Managerial Finance

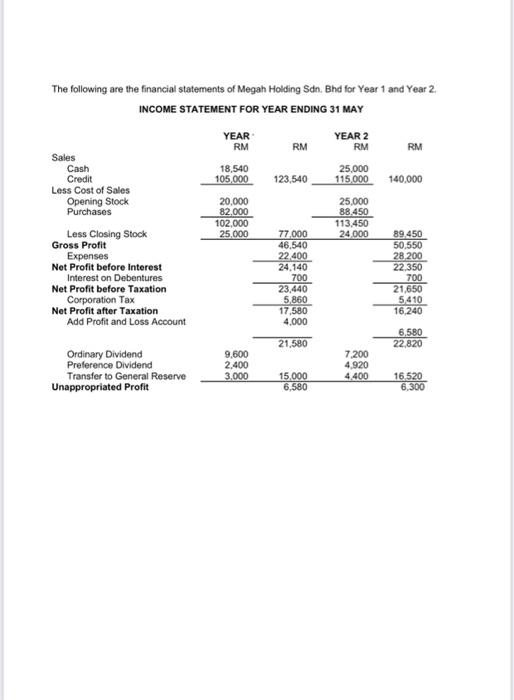

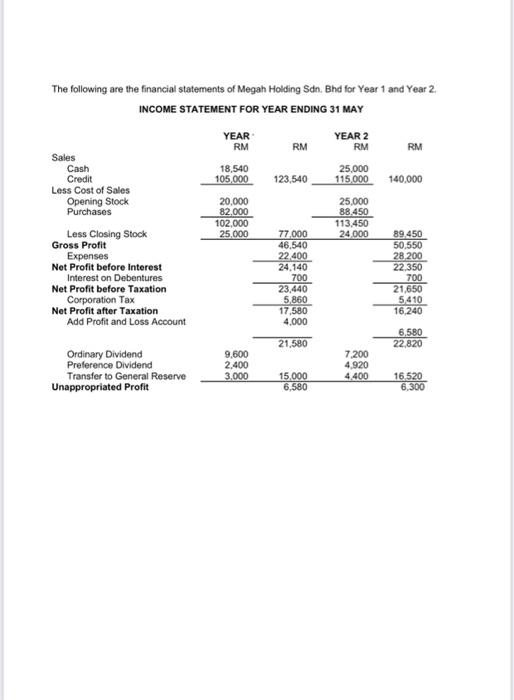

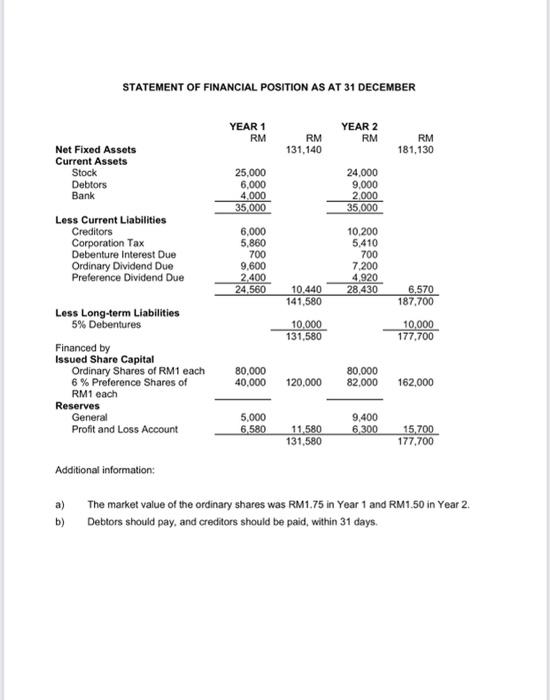

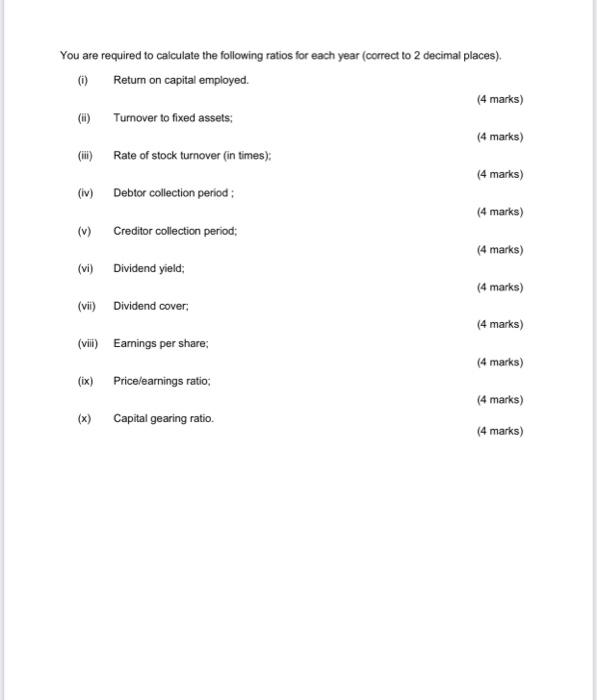

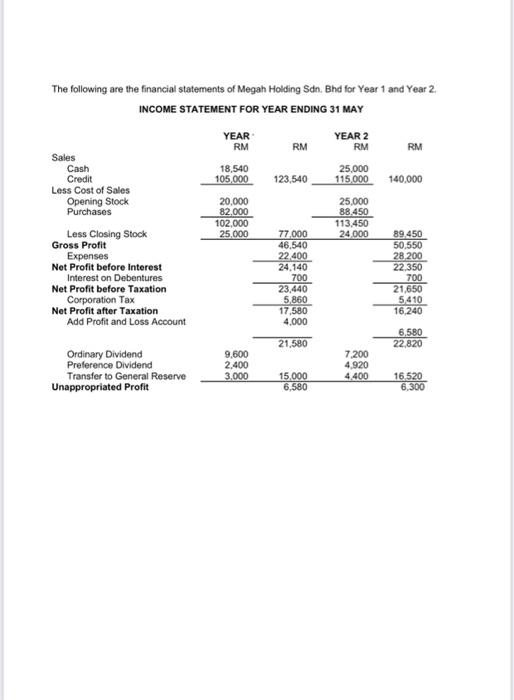

The following are the financial statements of Megah Holding Sdn. Bhd for Year 1 and Year 2. INCOME STATEMENT FOR YEAR ENDING 31 MAY YEAR RM YEAR 2 RM RM RM 18,540 105,000 25.000 115,000 123,540 Sales Cash Credit Less Cost of Sales Opening Stock Purchases 140,000 20.000 82.000 102,000 25,000 25,000 88.450 113.450 24 000 Less Closing Stock Gross Profit Expenses Net Profit before Interest Interest on Debentures Net Profit before Taxation Corporation Tax Net Profit after Taxation Add Profit and Loss Account 77,000 46.540 22.400 24.140 700 23,440 5,860 17,580 4.000 89.450 50.550 28.200 22.350 700 21,650 5410 16.240 6,580 22,820 21,580 Ordinary Dividend Preference Dividend Transfer to General Reserve 9.600 2.400 3.000 7.200 4.920 4 400 Unappropriated Profit 15.000 6.580 16 520 6,300 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER YEAR 1 RM YEAR 2 RM RM 131,140 RM 181,130 Net Fixed Assets Current Assets Stock Debtors Bank 25,000 6,000 4,000 35 000 24.000 9,000 2.000 35.000 Less Current Liabilities Creditors Corporation Tax Debenture Interest Due Ordinary Dividend Due Preference Dividend Due 6,000 5,860 700 9,600 2,400 24.560 10.200 5.410 700 7200 4,920 28,430 10.440 141,580 6,570 187,700 Less Long-term Liabilities 5% Debentures 10.000 131,580 10,000 177,700 Financed by Issued Share Capital Ordinary Shares of RM1 each 6 % Preference Shares of 80.000 40,000 80.000 82.000 120.000 162,000 RM1 each Reserves General Profit and Loss Account 5.000 6.580 9,400 6.300 11.580 131,580 15.700 177.700 Additional information: The market value of the ordinary shares was RM1.75 in Year 1 and RM1.50 in Year 2. b) Debtors should pay, and creditors should be paid, within 31 days. You are required to calculate the following ratios for each year (correct to 2 decimal places). ) Return on capital employed. (4 marks) (ii) Turnover to fixed assets (4 marks) Rate of stock turnover (in times) (4 marks) (iv) Debtor collection period : (4 marks) (v) Creditor collection period (4 marks) (vi) ) Dividend yield: (4 marks) (vii) Dividend cover (4 marks) (vii) Earnings per share; (4 marks) ix) Price/earnings ratio: (4 marks) (x) Capital gearing ratio. (4 marks)