Answered step by step

Verified Expert Solution

Question

1 Approved Answer

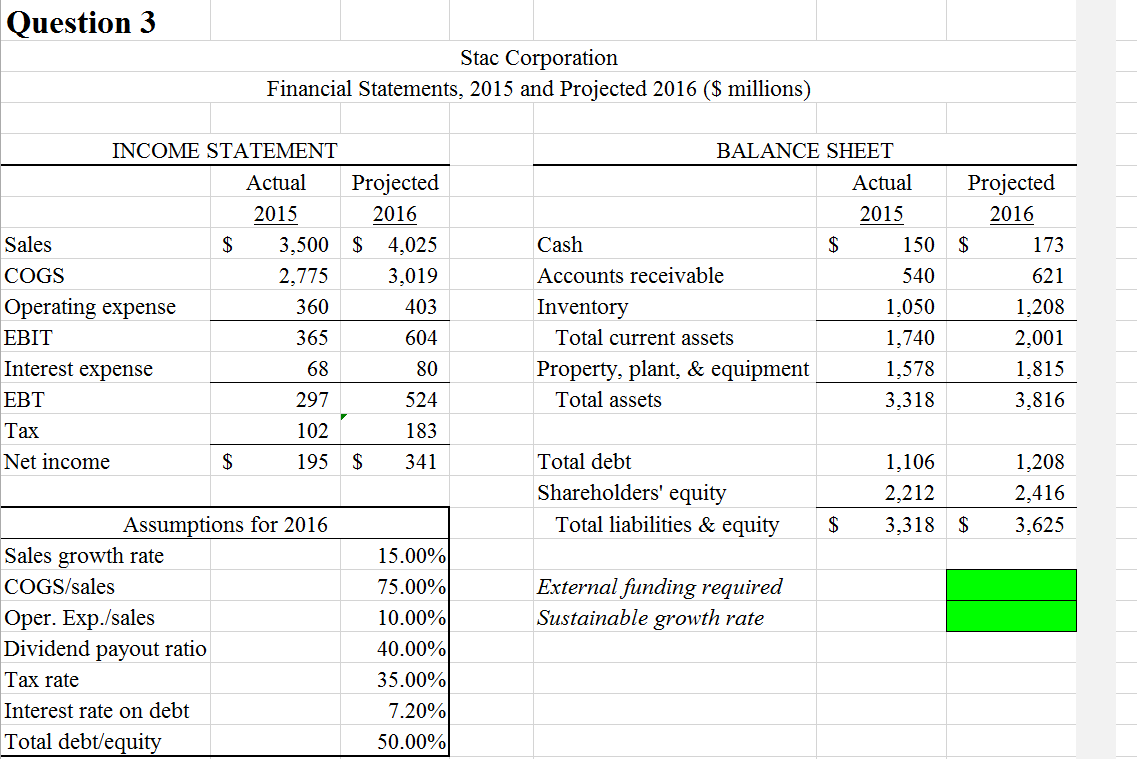

Managing Growth Use the provided income statement and balance sheet statement to calculate the companys actual growth rate, sustainable growth rate, external financing required. Also

Managing Growth Use the provided income statement and balance sheet statement to calculate the companys actual growth rate, sustainable growth rate, external financing required. Also analyze how management decisions can affect external financing requirements. See Excel file for details.

Question 3 Stac Corporation Financial Statements, 2015 and Projected 2016 (S millions) INCOME STATEMENT BALANCE SHEET Actual 2015 Projected 2016 ActualProjected 2015 2016 Sales COGS Operating expense EBIT Interest expense EBT Tax Net income Cash Accounts receivable Inventory 173 621 1,208 2,001 1,815 3,816 150 S $3,500 $ 4,025 3,019 403 604 80 524 183 195 $341 2,775 360 365 68 297 102 540 1,050 1,740 1,578 3,318 Total current assets Property, plant, & equipment Total assets Total debt Shareholders' equitv 1,106 2,212 S3,318 1,208 2,416 S3,625 Assumptions for 2016 Total liabilities & equity Sales growth rate COGS/sales Oper. Exp./sales Dividend payout rati0 Tax rate Interest rate on debt Total debt/equity 15.00% 75.00% 10.00% 40.00% 35.00% 7.20% 50.00% External funding required Sustainable growth rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started