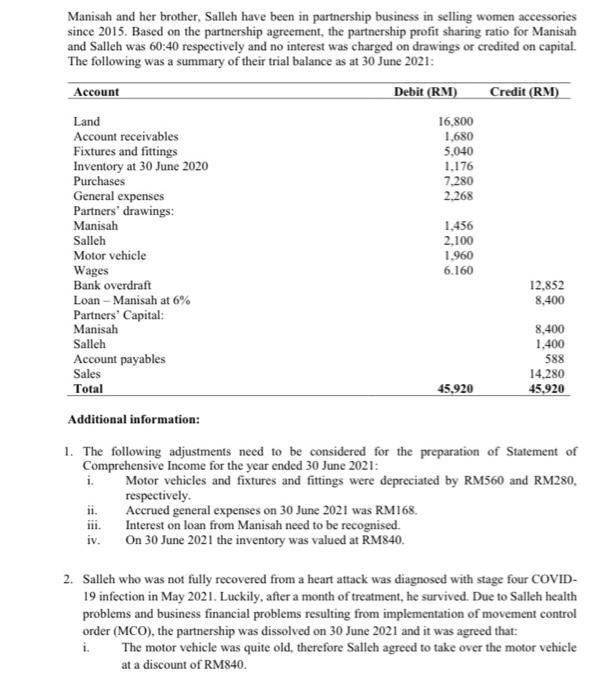

Manisah and her brother, Salleh have been in partnership business in selling women accessories since 2015. Based on the partnership agreement, the partnership profit

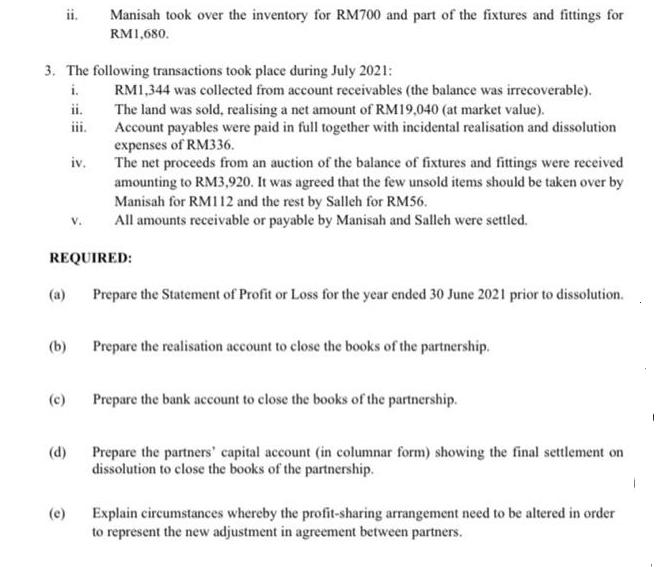

Manisah and her brother, Salleh have been in partnership business in selling women accessories since 2015. Based on the partnership agreement, the partnership profit sharing ratio for Manisah and Salleh was 60:40 respectively and no interest was charged on drawings or credited on capital. The following was a summary of their trial balance as at 30 June 2021: Debit (RM) Account Land Account receivables Fixtures and fittings Inventory at 30 June 2020 Purchases General expenses Partners' drawings: Manisah Salleh Motor vehicle Wages Bank overdraft Loan Manisah at 6% Partners' Capital: Manisah Salleh Account payables Sales Total Additional information: i. 16,800 1,680 5,040 1,176 7,280 2,268 111. iv. 1,456 2,100 1,960 6.160 45,920 Credit (RM) 12,852 8,400 1. The following adjustments need to be considered for the preparation of Statement of Comprehensive Income for the year ended 30 June 2021: Motor vehicles and fixtures and fittings were depreciated by RM560 and RM280, respectively. Accrued general expenses on 30 June 2021 was RM168. Interest on loan from Manisah need to be recognised. On 30 June 2021 the inventory was valued at RM840. 8,400 1,400 588 14,280 45,920 2. Salleh who was not fully recovered from a heart attack was diagnosed with stage four COVID- 19 infection in May 2021. Luckily, after a month of treatment, he survived. Due to Salleh health problems and business financial problems resulting from implementation of movement control order (MCO), the partnership was dissolved on 30 June 2021 and it was agreed that: i. The motor vehicle was quite old, therefore Salleh agreed to take over the motor vehicle at a discount of RM840. 3. The following transactions took place during July 2021: i. ii. iii. (a) (b) (c) (d) iv. REQUIRED: (e) Manisah took over the inventory for RM700 and part of the fixtures and fittings for RM1,680. V. RM1,344 was collected from account receivables (the balance was irrecoverable). The land was sold, realising a net amount of RM19,040 (at market value). Account payables were paid in full together with incidental realisation and dissolution expenses of RM336. The net proceeds from an auction of the balance of fixtures and fittings were received amounting to RM3,920. It was agreed that the few unsold items should be taken over by Manisah for RM112 and the rest by Salleh for RM56. All amounts receivable or payable by Manisah and Salleh were settled. Prepare the Statement of Profit or Loss for the year ended 30 June 2021 prior to dissolution. Prepare the realisation account to close the books of the partnership. Prepare the bank account to close the books of the partnership. Prepare the partners' capital account (in columnar form) showing the final settlement on dissolution to close the books of the partnership. Explain circumstances whereby the profit-sharing arrangement need to be altered in order to represent the new adjustment in agreement between partners.

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Profit or Loss for the year ended 30 June 2021 prior to dissolution Revenue Sales 142...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started