Answered step by step

Verified Expert Solution

Question

1 Approved Answer

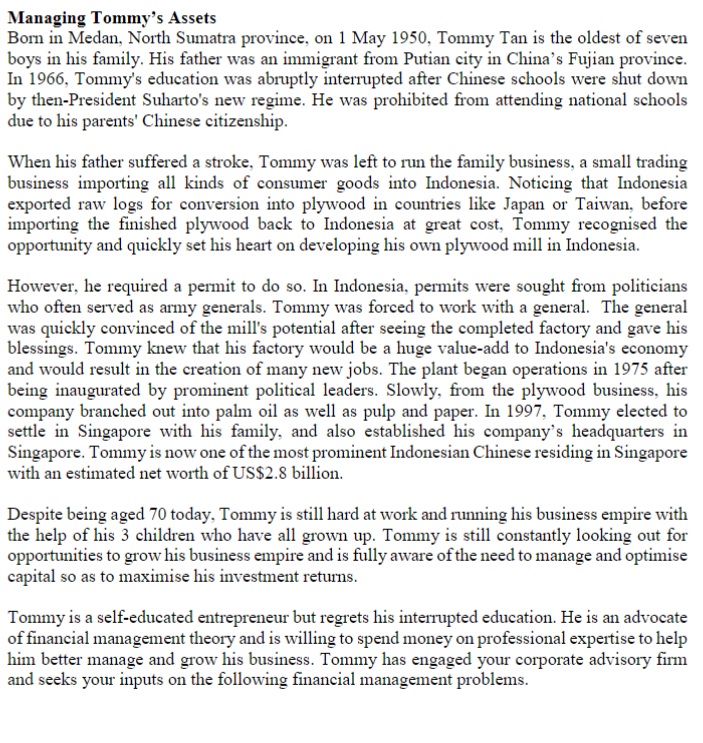

Managing Tommy's Assets Born in Medan, North Sumatra province, on 1 May 1950, Tommy Tan is the oldest of seven boys in his family. His

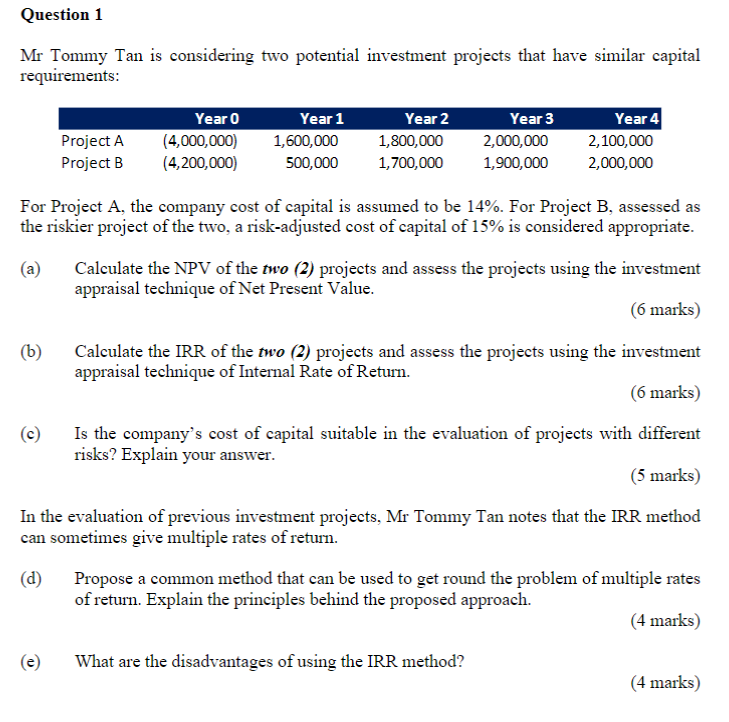

Managing Tommy's Assets Born in Medan, North Sumatra province, on 1 May 1950, Tommy Tan is the oldest of seven boys in his family. His father was an immigrant from Putian city in China's Fujian province. In 1966, Tommy's education was abruptly interrupted after Chinese schools were shut down by then-President Suharto's new regime. He was prohibited from attending national schools due to his parents' Chinese citizenship. When his father suffered a stroke, Tommy was left to run the family business, a small trading business importing all kinds of consumer goods into Indonesia. Noticing that Indonesia exported raw logs for conversion into plywood in countries like Japan or Taiwan, before importing the finished plywood back to Indonesia at great cost, Tommy recognised the opportunity and quickly set his heart on developing his own plywood mill in Indonesia. However, he required a permit to do so. In Indonesia, permits were sought from politicians who often served as army generals. Tommy was forced to work with a general. The general was quickly convinced of the mill's potential after seeing the completed factory and gave his blessings. Tommy knew that his factory would be a huge value-add to Indonesia's economy and would result in the creation of many new jobs. The plant began operations in 1975 after being inaugurated by prominent political leaders. Slowly, from the plywood business, his company branched out into palm oil as well as pulp and paper. In 1997, Tommy elected to settle in Singapore with his family, and also established his company's headquarters in Singapore. Tommy is now one of the most prominent Indonesian Chinese residing in Singapore with an estimated net worth of US$2.8 billion. Despite being aged 70 today, Tommy is still hard at work and running his business empire with the help of his 3 children who have all grown up. Tommy is still constantly looking out for opportunities to grow his business empire and is fully aware of the need to manage and optimise capital so as to maximise his investment returns. Tommy is a self-educated entrepreneur but regrets his interrupted education. He is an advocate of financial management theory and is willing to spend money on professional expertise to help him better manage and grow his business. Tommy has engaged your corporate advisory firm and seeks your inputs on the following financial management problems. Question 1 Mr Tommy Tan is considering two potential investment projects that have similar capital requirements: Project A Project B Year 0 (4,000,000) (4,200,000) Year 1 1,600,000 500,000 Year 2 1,800,000 1,700,000 Year 3 2,000,000 1.900.000 Year 4 2,100,000 2.000.000 For Project A, the company cost of capital is assumed to be 14%. For Project B, assessed as the riskier project of the two, a risk-adjusted cost of capital of 15% is considered appropriate. (a) Calculate the NPV of the two (2) projects and assess the projects using the investment appraisal technique of Net Present Value. (6 marks) (6) Calculate the IRR of the two (2) projects and assess the projects using the investment appraisal technique of Internal Rate of Return. (6 marks) Is the company's cost of capital suitable in the evaluation of projects with different risks? Explain your answer. (5 marks) In the evaluation of previous investment projects, Mr Tommy Tan notes that the IRR method can sometimes give multiple rates of return. (d) Propose a common method that can be used to get round the problem of multiple rates of return. Explain the principles behind the proposed approach. (4 marks) (e) What are the disadvantages of using the IRR method? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started