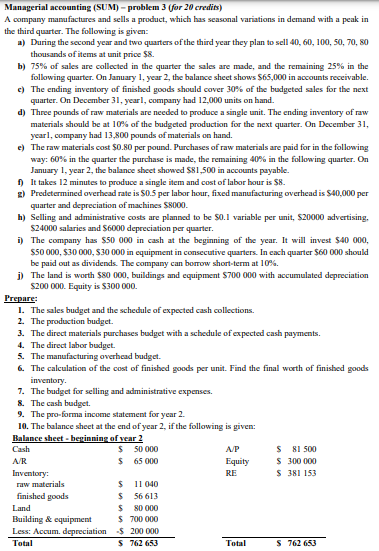

Managerial accounting (SUM) problem 3 (for 20 credits) A company manufactures and sells a product, which has seasonal variations in demand with a peak

Managerial accounting (SUM) problem 3 (for 20 credits) A company manufactures and sells a product, which has seasonal variations in demand with a peak in the third quarter. The following is given: a) During the second year and two quarters of the third year they plan to sell 40, 60, 100, 50, 70, 80 thousands of items at unit price $8. b) 75% of sales are collected in the quarter the sales are made, and the remaining 25% in the following quarter. On January 1, year 2, the balance sheet shows $65,000 in accounts receivable. e) The ending inventory of finished goods should cover 30% of the budgeted sales for the next quarter. On December 31, yearl, company had 12,000 units on hand. d) Three pounds of raw materials are needed to produce a single unit. The ending inventory of raw materials should be at 10% of the budgeted production for the next quarter. On December 31, yearl, company had 13,800 pounds of materials on hand. e) The raw materials cost $0.80 per pound. Purchases of raw materials are paid for in the following way: 60% in the quarter the purchase is made, the remaining 40% in the following quarter. On January 1, year 2, the balance sheet showed $81,500 in accounts payable. f) It takes 12 minutes to produce a single item and cost of labor hour is $8. g) Predetermined overhead rate is $0.5 per labor hour, fixed manufacturing overhead is $40,000 per quarter and depreciation of machines $8000. h) Selling and administrative costs are planned to be $0.1 variable per unit, $20000 advertising, $24000 salaries and $6000 depreciation per quarter. i) The company has $50 000 in cash at the beginning of the year. It will invest $40 000, $50 000, $30 000, $30 000 in equipment in consecutive quarters. In each quarter $60 000 should be paid out as dividends. The company can borrow short-term at 10%. j) The land is worth $80 000, buildings and equipment $700 000 with accumulated depreciation $200 000. Equity is $300 000. Prepare: 1. The sales budget and the schedule of expected cash collections. 2. The production budget. 3. The direct materials purchases budget with a schedule of expected cash payments. 4. The direct labor budget. 5. The manufacturing overhead budget. 6. The calculation of the cost of finished goods per unit. Find the final worth of finished goods inventory. 7. The budget for selling and administrative expenses. 8. The cash budget. 9. The pro-forma income statement for year 2. 10. The balance sheet at the end of year 2, if the following is given: Balance sheet - beginning of year 2 Cash $ 50 000 A/P S 81 500 A/R $ 65 000 Equity $ 300 000 Inventory: RE $ 381 153 raw materials $ 11040 finished goods $ 56 613 Land $ 80 000 Building & equipment $ 700 000 Less: Accum. depreciation $ 200 000 Total $ 762 653 Total $ 762 653

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started