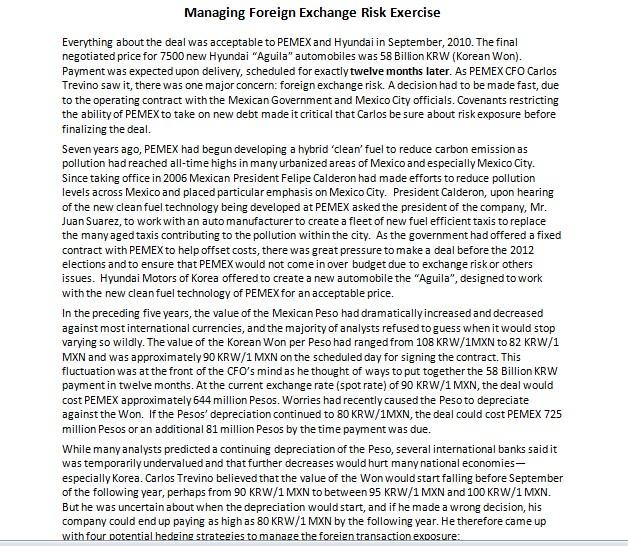

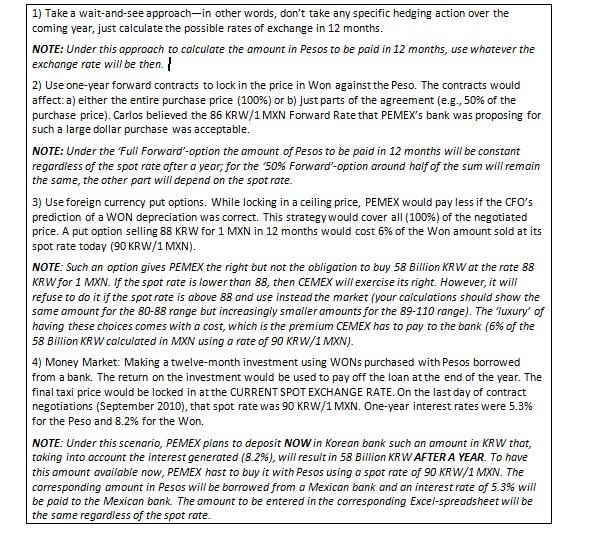

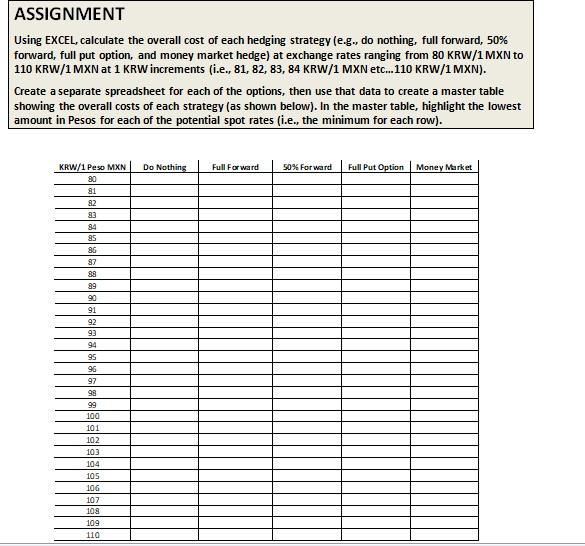

Managing Foreign Exchange Risk Exercise Everything about the deal was acceptable to PEMEX and Hyundai in September, 2010. The final negotiated price for 7500 new Hyundai "Aguila" automobiles was 58 Billion KRW (Korean Won). Payment was expected upon delivery, scheduled for exactly twelve months later. As PEMEX CFO Carlos Trevino saw it, there was one major concern: foreign exchange risk. A decision had to be made fast, due to the operating contract with the Mexican Government and Mexico City officials. Covenants restricting the ability of PEMEX to take on new debt made it critical that Carlos be sure about risk exposure before finalizing the deal. Seven years ago, PEMEX had begun developing a hybrid 'clean' fuel to reduce carbon emission as pollution had reached all-time highs in many urbanized areas of Mexico and especially Mexico City. Since taking office in 2006 Mexican President Felipe Calderon had made efforts to reduce pollution levels across Mexico and placed particular emphasis on Mexico City. President Calderon, upon hearing of the new clean fuel technology being developed at PEMEX asked the president of the company, Mr. Juan Suarez, to work with an auto manufacturer to create a fleet of new fuel efficient taxis to replace the many aged taxis contributing to the pollution within the city. As the government had offered a fixed contract with PEMEX to help offset costs, there was great pressure to make a deal before the 2012 elections and to ensure that PEMEX would not come in over budget due to exchange risk or others issues. Hyundai Motors of Korea offered to create a new automobile the "Aguila", designed to work with the new clean fuel technology of PEMEX for an acceptable price. In the preceding five years, the value of the Mexican Peso had dramatically increased and decreased against most international currencies, and the majority of analysts refused to guess when it would stop varying so wildly. The value of the Korean Won per Peso had ranged from 108KRW/1MXN to 82KRW/1 MXN and was approximately 90KRW/1MXN on the scheduled day for signing the contract. This fluctuation was at the front of the CFO's mind as he thought of ways to put together the 58 Billion KRW payment in twelve months. At the current exchange rate (spot rate) of 90KRW/1MXN, the deal would cost PEMEX approximately 644 million Pesos. Worries had recently caused the Peso to depreciate against the Won. If the Pesos' depreciation continued to 80KRW/1MXN, the deal could cost PEMEX 725 million Pesos or an additional 81 million Pesos by the time payment was due. While many analysts predicted a continuing depreciation of the Peso, several international banks said it was temporarily undervalued and that further decreases would hurt many national economiesespecially Korea. Carlos Trevino believed that the value of the Won would start falling before September of the following year, perhaps from 90KRW/1MXN to between 95KRW/1MXN and 100KRW/1MXN. But he was uncertain about when the depreciation would start, and if he made a wrong decision, his company could end up paying as high as 80KRW/1MXN by the following year. He therefore came up with four potential hedging strategies to manage the foreign transaction exoosure: 1) Take a wait-and-see approach-in other words, don't take any specific hedging action over the coming year, just calculate the possible rates of exchange in 12 months. NOTE: Under this approach to calculate the amount in Pesos to be paid in 12 months, use whatever the exchange rate will be then. 1 2) Use one-year forward contracts to lock in the price in Won against the Peso. The contracts would affect: a) either the entire purchase price (100% ) or b) just parts of the agreement (e.g., 50% of the purchase price). Carlos believed the 86 KRW/1 MXN Forward Rate that PEMEX's bank was proposing for such a large dollar purchase was acceptable. NOTE: Under the 'Full Forward'-option the amount of Pesos to be paid in 12 months will be constant regardless of the spot rate after a year; for the ' 50% Forward'-option around half of the sum will remain the same, the other part will depend on the spot rate. 3) Use foreign currency put options. While locking in a ceiling price, PEMEX would pay less if the CFO's prediction of a WON depreciation was correct. This strategy would cover all (100%) of the negotiated price. A put option selling 88 KRW for 1MXN in 12 months would cost 6% of the Won amount sold at its spot rate today (90 KRW/1 MXN). NOTE: Such an option gives PEMEX the right but not the obligation to buy 58 Billion KRW at the rate 88 KRW for 1MXN. If the spot rate is lower than 88 , then CEMEX will exercise its right. However, it will refuse to do it if the spot rate is above 88 and use instead the market (your calculations should show the same amount for the 80-88 range but increasingly smaller amounts for the 89-110 range). The "luxury" of having these choices comes with a cost, which is the premium CEMEX has to pay to the bank ( 6% of the 58 Billion KRW calculated in MXN using a rate of 90 KRW/1 MXN). 4) Money Market: Making a twelve-month investment using WONs purchased with Pesos borrowed from a bank. The return on the investment would be used to pay off the loan at the end of the year. The final taxi price would be locked in at the CURRENT SPOT EXCHANGE RATE. On the last day of contract negotiations (September 2010), that spot rate was 90 KRW/1 MXN. One-year interest rates were 5.3\% for the Peso and 8.2% for the Won. NOTE: Under this scenario, PEMEX plans to deposit NOW in Korean bank such an amount in KRW that, taking into account the interest generated (8.2\%), will result in 58 Billion KRW AFTER A YEAR. To have this amount available now, PEMEX hast to buy it with Pesos using a spot rate of 90KRW/1MXN. The corresponding amount in Pesos will be borrowed from a Mexican bank and an interest rate of 5.3\% will be paid to the Mexican bank. The amount to be entered in the corresponding Excel-spreadsheet will be the same regardless of the spot rate. ASSIGNMENT Using EXCEL, calculate the overall cost of each hedging strategy (e.g., do nothing, full forward, 50% forward, full put option, and money market hedge) at exchange rates ranging from 80KRW/1MXN to 110KRW/1MXN at 1KRW increments (i.e., 81, 82, 83, 84KRW/1MXN etc... 110KRW/1MXN ). Create a separate spreadsheet for each of the options, then use that data to create a master table showing the overall costs of each strategy (as shown below). In the master table, highlight the lowest amount in Pesos for each of the potential spot rates (i.e., the minimum for each row). Managing Foreign Exchange Risk Exercise Everything about the deal was acceptable to PEMEX and Hyundai in September, 2010. The final negotiated price for 7500 new Hyundai "Aguila" automobiles was 58 Billion KRW (Korean Won). Payment was expected upon delivery, scheduled for exactly twelve months later. As PEMEX CFO Carlos Trevino saw it, there was one major concern: foreign exchange risk. A decision had to be made fast, due to the operating contract with the Mexican Government and Mexico City officials. Covenants restricting the ability of PEMEX to take on new debt made it critical that Carlos be sure about risk exposure before finalizing the deal. Seven years ago, PEMEX had begun developing a hybrid 'clean' fuel to reduce carbon emission as pollution had reached all-time highs in many urbanized areas of Mexico and especially Mexico City. Since taking office in 2006 Mexican President Felipe Calderon had made efforts to reduce pollution levels across Mexico and placed particular emphasis on Mexico City. President Calderon, upon hearing of the new clean fuel technology being developed at PEMEX asked the president of the company, Mr. Juan Suarez, to work with an auto manufacturer to create a fleet of new fuel efficient taxis to replace the many aged taxis contributing to the pollution within the city. As the government had offered a fixed contract with PEMEX to help offset costs, there was great pressure to make a deal before the 2012 elections and to ensure that PEMEX would not come in over budget due to exchange risk or others issues. Hyundai Motors of Korea offered to create a new automobile the "Aguila", designed to work with the new clean fuel technology of PEMEX for an acceptable price. In the preceding five years, the value of the Mexican Peso had dramatically increased and decreased against most international currencies, and the majority of analysts refused to guess when it would stop varying so wildly. The value of the Korean Won per Peso had ranged from 108KRW/1MXN to 82KRW/1 MXN and was approximately 90KRW/1MXN on the scheduled day for signing the contract. This fluctuation was at the front of the CFO's mind as he thought of ways to put together the 58 Billion KRW payment in twelve months. At the current exchange rate (spot rate) of 90KRW/1MXN, the deal would cost PEMEX approximately 644 million Pesos. Worries had recently caused the Peso to depreciate against the Won. If the Pesos' depreciation continued to 80KRW/1MXN, the deal could cost PEMEX 725 million Pesos or an additional 81 million Pesos by the time payment was due. While many analysts predicted a continuing depreciation of the Peso, several international banks said it was temporarily undervalued and that further decreases would hurt many national economiesespecially Korea. Carlos Trevino believed that the value of the Won would start falling before September of the following year, perhaps from 90KRW/1MXN to between 95KRW/1MXN and 100KRW/1MXN. But he was uncertain about when the depreciation would start, and if he made a wrong decision, his company could end up paying as high as 80KRW/1MXN by the following year. He therefore came up with four potential hedging strategies to manage the foreign transaction exoosure: 1) Take a wait-and-see approach-in other words, don't take any specific hedging action over the coming year, just calculate the possible rates of exchange in 12 months. NOTE: Under this approach to calculate the amount in Pesos to be paid in 12 months, use whatever the exchange rate will be then. 1 2) Use one-year forward contracts to lock in the price in Won against the Peso. The contracts would affect: a) either the entire purchase price (100% ) or b) just parts of the agreement (e.g., 50% of the purchase price). Carlos believed the 86 KRW/1 MXN Forward Rate that PEMEX's bank was proposing for such a large dollar purchase was acceptable. NOTE: Under the 'Full Forward'-option the amount of Pesos to be paid in 12 months will be constant regardless of the spot rate after a year; for the ' 50% Forward'-option around half of the sum will remain the same, the other part will depend on the spot rate. 3) Use foreign currency put options. While locking in a ceiling price, PEMEX would pay less if the CFO's prediction of a WON depreciation was correct. This strategy would cover all (100%) of the negotiated price. A put option selling 88 KRW for 1MXN in 12 months would cost 6% of the Won amount sold at its spot rate today (90 KRW/1 MXN). NOTE: Such an option gives PEMEX the right but not the obligation to buy 58 Billion KRW at the rate 88 KRW for 1MXN. If the spot rate is lower than 88 , then CEMEX will exercise its right. However, it will refuse to do it if the spot rate is above 88 and use instead the market (your calculations should show the same amount for the 80-88 range but increasingly smaller amounts for the 89-110 range). The "luxury" of having these choices comes with a cost, which is the premium CEMEX has to pay to the bank ( 6% of the 58 Billion KRW calculated in MXN using a rate of 90 KRW/1 MXN). 4) Money Market: Making a twelve-month investment using WONs purchased with Pesos borrowed from a bank. The return on the investment would be used to pay off the loan at the end of the year. The final taxi price would be locked in at the CURRENT SPOT EXCHANGE RATE. On the last day of contract negotiations (September 2010), that spot rate was 90 KRW/1 MXN. One-year interest rates were 5.3\% for the Peso and 8.2% for the Won. NOTE: Under this scenario, PEMEX plans to deposit NOW in Korean bank such an amount in KRW that, taking into account the interest generated (8.2\%), will result in 58 Billion KRW AFTER A YEAR. To have this amount available now, PEMEX hast to buy it with Pesos using a spot rate of 90KRW/1MXN. The corresponding amount in Pesos will be borrowed from a Mexican bank and an interest rate of 5.3\% will be paid to the Mexican bank. The amount to be entered in the corresponding Excel-spreadsheet will be the same regardless of the spot rate. ASSIGNMENT Using EXCEL, calculate the overall cost of each hedging strategy (e.g., do nothing, full forward, 50% forward, full put option, and money market hedge) at exchange rates ranging from 80KRW/1MXN to 110KRW/1MXN at 1KRW increments (i.e., 81, 82, 83, 84KRW/1MXN etc... 110KRW/1MXN ). Create a separate spreadsheet for each of the options, then use that data to create a master table showing the overall costs of each strategy (as shown below). In the master table, highlight the lowest amount in Pesos for each of the potential spot rates (i.e., the minimum for each row)