Question

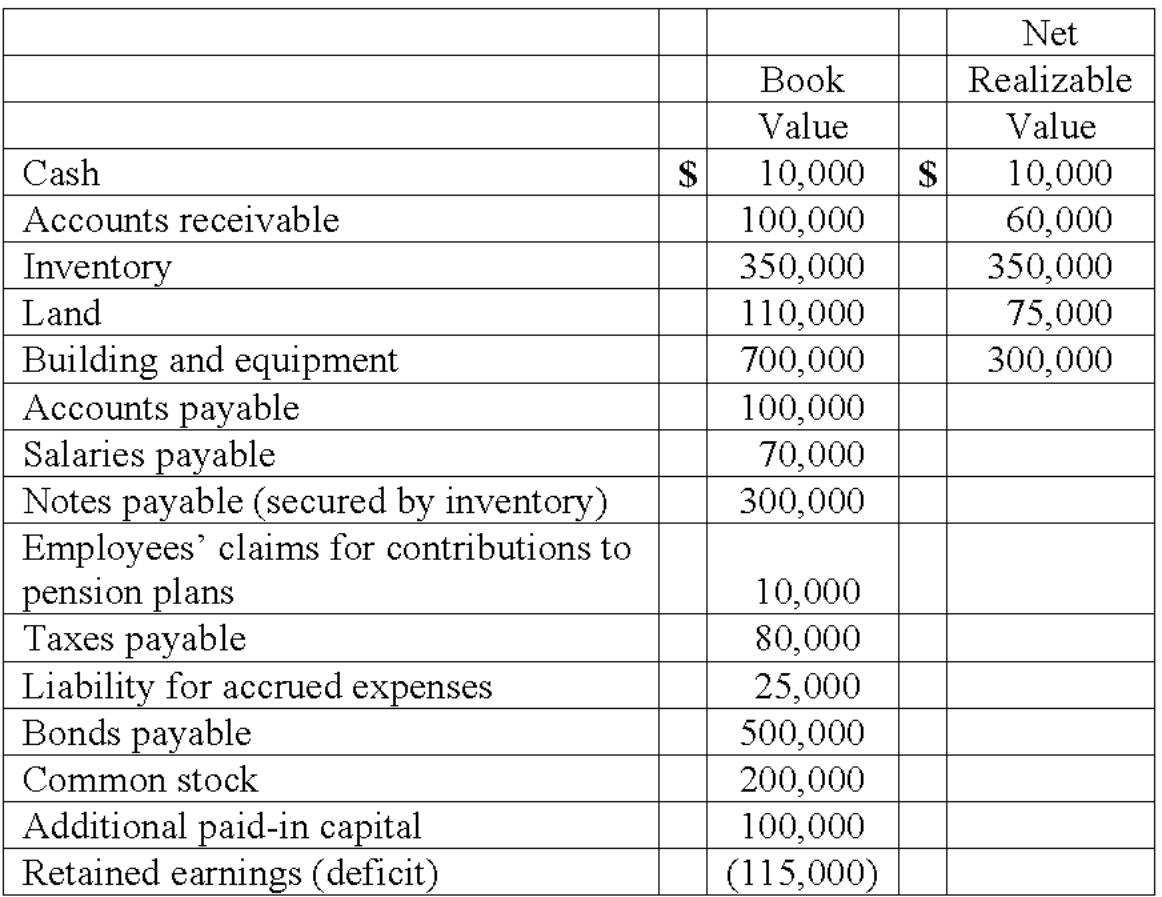

Mandich Co. had the following amounts for its assets, liabilities, and stockholders' equity accounts just before filing a bankruptcy petition and requesting liquidation: Of the

Mandich Co. had the following amounts for its assets, liabilities, and stockholders' equity accounts just before filing a bankruptcy petition and requesting liquidation:

Of the salaries payable, $30,000 was owed to an officer of the company. The remaining amount was owed to salaried employees who had not been paid within the previous 80 days: John Webb was owed $10,600, Samantha Jones was owed $15,000, Sandra Johnson was owed $11,900, and Dennis Roberts was owed $2,500. The maximum owed for any one employee's claims for contributions to benefit plans was $800. Estimated expense for administering the liquidation amounted to $40,000.

On a statement of financial affairs, what amount would have been shown as assets available to pay liabilities wiht priority and unsecured creditors? Show all work.

Net Book Realizable Value Value S 10,000 s 10,000 Cash 60,000 Accounts receivable 100,000 Inventory 350,000 350,000 Land 110,000 75,000 700,000 Building and equipment 300,000 Accounts payable 100,000 Salaries payable 70,000 Notes payable (secured by inventory) 300,000 Employees claims for contributions to 10,000 pension plans 80,000 Taxes payable Liability for accrued expenses 25,000 Bonds payable 500,000 Common stock 200,000 Additional paid-in capital 100,000 115,000 Retained earnings (deficit) Net Book Realizable Value Value S 10,000 s 10,000 Cash 60,000 Accounts receivable 100,000 Inventory 350,000 350,000 Land 110,000 75,000 700,000 Building and equipment 300,000 Accounts payable 100,000 Salaries payable 70,000 Notes payable (secured by inventory) 300,000 Employees claims for contributions to 10,000 pension plans 80,000 Taxes payable Liability for accrued expenses 25,000 Bonds payable 500,000 Common stock 200,000 Additional paid-in capital 100,000 115,000 Retained earnings (deficit)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started