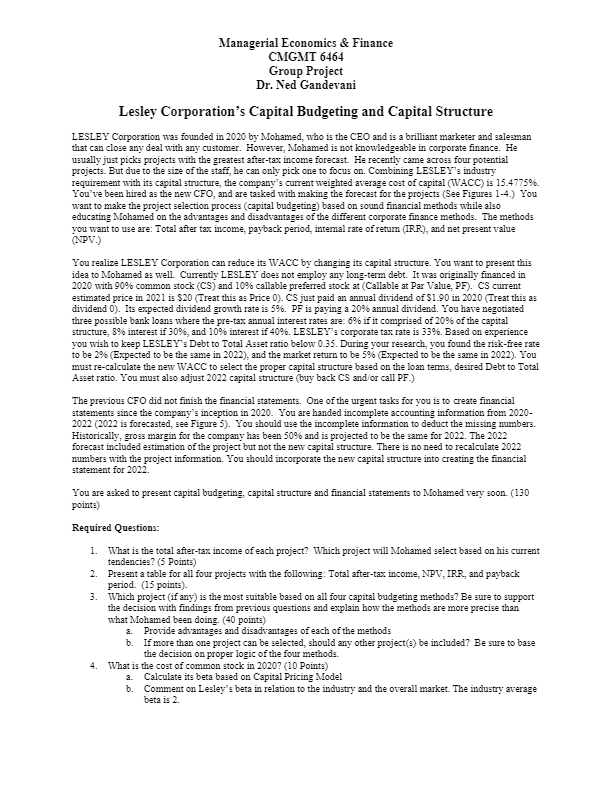

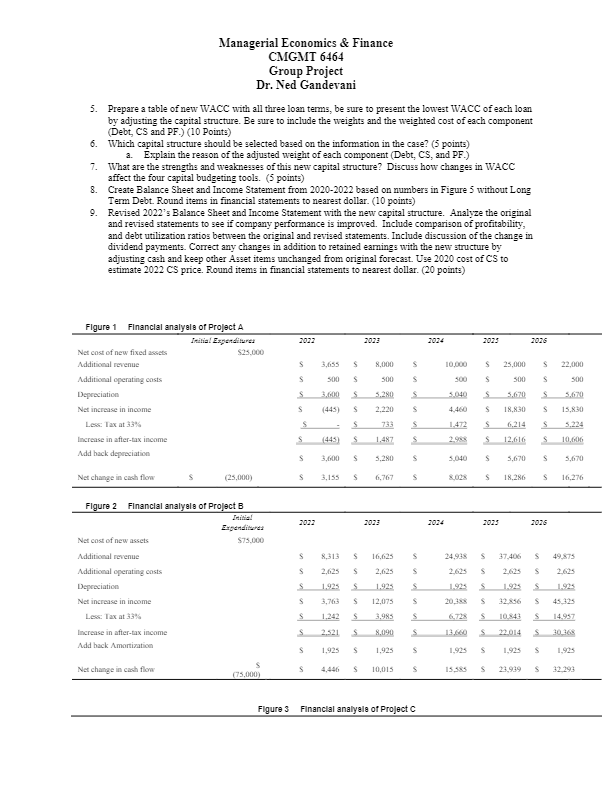

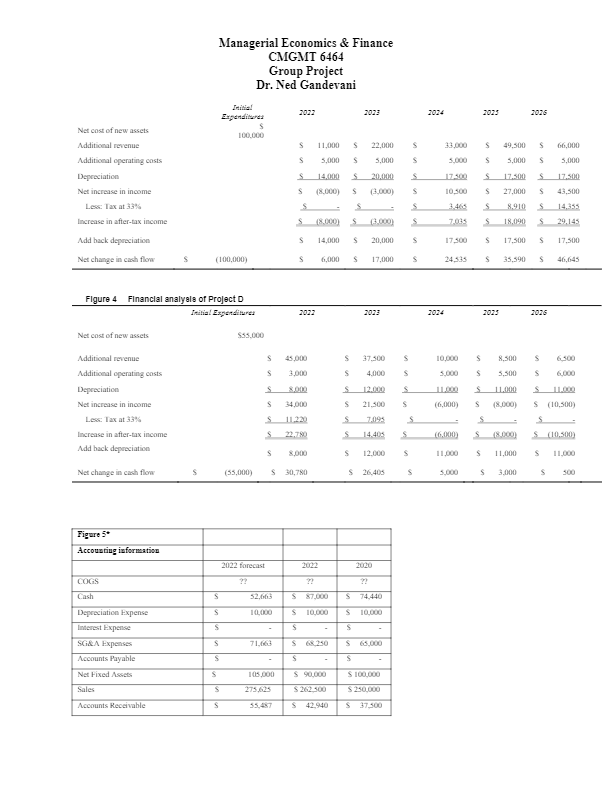

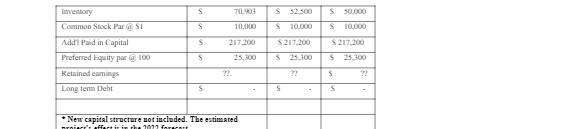

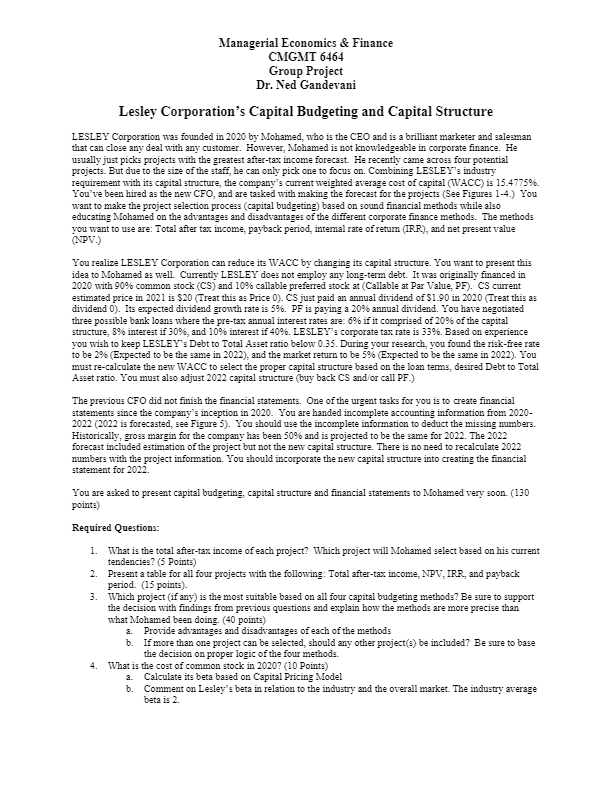

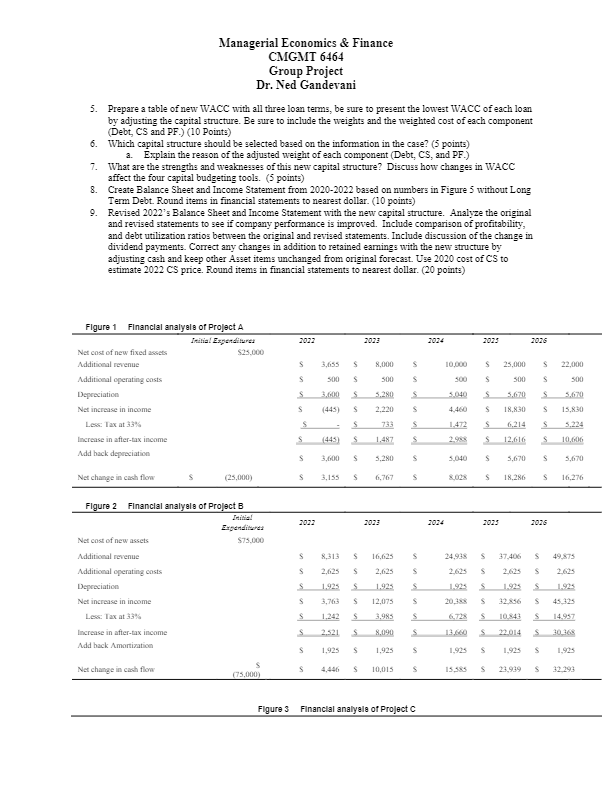

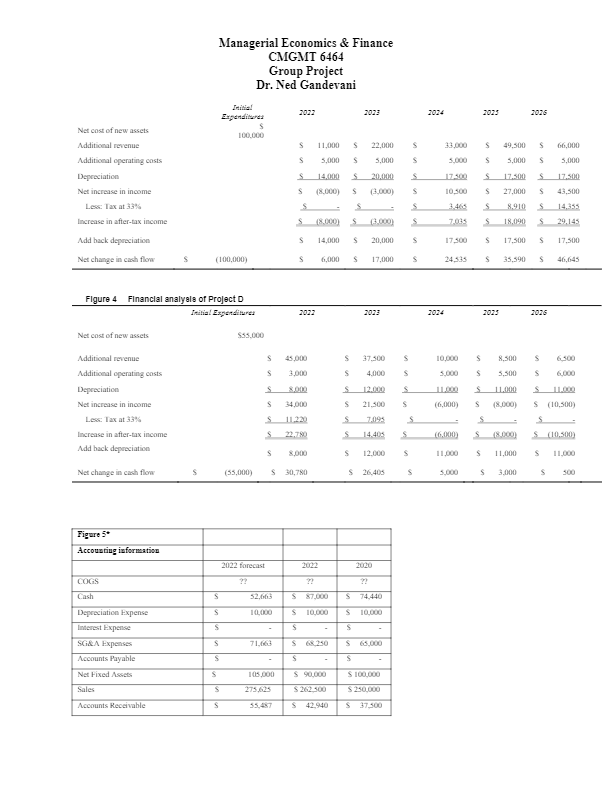

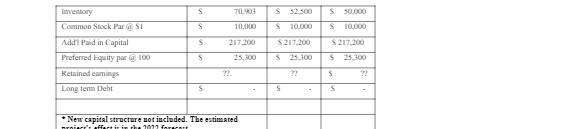

Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani Lesley Corporation's Capital Budgeting and Capital Structure LESLEY Corporation was founded in 2020 by Mohamed, who is the CEO and is a brilliant marketer and salesman that can close any deal with any customer. However, Mohamed is not knowledgeable in corporate finance. He usually just picks projects with the greatest after-tax income forecast. He recently came across four potential projects. But due to the size of the staff, he can only pick one to focus on. Combining LESLEY's industry requirement with its capital structure, the company's current weighted average cost of capital (WACC) is 15.4775%. You've been hired as the new CFO, and are tasked with making the forecast for the projects (See Figures 1-4.) You want to make the project selection process (capital budgeting) based on sound financial methods while also educating Mohamed on the advantages and disadvantages of the different corporate finance methods. The methods you want to use are: Total after tax income, payback period, internal rate of retum (IRR), and net present value (NPV.) You realize LESLEY Corporation can reduce its WACC by changing its capital structure. You want to present this idea to Mohamed as well. Currently LESLEY does not employ any long-term debt. It was originally financed in 2020 with 90% common stock (CS) and 10% callable preferred stock at (Callable at Par Value PF). CS current estimated price in 2021 is $20 (Treat this as Price 0). CS just paid an annual dividend of $1.90 in 2020 (Treat this as dividend 0). Its expected dividend growth rate is 5%. PF is paying a 20% annual dividend. You have negotiated three possible bank loans where the pre-tax annual interest rates are: 6% if it comprised of 20% of the capital structure, 8% interest if 30%, and 10% interest if 40%. LESLEY's corporate tax rate is 33%. Based on experience you wish to keep LESLEY's Debt to Total Asset ratio below 0.35. During your research, you found the risk-free rate to be 2% (Expected to be the same in 2022), and the market return to be 5% (Expected to be the same in 2022). You must re-calculate the new WACC to select the proper capital structure based on the loan terms, desired Debt to Total Asset ratio. You must also adjust 2022 capital structure (buy back CS and/or call PF.) The previous CFO did not finish the financial statements. One of the urgent tasks for you is to create financial statements since the company's inception in 2020. You are handed incomplete accounting information from 2020- 2022 (2022 is forecasted, see Figure 5). You should use the incomplete information to deduct the missing numbers. Historically, gross margin for the company has been 50% and is projected to be the same for 2022. The 2022 forecast included estimation of the project but not the new capital structure. There is no need to recalculate 2022 numbers with the project information. You should incorporate the new capital structure into creating the financial statement for 2022 You are asked to present capital budgeting, capital structure and financial statements to Mohamed very soon. (130 points) Required Questions: 1. What is the total after-tax income of each project? Which project will Mohamed select based on his current tendencies? (5 Points) 2. Present a table for all four projects with the following: Total after-tax income, NPV, IRR and payback period. (15 points) 3. Which project (if any) is the most suitable based on all four capital budgeting method:? Be sure to support the decision with findings from previous questions and explain how the methods are more precise than what Mohamed been doing. (40 points) a. Provide advantages and disadvantages of each of the methods b. If mo than one project can be selected, should any other ject(s) be included? Be sure to base the decision on proper logic of the four methods. 4. What is the cost of common stock in 2020? (10 Points) a. Calculate its beta based on Capital Pricing Model b. Comment on Lesley's beta in relation to the industry and the overall market. The industry average beta is 2. Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani 5. Prepare a table of new WACC with all three loan terms, be sure to present the lowest WACC of each loan by adjusting the capital structure. Be sure to include the weights and the weighted cost of each component (Debt CS and PF.) (10 Points) 6. Which capital structure should be selected based on the information in the case? (5 points) a. Explain the reason of the adjusted weight of each component (Debt, CS, and PF.) 7. What are the strengths and weaknesses of this new capital structure? Discuss how changes in WACC affect the four capital budgeting tools. (5 points) 8. Create Balance Sheet and Income Statement from 2020-2022 based on numbers in Figure 3 without Long Term Debt. Round items in financial statements to nearest dollar. (10 points) 9. Revised 2022's Balance Sheet and Income Statement with the new capital structure. Analyze the original and revised statements to see if company performance is improved. Include comparison of profitability, and debt utilization ratios between the original and revised statements. Include discussion of the change in dividend payments. Correct any changes in addition to retained earnings with the new structure by adjusting cash and keep other Asset items unchanged from original forecast. Use 2020 cost of CS to estimate 2022 CS price. Round items in financial statements to nearest dollar. (20 points) 2024 2023 2026 S 3.655 S 8.000 S 10,000 S 25,000 S 22.000 S 500 S 500 S 300 S 500 S 500 Figure 1 Financial analysis of Project A Telia Expenditures Netcost of new fixed assets $25.000 Additional revenue Additional operating costs Depreciation Net increase in income Less: Tax at 33% Increase in after-tax income Add hack depreciation S S S 3.600 (445) 5.280 2.220 5.670 18.830 5.670 15.30 S S S 4.460 S S S S S 6,214 S 733 1.487 1.472 2.94% 3.224 10.000 S (445 s S 12.616 S S 3.600 S 5.280 S 3.040 S 5,670 S 5.670 Net change in cash flow (25,000) S 3.155 S 6,767 S XO S 18.286 S 16.276 Figure 2 Financial analyale of Project B 2022 2023 2026 Ergonditures $75.000 S 24,938 S 37.406 S 49.75 8,313 2.625 16.625 2.625 S S S 2.625 S S 2.625 S S S S Netcost of new assets Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income Add back Amortization 1.925 12.075 1.925 32256 1.925 4525 S S S 20,183 S S 3,763 1.242 S S 3.985 S S 102843 S 14.957 S 2.521 S 8,090 s 13.600 S 22.014 S 30.368 S 1.925 S 1.925 $ 1.925 S 1.925 s 1.925 Net change in cash flow S S 10.015 S 15.35 S S 23,939 (75,000) 32293 Figure 3 Financial analyale of Project Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani 2022 2023 2026 Expenditures S 100.000 Netcost of new assets s 11.000 S 22.000 S S 49,500 S 66,000 S 5,000 S 5,000 S S S 5,000 17.500 S 5,000 17.300 10.500 S Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income S 20.000 (3.000) 5,000 17.500 45,500 S (8.000) S S S 27,000 S S S S 14.455 S S S 8,910 S 18.090 S 8.000) $3.000 7.025 S 29.145 Add back depreciation S 14.000 S 20,000 S 17.500 S 17.500 S 17.500 Net change in cash flow (100,000) S 6,000 S 17.000 S 24.535 S 35.500 S 46,645 Figure 4 Financial analysis of Project D Initia! Expenditures 2022 2023 2024 2023 2026 Netcost of new assets $35.000 S 37.500 $ S S 6.300 45,000 3,000 S S 10,000 3.000 8.500 5.500 S 4.000 S S S 6.000 S SAL S 2.000 S S S 100 Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income Add hack depreciation 11.000 (8000) S 34.000 S S (6,000) S 21.500 7.095 S (10.500 S S 5 S S 22.780 S 14.405 S (6.000 S 18.000) S (10.500 S 8.000 S 12.000 s 11.000 S 11,000 S 11.000 Net change in cash flow S (55,000) 30,70 S 26.405 3.000 3.000 S 500 Figure Accoustiug information 2022 forecast 2022 COGS Cash S 52.663 S 87.000 S 74.440 S 10.000 S 10,000 S 10000 S S S Depreciation Expense Interest Expense SC&A Expenses Accounts Payable Net Fixed Assets S 71.663 S 6350 S S S S S 105.000 S 90.000 S 100.000 Sales $ 275.623 S 262 300 S250.000 Accounts Receivable s 35.47 $ 42.940 S 37 500 S 701 S 32.500 S 300000 Common Stock Par SI S 10.000 S 10.000 S 10.000 5 217200 S217.200 S211.200 S 25.100 S 15.300 5 15.300 Add Paid in Capital Preferred quity par 100 Retained as Long term Leht 72 5 72 5 5 * Nem capital structure not included. The estimated ni affartir in the 1971 forecast Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani Lesley Corporation's Capital Budgeting and Capital Structure LESLEY Corporation was founded in 2020 by Mohamed, who is the CEO and is a brilliant marketer and salesman that can close any deal with any customer. However, Mohamed is not knowledgeable in corporate finance. He usually just picks projects with the greatest after-tax income forecast. He recently came across four potential projects. But due to the size of the staff, he can only pick one to focus on. Combining LESLEY's industry requirement with its capital structure, the company's current weighted average cost of capital (WACC) is 15.4775%. You've been hired as the new CFO, and are tasked with making the forecast for the projects (See Figures 1-4.) You want to make the project selection process (capital budgeting) based on sound financial methods while also educating Mohamed on the advantages and disadvantages of the different corporate finance methods. The methods you want to use are: Total after tax income, payback period, internal rate of retum (IRR), and net present value (NPV.) You realize LESLEY Corporation can reduce its WACC by changing its capital structure. You want to present this idea to Mohamed as well. Currently LESLEY does not employ any long-term debt. It was originally financed in 2020 with 90% common stock (CS) and 10% callable preferred stock at (Callable at Par Value PF). CS current estimated price in 2021 is $20 (Treat this as Price 0). CS just paid an annual dividend of $1.90 in 2020 (Treat this as dividend 0). Its expected dividend growth rate is 5%. PF is paying a 20% annual dividend. You have negotiated three possible bank loans where the pre-tax annual interest rates are: 6% if it comprised of 20% of the capital structure, 8% interest if 30%, and 10% interest if 40%. LESLEY's corporate tax rate is 33%. Based on experience you wish to keep LESLEY's Debt to Total Asset ratio below 0.35. During your research, you found the risk-free rate to be 2% (Expected to be the same in 2022), and the market return to be 5% (Expected to be the same in 2022). You must re-calculate the new WACC to select the proper capital structure based on the loan terms, desired Debt to Total Asset ratio. You must also adjust 2022 capital structure (buy back CS and/or call PF.) The previous CFO did not finish the financial statements. One of the urgent tasks for you is to create financial statements since the company's inception in 2020. You are handed incomplete accounting information from 2020- 2022 (2022 is forecasted, see Figure 5). You should use the incomplete information to deduct the missing numbers. Historically, gross margin for the company has been 50% and is projected to be the same for 2022. The 2022 forecast included estimation of the project but not the new capital structure. There is no need to recalculate 2022 numbers with the project information. You should incorporate the new capital structure into creating the financial statement for 2022 You are asked to present capital budgeting, capital structure and financial statements to Mohamed very soon. (130 points) Required Questions: 1. What is the total after-tax income of each project? Which project will Mohamed select based on his current tendencies? (5 Points) 2. Present a table for all four projects with the following: Total after-tax income, NPV, IRR and payback period. (15 points) 3. Which project (if any) is the most suitable based on all four capital budgeting method:? Be sure to support the decision with findings from previous questions and explain how the methods are more precise than what Mohamed been doing. (40 points) a. Provide advantages and disadvantages of each of the methods b. If mo than one project can be selected, should any other ject(s) be included? Be sure to base the decision on proper logic of the four methods. 4. What is the cost of common stock in 2020? (10 Points) a. Calculate its beta based on Capital Pricing Model b. Comment on Lesley's beta in relation to the industry and the overall market. The industry average beta is 2. Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani 5. Prepare a table of new WACC with all three loan terms, be sure to present the lowest WACC of each loan by adjusting the capital structure. Be sure to include the weights and the weighted cost of each component (Debt CS and PF.) (10 Points) 6. Which capital structure should be selected based on the information in the case? (5 points) a. Explain the reason of the adjusted weight of each component (Debt, CS, and PF.) 7. What are the strengths and weaknesses of this new capital structure? Discuss how changes in WACC affect the four capital budgeting tools. (5 points) 8. Create Balance Sheet and Income Statement from 2020-2022 based on numbers in Figure 3 without Long Term Debt. Round items in financial statements to nearest dollar. (10 points) 9. Revised 2022's Balance Sheet and Income Statement with the new capital structure. Analyze the original and revised statements to see if company performance is improved. Include comparison of profitability, and debt utilization ratios between the original and revised statements. Include discussion of the change in dividend payments. Correct any changes in addition to retained earnings with the new structure by adjusting cash and keep other Asset items unchanged from original forecast. Use 2020 cost of CS to estimate 2022 CS price. Round items in financial statements to nearest dollar. (20 points) 2024 2023 2026 S 3.655 S 8.000 S 10,000 S 25,000 S 22.000 S 500 S 500 S 300 S 500 S 500 Figure 1 Financial analysis of Project A Telia Expenditures Netcost of new fixed assets $25.000 Additional revenue Additional operating costs Depreciation Net increase in income Less: Tax at 33% Increase in after-tax income Add hack depreciation S S S 3.600 (445) 5.280 2.220 5.670 18.830 5.670 15.30 S S S 4.460 S S S S S 6,214 S 733 1.487 1.472 2.94% 3.224 10.000 S (445 s S 12.616 S S 3.600 S 5.280 S 3.040 S 5,670 S 5.670 Net change in cash flow (25,000) S 3.155 S 6,767 S XO S 18.286 S 16.276 Figure 2 Financial analyale of Project B 2022 2023 2026 Ergonditures $75.000 S 24,938 S 37.406 S 49.75 8,313 2.625 16.625 2.625 S S S 2.625 S S 2.625 S S S S Netcost of new assets Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income Add back Amortization 1.925 12.075 1.925 32256 1.925 4525 S S S 20,183 S S 3,763 1.242 S S 3.985 S S 102843 S 14.957 S 2.521 S 8,090 s 13.600 S 22.014 S 30.368 S 1.925 S 1.925 $ 1.925 S 1.925 s 1.925 Net change in cash flow S S 10.015 S 15.35 S S 23,939 (75,000) 32293 Figure 3 Financial analyale of Project Managerial Economics & Finance CMGMT 6464 Group Project Dr. Ned Gandevani 2022 2023 2026 Expenditures S 100.000 Netcost of new assets s 11.000 S 22.000 S S 49,500 S 66,000 S 5,000 S 5,000 S S S 5,000 17.500 S 5,000 17.300 10.500 S Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income S 20.000 (3.000) 5,000 17.500 45,500 S (8.000) S S S 27,000 S S S S 14.455 S S S 8,910 S 18.090 S 8.000) $3.000 7.025 S 29.145 Add back depreciation S 14.000 S 20,000 S 17.500 S 17.500 S 17.500 Net change in cash flow (100,000) S 6,000 S 17.000 S 24.535 S 35.500 S 46,645 Figure 4 Financial analysis of Project D Initia! Expenditures 2022 2023 2024 2023 2026 Netcost of new assets $35.000 S 37.500 $ S S 6.300 45,000 3,000 S S 10,000 3.000 8.500 5.500 S 4.000 S S S 6.000 S SAL S 2.000 S S S 100 Additional revenue Additional operating costs Depreciation Net increase in income Less: Taxat 33% Increase in after-tax income Add hack depreciation 11.000 (8000) S 34.000 S S (6,000) S 21.500 7.095 S (10.500 S S 5 S S 22.780 S 14.405 S (6.000 S 18.000) S (10.500 S 8.000 S 12.000 s 11.000 S 11,000 S 11.000 Net change in cash flow S (55,000) 30,70 S 26.405 3.000 3.000 S 500 Figure Accoustiug information 2022 forecast 2022 COGS Cash S 52.663 S 87.000 S 74.440 S 10.000 S 10,000 S 10000 S S S Depreciation Expense Interest Expense SC&A Expenses Accounts Payable Net Fixed Assets S 71.663 S 6350 S S S S S 105.000 S 90.000 S 100.000 Sales $ 275.623 S 262 300 S250.000 Accounts Receivable s 35.47 $ 42.940 S 37 500 S 701 S 32.500 S 300000 Common Stock Par SI S 10.000 S 10.000 S 10.000 5 217200 S217.200 S211.200 S 25.100 S 15.300 5 15.300 Add Paid in Capital Preferred quity par 100 Retained as Long term Leht 72 5 72 5 5 * Nem capital structure not included. The estimated ni affartir in the 1971 forecast