Question

Managing Director has 2 requirement from Clients, please solve the calculaiton 1. Client-1 Syed Family The Syed Family Mr. Syed had recently called Raza and

Managing Director has 2 requirement from Clients, please solve the calculaiton

1. Client-1 Syed Family

The Syed Family Mr. Syed had recently called Raza and talked about how one of his neighbors was making good money investing in Pakistan Stock Exchange. He was wondering if this could be a good avenue of investment for accumulating his childrens education fund. Raza then met Mr. and Mrs. Syed, both government employees, whose major concern was to provide quality education to their 3 kids, aged seven, five and two. With the rising trend of private sector education systems, the couple was concerned about the immense costs attached with quality. Raza and Mr. and Mrs. Syed concluded that they should consider private schools for A-levels before they choose a suitable private university. Generally they expected their kids to start A-levels at the age of 16, followed by four years of university for an undergraduate degree. After doing a survey of schools in their vicinity, and calculating an annual increase of around 5% in fees, they estimated that A-levels expenses for their two older kids would be PKR 500,000 per year, and 4 years of university would cost PKR 1,000,000 per year; whereas for the youngest child, the costs would be 10% higher. Mr. and Mrs. Syed knew that with their limited source of income, they would need to initiate a savings plan very soon. They intended to accumulate enough funds by the time the eldest child started A-levels. Raza began contemplating whether Mr. and Mrs. Syed should enter into a savings plan for 8 years for all 3 kids together, or a staggered plan for each child. A staggered plan would involve starting investments and accumulating funds for each child separately. Such plans can reduce the burden of cash outflows in the early years but would continue for a longer term until the needs for the youngest kids education started. Raza had talked to a bank about their saving plans and they had offered an interest rate of 8% on savings plans specifically designed for such purposes. Dr. Fahad Mehmood Dr. Fahad Mehmood, a 32-year old was working at a leading private university in the country. While he enjoyed his job, he was concerned about his post-retirement life since his private sector job did not offer housing or pension benefits. After much contemplation, he had approached Raza, a couple of weeks ago, for guidance on how to manage his finances. Dr. Fahad had always wished for early retirement in order to be able to spend some quality time with his family. He had recently inherited a small fortune, and his dream of retiring early seemed more achievable now. He planned to invest his money in relatively safe assets, so as to be able to have enough funds for a comfortable retirement. He was intrigued by his some of his friends boasting about fantastic returns they had recently made by investing in stocks. He was wondering how much of his fortune he should save and how much could be invested in suitable assets. In this regard, he had informed Raza during their meeting that he had ideally planned to work till the age of 50. Following retirement, he wanted to build a house in Rawalpindi, for which he has already made a down payment in Bahria Town worth PKR 5 million for 2 plots of 500 square yards each. He had to pay another PKR 8 million over the next 5 years in equal installments, and expected the construction of his house to cost around PKR 30 million at that time. Upon his retirement, he planned to sell 500 square yards of his land for PKR 15 million, and use the proceeds towards funding construction of his house.

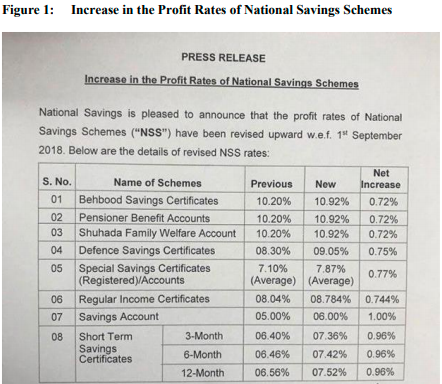

Dr. Fahad had recently come across advertisements for increased profit rates offered through Behbood Certificates.

With no pensionable job, Dr. Fahad was considering investment in the National Savings Schemes Behbood Saving Certificate for meeting his living expenses after retirement. These certificates paid monthly profits in perpetuity. Fahad estimated his monthly expense would be around PKR450,000. He was also going to receive Rs.300,000 per month as his share of profit from a family business. Raza had calculated that using several investment options for Fahad, the relevant discount rate would be 10%

2. Client-2 Kamran Ali

Kamran Ali, a famous surgeon in Lahore, volunteered quite a bit at charity hospitals in low income neighbourhoods of the city. However, he had started feeling disillusioned with these charity hospitals, and wanted to establish a model trust hospital. After discussing the idea with some of his friends from medical school, he planned to establish his trust hospital project within five years. On the advice of one of his childhood friends, Kamran approached Raza to discuss financial planning for his dream project. Kamran had appraised Raza in the previous meeting that he and his friends estimated the hospital would start with a 2 room outdoor patients' service. This would cost PKR 20 million for construction, and the land would be donated by Kamran. In addition to that, it would cost PKR 1 million per annum to maintain the outdoor centre. After two years, the hospital was to be expanded to include a surgical ward, which would cost another PKR50 million for building and equipment, and an additional PKR 5 million per annum for running expenses. Kamran and his friends had decided to set up a foundation to support this project for 10 years and wanted to start a fundraising campaign. Raza opined that these funds should be invested in fixed income generating products which would generate a 9% discount rate.

Figure 1: Increase in the Profit Rates of National Savings Schemes PRESS RELEASE Increase in the Profit Rates of National Savings Schemes National Savings is pleased to announce that the profit rates of National Savings Schemes ("NSS") have been revised upward w.e.f. 14 September 2018. Below are the details of revised NSS rates: Net S. No. Name of Schemes Previous New Increase 01 Behbood Savings Certificates 10.20% 10.92% 0.72% 02 Pensioner Benefit Accounts 10.20% 10.92% 0.72% 03 Shuhada Family Welfare Account 10.20% 10.92% 0.72% 04 Defence Savings Certificates 08.30% 09.05% 0.75% 05 Special Savings Certificates 7.10% 7.87% (Registered)/Accounts 0.77% (Average) (Average) 06 Regular Income Certificates 08.04% 08.784% 0.744% 07 Savings Account 05.00% 06.00% 1.00% 08 Short Term 3-Month 06.40% 07.36% 0.96% Savings 6-Month Certificates 06.46% 07.42% 0.96% 12 Month 06.56% 07.52% 0.96% Figure 1: Increase in the Profit Rates of National Savings Schemes PRESS RELEASE Increase in the Profit Rates of National Savings Schemes National Savings is pleased to announce that the profit rates of National Savings Schemes ("NSS") have been revised upward w.e.f. 14 September 2018. Below are the details of revised NSS rates: Net S. No. Name of Schemes Previous New Increase 01 Behbood Savings Certificates 10.20% 10.92% 0.72% 02 Pensioner Benefit Accounts 10.20% 10.92% 0.72% 03 Shuhada Family Welfare Account 10.20% 10.92% 0.72% 04 Defence Savings Certificates 08.30% 09.05% 0.75% 05 Special Savings Certificates 7.10% 7.87% (Registered)/Accounts 0.77% (Average) (Average) 06 Regular Income Certificates 08.04% 08.784% 0.744% 07 Savings Account 05.00% 06.00% 1.00% 08 Short Term 3-Month 06.40% 07.36% 0.96% Savings 6-Month Certificates 06.46% 07.42% 0.96% 12 Month 06.56% 07.52% 0.96%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started