Question

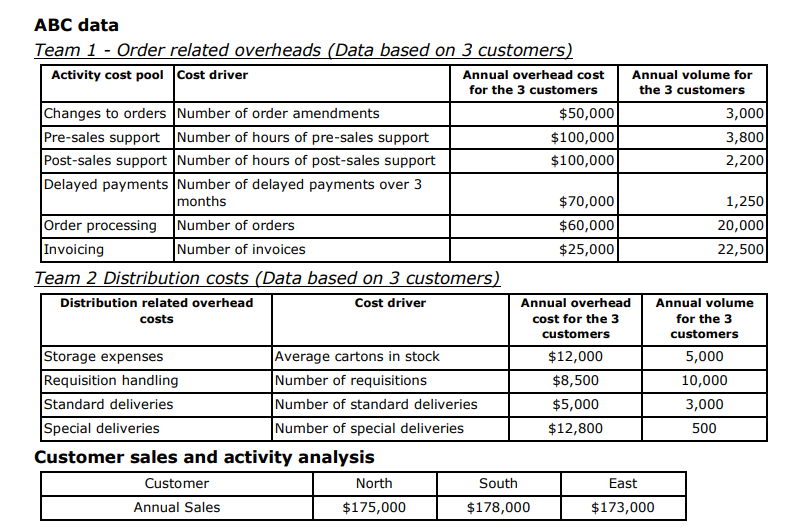

Managers at Aiwa Co. have been using various teams to collect activity-based data since 2000. Each team has consisted of one or more management accountants

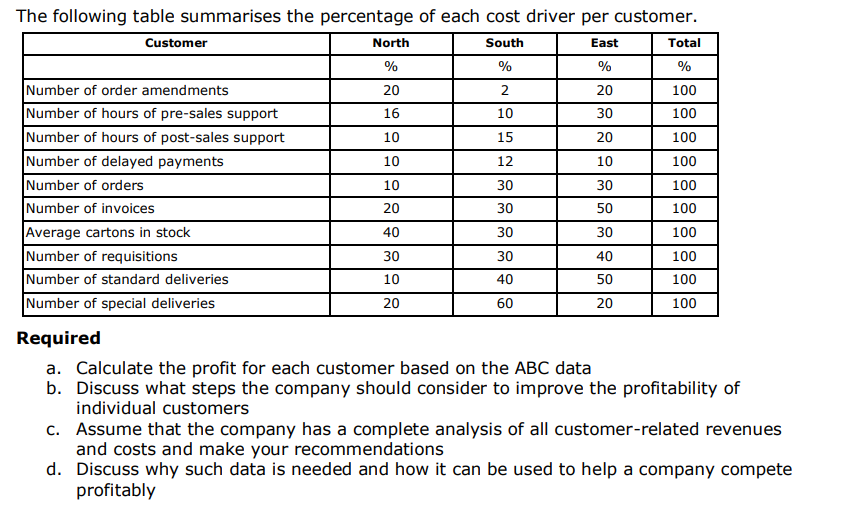

Managers at Aiwa Co. have been using various teams to collect activity-based data since 2000. Each team has consisted of one or more management accountants working closely with department managers. To date the teams have mainly focused on product costing. Recently two teams have been set up to collect data to improve the companys understanding of customer-related costs and profitability. One team has looked at distribution costs and the second at order related costs. The company has approximately 250 customers in total. Only 3 customers were included in the analysis. These 3 customers represent 10% of total sales. Finally the teams only considered labour related costs and direct costs for the cost pools. The first objective for each team was to estimate the total annual overhead cost and annual volume for each cost driver. As the company only focused on three customers the data was quickly estimated. The second objective was to estimate the percentage of each cost driver per customer. Collecting data The management accept that a cost sampling or `snapshot approach is the best way to identify key activities and their costs. This technique helps the department to develop estimates of how much time is devoted to different activities. Then by using an average hourly rate for all staff managers will be able to estimate the total annual cost of an activity. The decision to use an average hourly rate for all staff will save time. Managers decided that between 4 to 8 activities should to be identified by each team. Most of the managers involved with the new teams have little experience of collecting data regarding activities and cost drivers. With some activities several cost drivers were discussed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started