Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mandatory Fashions Ltd is a fashion retail chain with stores located throughout Australia and New Zealand. The company specialises in medium to high end

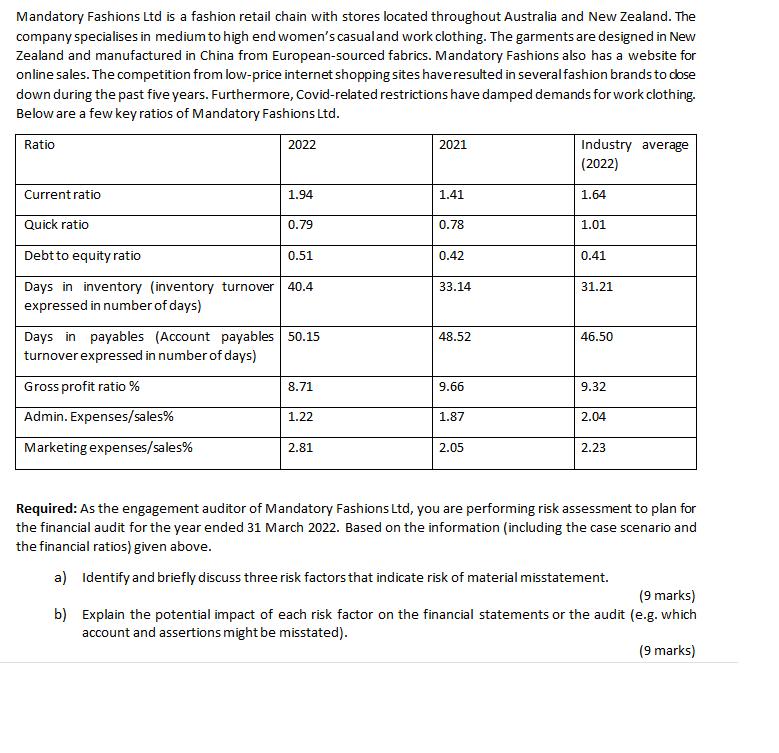

Mandatory Fashions Ltd is a fashion retail chain with stores located throughout Australia and New Zealand. The company specialises in medium to high end women's casual and work clothing. The garments are designed in New Zealand and manufactured in China from European-sourced fabrics. Mandatory Fashions also has a website for online sales. The competition from low-price internet shopping sites have resulted in several fashion brands to dose down during the past five years. Furthermore, Covid-related restrictions have damped demands for work clothing. Below are a few key ratios of Mandatory Fashions Ltd. Ratio 2022 Current ratio Quick ratio Debt to equity ratio 0.51 Days in inventory (inventory turnover 40.4 expressed in number of days) 1.94 0.79 Days in payables (Account payables 50.15 turnover expressed in number of days) Gross profit ratio % Admin. Expenses/sales% Marketing expenses/sales% 8.71 1.22 2.81 2021 1.41 0.78 0.42 33.14 48.52 9.66 1.87 2.05 Industry average (2022) 1.64 1.01 0.41 31.21 46.50 9.32 2.04 2.23 Required: As the engagement auditor of Mandatory Fashions Ltd, you are performing risk assessment to plan for the financial audit for the year ended 31 March 2022. Based on the information (including the case scenario and the financial ratios) given above. a) Identify and briefly discuss three risk factors that indicate risk of material misstatement. b) Explain the potential impact of each risk factor on the financial statements or the audit account and assertions might be misstated). (9 marks) (e.g. which (9 marks)

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The three risk factors that indicate risk of material misstatement are 1 The competitive environment in the retail industry is intense and Mandatory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started