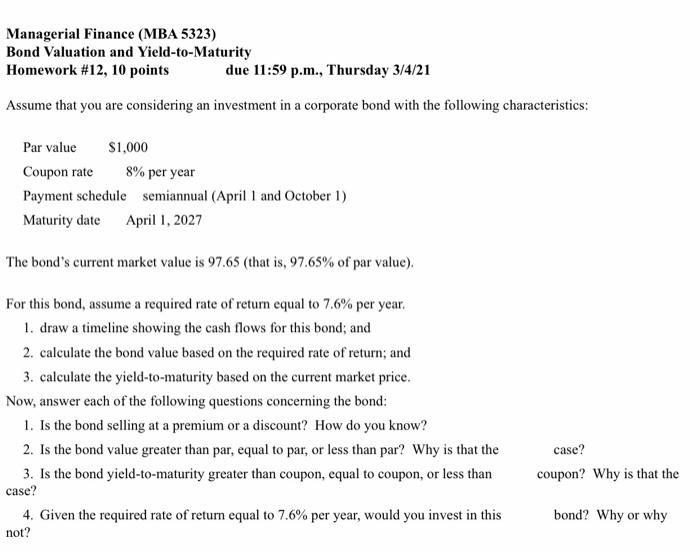

Managerial Finance (MBA 5323) Bond Valuation and Yield-to-Maturity Homework #12, 10 points due 11:59 p.m., Thursday 3/4/21 Assume that you are considering an investment in a corporate bond with the following characteristics: Par value $1,000 Coupon rate 8% per year Payment schedule semiannual (April 1 and October 1) Maturity date April 1, 2027 The bond's current market value is 97.65 (that is, 97.65% of par value). For this bond, assume a required rate of return equal to 7.6% per year. 1. draw a timeline showing the cash flows for this bond; and 2. calculate the bond value based on the required rate of return; and 3. calculate the yield-to-maturity based on the current market price. Now, answer each of the following questions concerning the bond: 1. Is the bond selling at a premium or a discount? How do you know? 2. Is the bond value greater than par, equal to par, or less than par? Why is that the 3. Is the bond yield-to-maturity greater than coupon, equal to coupon, or less than case? 4. Given the required rate of return equal to 7.6% per year, would you invest in this not? case? coupon? Why is that the bond? Why or why Managerial Finance (MBA 5323) Bond Valuation and Yield-to-Maturity Homework #12, 10 points due 11:59 p.m., Thursday 3/4/21 Assume that you are considering an investment in a corporate bond with the following characteristics: Par value $1,000 Coupon rate 8% per year Payment schedule semiannual (April 1 and October 1) Maturity date April 1, 2027 The bond's current market value is 97.65 (that is, 97.65% of par value). For this bond, assume a required rate of return equal to 7.6% per year. 1. draw a timeline showing the cash flows for this bond; and 2. calculate the bond value based on the required rate of return; and 3. calculate the yield-to-maturity based on the current market price. Now, answer each of the following questions concerning the bond: 1. Is the bond selling at a premium or a discount? How do you know? 2. Is the bond value greater than par, equal to par, or less than par? Why is that the 3. Is the bond yield-to-maturity greater than coupon, equal to coupon, or less than case? 4. Given the required rate of return equal to 7.6% per year, would you invest in this not? case? coupon? Why is that the bond? Why or why