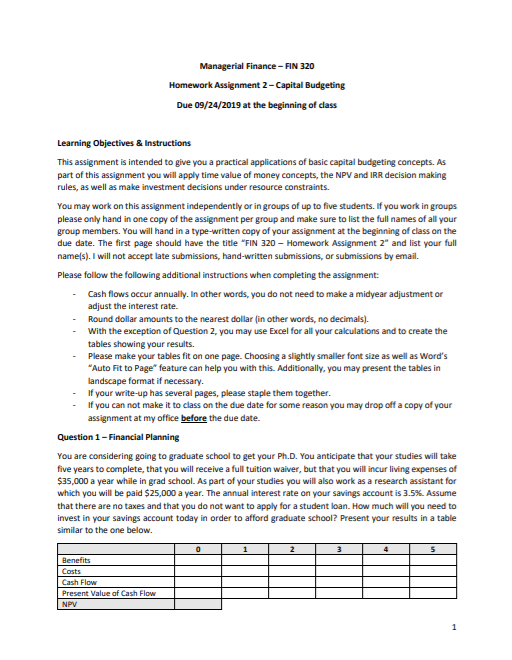

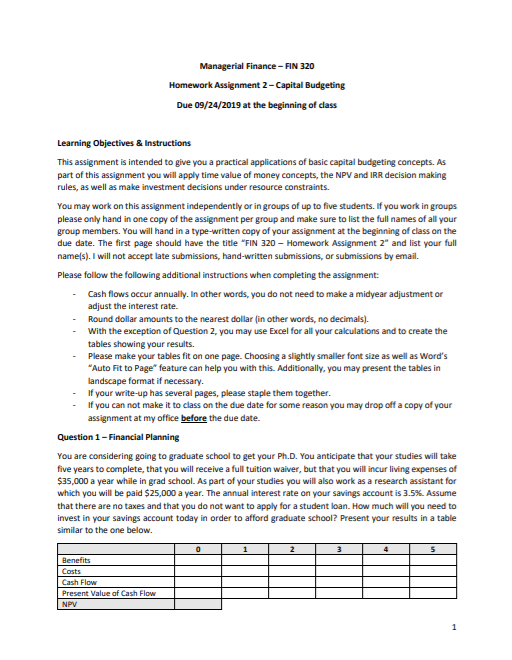

Managerial Finance -FIN 320 Homework Assignment 2-Capital Budgeting Due 09/24/2019 at the beginning of class Learning Objectives & Instructions This assignment is intended to give you a practical applications of basic capital budgeting concepts. As part of this assignment you will apply time value of money concepts, the NPV and IRR decision making rules, as well as make investment decisions under resource constraints. You may work on this assignment independently or in groups of up to five students. If you work in groups please only hand in one copy of the assignment per group and make sure to list the full names of all your group members. You will hand in a type-written copy of your assignment at the beginning of class on the due date. The first page should have the title "FIN 320 - Homework Assignment 2" and list your full names). I will not accept late submissions, hand-written submissions, or submissions by email Please follow the following additional instructions when completing the assignment: - Cash flows occur annually. In other words, you do not need to make a midyear adjustment or adjust the interest rate. Round dollar amounts to the nearest dollar in other words, no decimals). . With the exception of Question 2. you may use Excel for all your calculations and to create the tables showing your results. Please make your tables fit on one page. Choosing a slightly smaller font size as well as Word's "Auto Fit to Page" feature can help you with this. Additionally, you may present the tables in landscape format if necessary. . If your write-up has several pages, please staple them together. - If you can not make it to class on the due date for some reason you may drop off a copy of your assignment at my office before the due date. Question 1 - Financial Planning You are considering going to graduate school to get your Ph.D. You anticipate that your studies will take five years to complete, that you will receive a full tuition waiver, but that you will incur living expenses of $35,000 a year while in grad school. As part of your studies you will also work as a research assistant for which you will be paid $25,000 a year. The annual interest rate on your savings account is 3.5%. Assume that there are no taxes and that you do not want to apply for a student loan. How much will you need to invest in your savings account today in order to afford graduate school? Present your results in a table Similar to the one below. Benefits Cash Flow Present Value of Cash Flow