Answered step by step

Verified Expert Solution

Question

1 Approved Answer

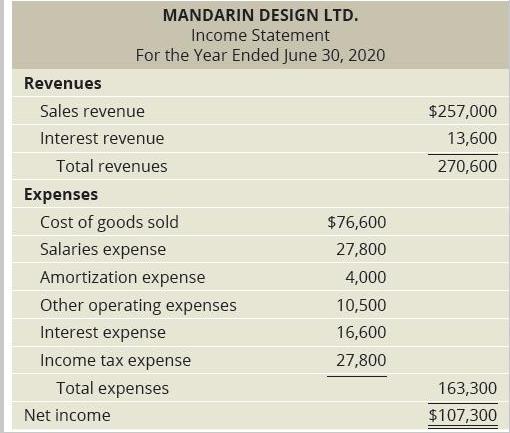

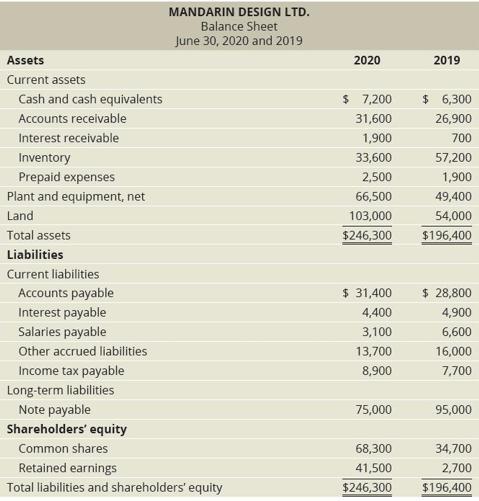

The 2020 income statement and comparative balance sheet of Mandarin Design Ltd. follow: Mandarin Design Ltd. had no non-cash financing and investing transactions during 2020.

The 2020 income statement and comparative balance sheet of Mandarin Design Ltd. follow:

Mandarin Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or plant and equipment, and no issuances of note payable.

Required

1. Prepare the operating section of the 2020 cash flow statement, using the indirect method.

2. Evaluate net cash flows from operating activities compared to its net income.

MANDARIN DESIGN LTD. Income Statement For the Year Ended June 30, 2020 Revenues Sales revenue $257,000 Interest revenue 13,600 Total revenues 270,600 Expenses Cost of goods sold $76,600 Salaries expense 27,800 Amortization expense 4,000 Other operating expenses 10,500 Interest expense 16,600 Income tax expense 27,800 Total expenses 163,300 Net income $107,300

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Statement of cash flows is prepared for a reporting period for analyzing reasons for change in cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started