Question

Managerial Finance Question QUESTION 1: Nova Electricals Limited was founded ten years ago by Keith and Reena Wellfield. The company manufactures and installs both traditional

Managerial Finance Question

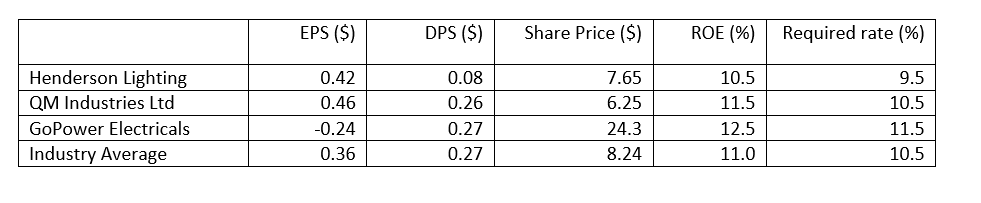

QUESTION 1: Nova Electricals Limited was founded ten years ago by Keith and Reena Wellfield. The company manufactures and installs both traditional and contemporary models of lights for residential and commercial purposes. Nova Electricals Limited has experienced rapid growth because of the new technology that increases the energy efficiency of its systems and the introduction of new models of LED integrated lights. The company is equally owned by Keith and Reena holding 100,000 shares each. In August 2019, Keith and Reena have decided to value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about the main competitors in the industry.  Last year, Nova Electricals Ltd had an EPS of $0.48 and paid dividends to Keith and Reena of $36,000 each. The company also had a return on equity of 15%. Keith and Reena believe a required rate of return of 12.5% for the company is appropriate. Required: 1. Assuming the company continues its current growth rate (growth rate should be calculated from the data given) into the infinite period, what is the share price of the company? (7marks) 2. To verify their calculations, Keith and Reena have hired Jarome Park, a consultant. Jerome was previously an equity analyst, and he has a good understanding of the electrical Industry. Jerome has examined the companys financial statements as well as those of its competitors. Although Nova Electricals Ltd currently has a technological advantage, Jeromes research indicates that Nova Electricals Limiteds competitors are investigating other methods to improve efficiency. Given this, Jerome believes that Nova Electricals technological advantage will last for the next five years only. After that period, the companys growth is likely to slow down to the industry average. Additionally, Jerome believes that the companys required return currently is high, and so the industry average required return is a more appropriate rate for valuation. Taking Jeromes assumptions into consideration, calculate the estimated share price of Nova Electricals Ltd. (17 marks)

Last year, Nova Electricals Ltd had an EPS of $0.48 and paid dividends to Keith and Reena of $36,000 each. The company also had a return on equity of 15%. Keith and Reena believe a required rate of return of 12.5% for the company is appropriate. Required: 1. Assuming the company continues its current growth rate (growth rate should be calculated from the data given) into the infinite period, what is the share price of the company? (7marks) 2. To verify their calculations, Keith and Reena have hired Jarome Park, a consultant. Jerome was previously an equity analyst, and he has a good understanding of the electrical Industry. Jerome has examined the companys financial statements as well as those of its competitors. Although Nova Electricals Ltd currently has a technological advantage, Jeromes research indicates that Nova Electricals Limiteds competitors are investigating other methods to improve efficiency. Given this, Jerome believes that Nova Electricals technological advantage will last for the next five years only. After that period, the companys growth is likely to slow down to the industry average. Additionally, Jerome believes that the companys required return currently is high, and so the industry average required return is a more appropriate rate for valuation. Taking Jeromes assumptions into consideration, calculate the estimated share price of Nova Electricals Ltd. (17 marks)

3. Based on Jeromes estimation in part (2) above, what is Nova Electricals Limiteds price-earnings ratio? Calculate the industry average price-earnings ratio? Explain why Novas price-earnings ratio is different from the industry average price-earnings ratio. (6 marks)

4. After discussion with Jerome, Keith and Reena decided to increase the value of the companys equity. Like many small business owners, they want to retain control of the company and do not want to sell shares to outside investors. They also feel that the companys debt is at a manageable level and do not want to borrow more money. What steps can they take to increase the share price? Justify your suggestions. (5 marks)

EPS ($) DPS ($) Share Price si ROE (%) Required rate (%) Henderson Lighting QM Industries Ltd GoPower Electricals Industry Average 0.42 0.46 -0.24 0.36 0.08 0.26 0.27 0.27 7.65 6.25 24.3 8.24 10.5 11.5 12.5 9.5 10.5 11.5 10.5 11.0 EPS ($) DPS ($) Share Price si ROE (%) Required rate (%) Henderson Lighting QM Industries Ltd GoPower Electricals Industry Average 0.42 0.46 -0.24 0.36 0.08 0.26 0.27 0.27 7.65 6.25 24.3 8.24 10.5 11.5 12.5 9.5 10.5 11.5 10.5 11.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started