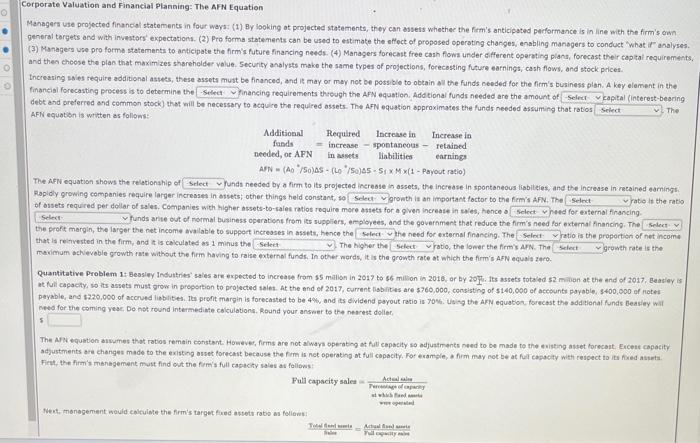

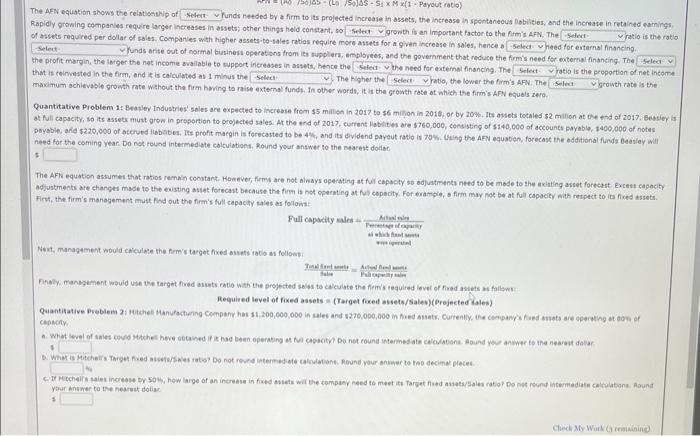

Managers use projected financial statements in fout wayz (1) By looking at projectid statements, they can asseis whethee the firm's anticipated performance is in line with the firm's ewn. general torgets and with inwestors expectations. (2) Pro forma statements can be used to estimate the affect of proposed operating changes, enabling manogers to conduct what if analyses. (3) Managers use pro forme statements to anticipate the firm's future financing needs. (4) Managers forecast free cash flows under cifferent operating plans, forecast their cap tal requiremants. and then choose the plan that maximites shareholder velue. Security andlybs mako the same types of projections, forecosting future earnings, cash flows, and stock prices. tncreasing soles hequire additional astecs, these assets mutt be financed, and it may or mey nok be potsible to obeain all the funds peeded for the firm's business plan, A key element in the finsecial forecasting precess is to determine the linancing requirements thsedgh the AFN equation, Add tional funds needed are the amount of debt and breferred and common stock) that will be necessary to acquire the requlred assets. The AFN equation approximates the funds needed assumirg that ratios. capikal (interest-beering AFN equation is whiten as follows: The AfN equation shows the relationahip of Unds needed by a firm to its projected increase in assets, the increase in spontaneous liabilties, and the increase in racained asmingh. Fapidy growing companies require larger increases in sivets; other things held constant, 10 gronth is an important foctor to the firm's AfN, the It the ratio of ossets required per dollar of sales. Companies whth higher absets-to-sales retios require more astest for a qven increase in swes, hence o Wnds arhe out of normal business operabees from its suppiers, emplovees, and the government that reduce the firm's need for external Pinancing. The the proft margin, the iarger the net ingome avallable to support increases in assets, hence the that is reitwested in the firm, and it is cokulated as 1 minus the mavimum detvevoble growth rase without the firm having to raise external funds. In other words, it is the groweh rate at which the firm's afN equals zero. Quantitative Problem 1+ Bessiey Induttries' saies are expected to increate fram 15 mallion in 2017 to 56 millon in 2016, or by 20 I, Its assets totaled 52 milien at the and of 2017 , Beasley is at fuli cagacty, so its assets must grow in proportion to projected salet. At the and of 2017 , current lisblites are $769,000, consisting of $140,000 of aceounts poyable, 3400,000 of hotes neta for the coming yeac, Do not round intermediate cakulations. Round your ansser to the nearest dolier. 5 The Ani equation aiwumes that ratios remain constant. However, firms are not always operabog at fill capacity ao adjuatments need to be made to the avisting anset forecast, Ercent capacity Fint, the firm's manegement must find ewt the firm's full capecity sales as follows: Nect. monagement weuld coltuime the firm's target finec astett rato as folions: AFN equation shows the relatioeithip of Inds petded by a firm to its projected increase in assets, the increase in spontaneous lioblities, and the incrate in retained eaming? tapidly growing companies require larger intreases in assets; other thins held constant, so Jronth is an important factor to the fimis AFN. The Oasets requiced ber dollar of sales. Componies wath higher assets-to-tales ration require more asselt for a given increase in sales, hance a Unds arite out of normal businesi opecations from iti supplers. emplojees, and the government that reduce the fim. the profit mergin, the larger the nat income svalable to tupport ificreases in aswets, bece the that is ceinested in the firm, and is is calculated as 1 minus the maximum achievable grosth rate wehout the firm heving to raise external fundt. In other words, it it the groweth rate ot atich the firm's aFN equals zero. Quantitative Problen 1: Beatley Industries' sales are expected to increase from $5 millon in 2017 to 56 minion in 2016 , or by 20%, 1ts avsets totaled 52 million at tie tha of 2017 . Bessien Ot full capacity, so its assets must grow in propertion to projected sales. At the end of 2017, current lubbite1 are $760,000, c9esisting of 5140,600 of accounts payable, 1400,000 of notas need for the coming year. Do not round intermediate coltulatioes, Round your antwer to the narest doliar. 13 The AFh equation assumei that ratios remain constart. Homever, firmit are not alnays ogerating at ful capocty ao adjustmenta need to be mbde to the exiating asset forecast excett capocity adjustments are charpes made to the evisting asiat forecast because the firm is not osermting at hul copocity. For erample, of firm may noe be at full cagacity with respect to its fixed assets. Firt, the firm's management must find out the firm's full capacity tales as follonst. Next, managament would caiculote the fro's targht fored aisets rabio as follow: Firaly, manegement wouid use the target fived asuts ratio with the projected soles to calcuiate the flim's required level of fined asiets ar follswn: Required level of fixed assets = (Target ficeif absets/Salev)(Projectediales) chescity Yibar mhtwer to the nearest dofiac Managers use projected financial statements in fout wayz (1) By looking at projectid statements, they can asseis whethee the firm's anticipated performance is in line with the firm's ewn. general torgets and with inwestors expectations. (2) Pro forma statements can be used to estimate the affect of proposed operating changes, enabling manogers to conduct what if analyses. (3) Managers use pro forme statements to anticipate the firm's future financing needs. (4) Managers forecast free cash flows under cifferent operating plans, forecast their cap tal requiremants. and then choose the plan that maximites shareholder velue. Security andlybs mako the same types of projections, forecosting future earnings, cash flows, and stock prices. tncreasing soles hequire additional astecs, these assets mutt be financed, and it may or mey nok be potsible to obeain all the funds peeded for the firm's business plan, A key element in the finsecial forecasting precess is to determine the linancing requirements thsedgh the AFN equation, Add tional funds needed are the amount of debt and breferred and common stock) that will be necessary to acquire the requlred assets. The AFN equation approximates the funds needed assumirg that ratios. capikal (interest-beering AFN equation is whiten as follows: The AfN equation shows the relationahip of Unds needed by a firm to its projected increase in assets, the increase in spontaneous liabilties, and the increase in racained asmingh. Fapidy growing companies require larger increases in sivets; other things held constant, 10 gronth is an important foctor to the firm's AfN, the It the ratio of ossets required per dollar of sales. Companies whth higher absets-to-sales retios require more astest for a qven increase in swes, hence o Wnds arhe out of normal business operabees from its suppiers, emplovees, and the government that reduce the firm's need for external Pinancing. The the proft margin, the iarger the net ingome avallable to support increases in assets, hence the that is reitwested in the firm, and it is cokulated as 1 minus the mavimum detvevoble growth rase without the firm having to raise external funds. In other words, it is the groweh rate at which the firm's afN equals zero. Quantitative Problem 1+ Bessiey Induttries' saies are expected to increate fram 15 mallion in 2017 to 56 millon in 2016, or by 20 I, Its assets totaled 52 milien at the and of 2017 , Beasley is at fuli cagacty, so its assets must grow in proportion to projected salet. At the and of 2017 , current lisblites are $769,000, consisting of $140,000 of aceounts poyable, 3400,000 of hotes neta for the coming yeac, Do not round intermediate cakulations. Round your ansser to the nearest dolier. 5 The Ani equation aiwumes that ratios remain constant. However, firms are not always operabog at fill capacity ao adjuatments need to be made to the avisting anset forecast, Ercent capacity Fint, the firm's manegement must find ewt the firm's full capecity sales as follows: Nect. monagement weuld coltuime the firm's target finec astett rato as folions: AFN equation shows the relatioeithip of Inds petded by a firm to its projected increase in assets, the increase in spontaneous lioblities, and the incrate in retained eaming? tapidly growing companies require larger intreases in assets; other thins held constant, so Jronth is an important factor to the fimis AFN. The Oasets requiced ber dollar of sales. Componies wath higher assets-to-tales ration require more asselt for a given increase in sales, hance a Unds arite out of normal businesi opecations from iti supplers. emplojees, and the government that reduce the fim. the profit mergin, the larger the nat income svalable to tupport ificreases in aswets, bece the that is ceinested in the firm, and is is calculated as 1 minus the maximum achievable grosth rate wehout the firm heving to raise external fundt. In other words, it it the groweth rate ot atich the firm's aFN equals zero. Quantitative Problen 1: Beatley Industries' sales are expected to increase from $5 millon in 2017 to 56 minion in 2016 , or by 20%, 1ts avsets totaled 52 million at tie tha of 2017 . Bessien Ot full capacity, so its assets must grow in propertion to projected sales. At the end of 2017, current lubbite1 are $760,000, c9esisting of 5140,600 of accounts payable, 1400,000 of notas need for the coming year. Do not round intermediate coltulatioes, Round your antwer to the narest doliar. 13 The AFh equation assumei that ratios remain constart. Homever, firmit are not alnays ogerating at ful capocty ao adjustmenta need to be mbde to the exiating asset forecast excett capocity adjustments are charpes made to the evisting asiat forecast because the firm is not osermting at hul copocity. For erample, of firm may noe be at full cagacity with respect to its fixed assets. Firt, the firm's management must find out the firm's full capacity tales as follonst. Next, managament would caiculote the fro's targht fored aisets rabio as follow: Firaly, manegement wouid use the target fived asuts ratio with the projected soles to calcuiate the flim's required level of fined asiets ar follswn: Required level of fixed assets = (Target ficeif absets/Salev)(Projectediales) chescity Yibar mhtwer to the nearest dofiac