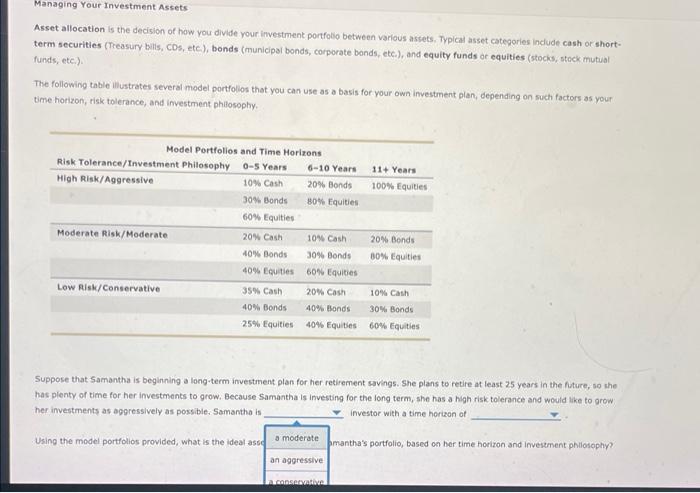

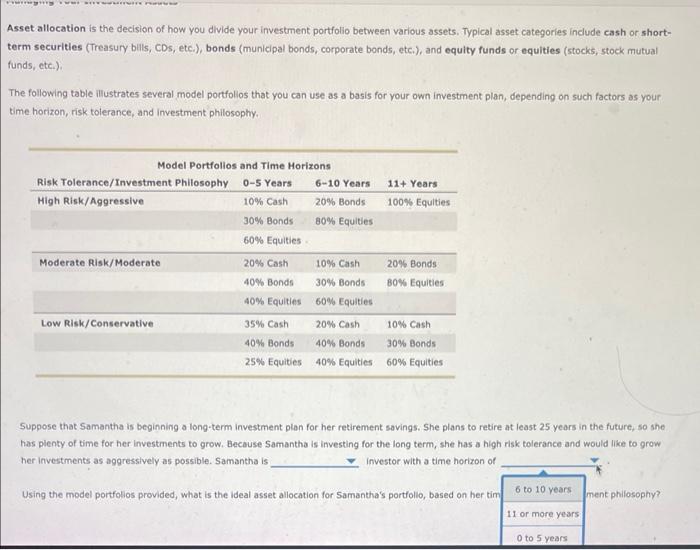

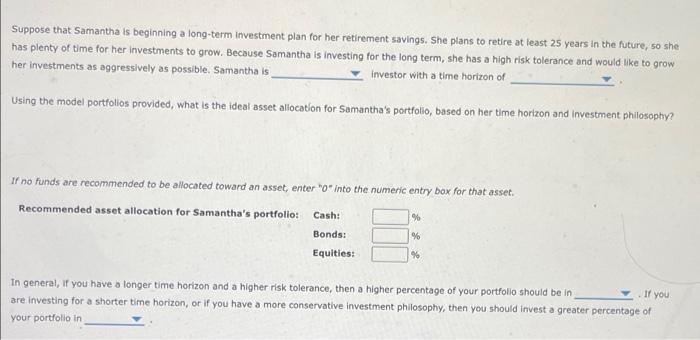

Managing Your Investment Assets Asset allocation is the decision of how you divide your investment portfolio between various assets. Typical asset categories include cash or short- term securities (Treasury bills, CDs, etc.), bonds (municipal bonds, corporate bonds, etc.), and equity funds or equities (stocks, stock mutual funds, etc.) The following table illustrates several model portfollos that you can use as a basis for your own investment plan, depending on such factors as your time horizon, risk tolerance, and Investment philosophy Model Portfolios and Time Horizons Risk Tolerance/Investment Philosophy 0-5 Years 6-10 Years 11+ Years High Risk/Aggressive 10% Cash 20% Bonds 100% Equities 30% Bonds 80% Equities 60% Equities Moderate Risk/Moderate 20% Cash 10% Cash 20% Bonds 40% Bonds 30% Bonds B0% Equities 40% Equities 60% Equities Low Risk/Conservative 35% Cash 20% Cash 10% Cash 40% Bonds 40% Bonds 30% Bonds 25% Equities 40% Equities 60% Equities Suppose that Samantha is beginning a long-term investment plan for her retirement savings. She plans to retire at least 25 years in the future, so she has plenty of time for her investments to grow. Because Samantha is investing for the long term, she has a high risk tolerance and would ike to grow her investments as aggressively as possible. Samantha is Investor with a time horizon of Using the model portfolios provided, what is the ideal ass a moderate bmantha's portfolio, based on her time horizon and Investment philosophy an aggressive In conserve Asset allocation is the decision of how you divide your investment portfolio between various assets. Typical asset categories include cash or short- term securities (Treasury bills, CDs, etc.), bonds (municipal bonds, corporate bonds, etc.), and equity funds or equities (stocks, stock mutual funds, etc.) The following table mustrates several model portfolios that you can use as a basis for your own investment plan, depending on such factors as your time horizon, risk tolerance, and investment philosophy Model Portfolios and Time Horizons Risk Tolerance/Investment Philosophy 0-5 Years 6-10 Years 11+ Years High Risk/Aggressive 10% Cash 20% Bonds 100% Equities 30% Bonds 80% Equities 60% Equities Moderate Risk/Moderate 20% Cash 10% Cash 20% Bonds 40% Bonds 30% Bonds 80% Equities 40% Equities 60% Equities Low Risk/Conservative 35% Cash 20% Cash 10% Cash 40% Bonds 40% Bonds 30% Bonds 25% Equities 40% Equities 60% Equities Suppose that Samantha is beginning a long-term investment plan for her retirement savings. She plans to retire at least 25 years in the future, so she has plenty of time for her investments to grow. Because Samantha is investing for the long term, she has a high risk tolerance and would like to grow her Investments as aggressively as possible. Samantha is Investor with a time horizon of 6 to 10 years Using the model portfolios provided what is the ideal asset allocation for Samantha's portfolio, based on her tim ment philosophy 11 or more years O to 5 years Suppose that Samantha is beginning a long-term investment plan for her retirement savings. She plans to retire at least 25 years in the future, so she has plenty of time for her investments to grow. Because Samantha is investing for the long term, she has a high risk tolerance and would like to grow her investments as aggressively as possible. Samantha is investor with a time horizon of Using the model portfolios provided, what is the ideal asset allocation for Samantha's portfolio, based on her time horizon and Investment philosophy? If no funds are recommended to be allocated toward an asset, enter "o" into the numeric entry box for that asset. Recommended asset allocation for Samantha's portfolio: Cash: % % Bonds: Equities: % If you In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in