Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mandolin Co is a quoted manufacturing company. Its finished products are stored in a nearby warehouse until ordered by customers. Mandolin Co has performed

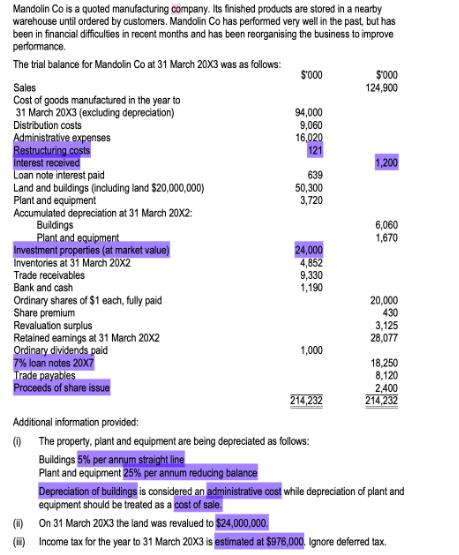

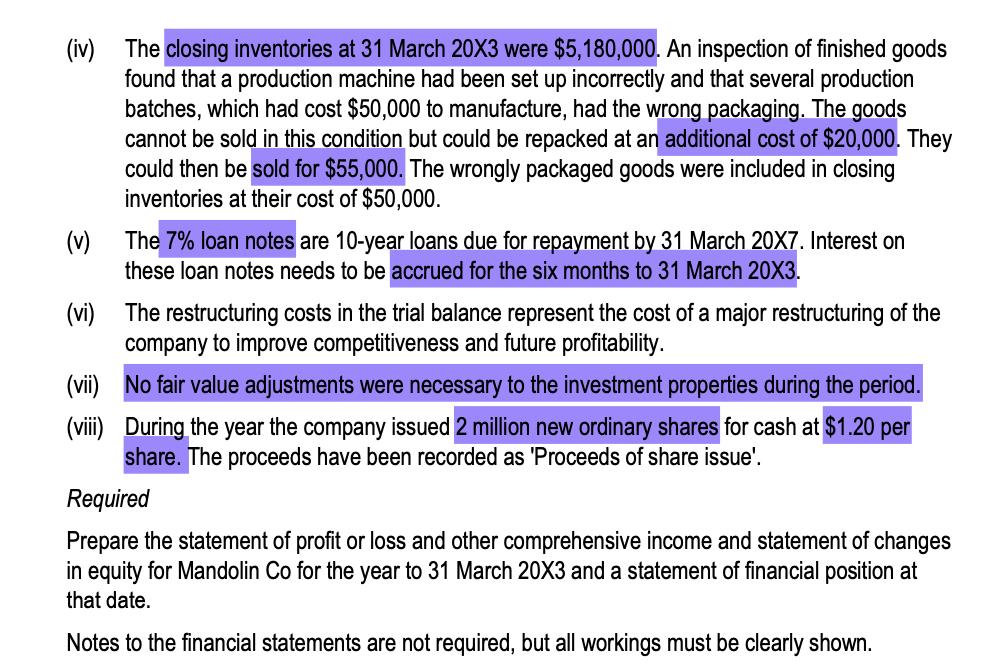

Mandolin Co is a quoted manufacturing company. Its finished products are stored in a nearby warehouse until ordered by customers. Mandolin Co has performed very well in the past, but has been in financial difficulties in recent months and has been reorganising the business to improve performance. The trial balance for Mandolin Co at 31 March 20X3 was as follows: Sales Cost of goods manufactured in the year to 31 March 20X3 (excluding depreciation) Distribution costs Administrative expenses Restructuring costs Interest received Loan note interest paid Land and buildings (including land $20,000,000) Plant and equipment Accumulated depreciation at 31 March 20X2: Buildings Plant and equipment Investment properties (at market value) Inventories at 31 March 20X2 Trade receivables Bank and cash Ordinary shares of $1 each, fully paid Share premium Revaluation surplus Retained eamings at 31 March 20X2 Ordinary dividends paid 7% loan notes 20X7 Trade payables Proceeds of share issue $'000 (i) () 94,000 9,060 16,020 121 639 50,300 3,720 24,000 4,852 9,330 1,190 1,000 214,232 Additional information provided: (1) The property, plant and equipment are being depreciated as follows: Buildings 5% per annum straight line Plant and equipment 25% per annum reducing balance $'000 124,900 1,200 6,060 1,670 20,000 430 3,125 28,077 18,250 8,120 2,400 214,232 Depreciation of buildings is considered an administrative cost while depreciation of plant and equipment should be treated as a cost of sale On 31 March 20X3 the land was revalued to $24,000,000 Income tax for the year to 31 March 20X3 is estimated at $976,000 Ignore deferred tax. (iv) The closing inventories at 31 March 20X3 were $5,180,000. An inspection of finished goods found that a production machine had been set up incorrectly and that several production batches, which had cost $50,000 to manufacture, had the wrong packaging. The goods cannot be sold in this condition but could be repacked at an additional cost of $20,000. They could then be sold for $55,000. The wrongly packaged goods were included in closing inventories at their cost of $50,000. (v) The 7% loan notes are 10-year loans due for repayment by 31 March 20X7. Interest on these loan notes needs to be accrued for the six months to 31 March 20X3. (vi) The restructuring costs in the trial balance represent the cost of a major restructuring of the company to improve competitiveness and future profitability. (vii) No fair value adjustments were necessary to the investment properties during the period. (viii) During the year the company issued 2 million new ordinary shares for cash at $1.20 per share. The proceeds have been recorded as 'Proceeds of share issue'. Required Prepare the statement of profit or loss and other comprehensive income and statement of changes in equity for Mandolin Co for the year to 31 March 20X3 and a statement of financial position at that date. Notes to the financial statements are not required, but all workings must be clearly shown.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Mandolin Co Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 March 20X3 Notes 000 Revenue 214232 Cost of sales Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started