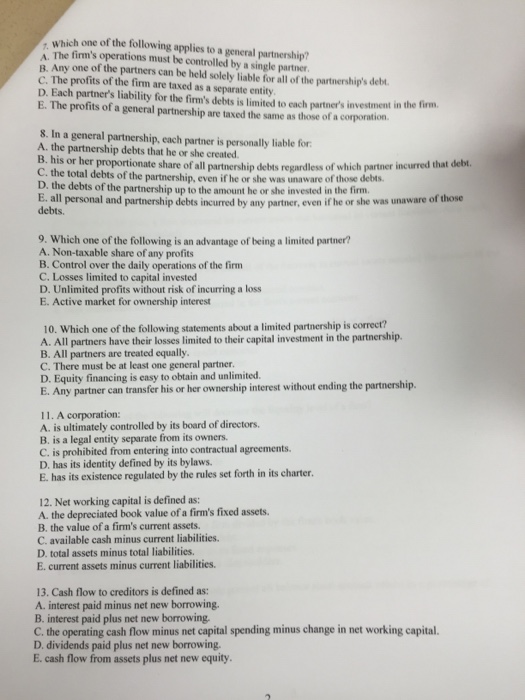

Which one of the following applies to general partnershiop? The firm's operations must be controlled by a single partner. Any one of the partners can be held solely liable for all of the partnership's debt. The profits of the firm are taxed as a separate entity. Each partner;s liability for the firm's debts is limited to each partner's investment in the firm. The profits of a general partnership are taxed the same as those of a corporation. In a general partnership, even if he or she was unaware of those debts. the debts of the partnership up to the amount he or she invested in the firm. all personal and partnership debts incurred by any partner, even if he or she was unaware of those debts. Which one of the following is an advantage of being a limited partner? A. Non-taxable share of any profits Control over the daily operations of the firm Losses limited to capital invested Unlimited profits without risk of incurring a loss Active market for ownership interest Which one of the following statements about a limited partnership is correct ? All partners have their losses limited to their capital investment in the partnership. All partners are treated equally. There must be at least one general partner. Equity financing is easy to obtain and unlimited. Any partner can transfer his or her ownership interest without ending the partnership. A corporation: is ultimately controlled by its board of directors. is a legal entity separate from its owners. is prohibited from entering into contractual agreements. has its identity defined by its bylaws. has its existence regulated by the rules set forth in its charter. Net working capital is defined ns: the depreciated book value of a firm's fixed assets. the value of a firm's current assets. available cash minus current liabilities. total assets minus total liabilities. current assets minus current liabilities. Cash How to creditors is defined as: interest paid minus net new borrowing. interest paid plus net new borrowing. the operating cash flow minus net capital spending minus change in net working capital. dividends paid plus net new borrowing. cash flow from assets plus net new equity