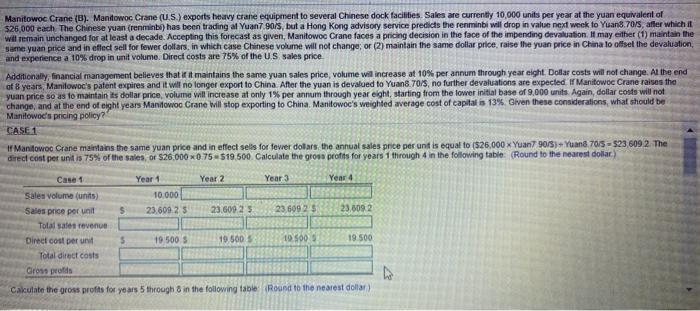

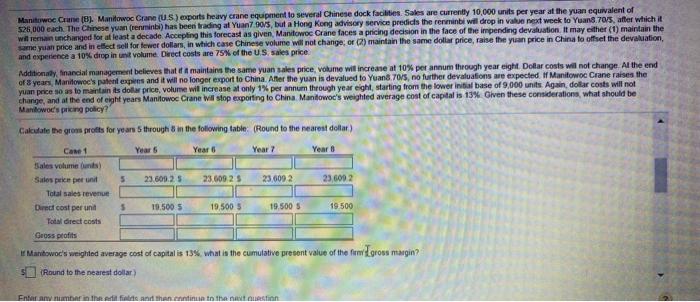

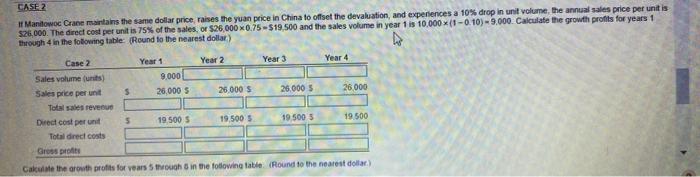

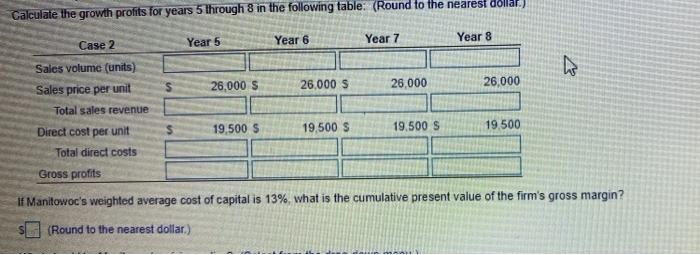

Manitowoc Crane (B). Manitowoc Crane (U.S.) exports heavy crane equipment to several Chinese dock facilities. Sales are currently 10,000 units per year at the yuan equivalent of 526,000 cach The Chinese yuan (renminbi) has been trading af Yuan 90/s, but a Hong Kong advisory service predicts the renminbi will drop in value next week to Yuan 8.707, after which it will remain unchanged for at least a decade. Accepting this forecast as given, Manitowoc Crane faces a pricing decision in the face of the impending devaluation. It may either (1) maintain the same yuan price and in effect sell for fewer dollars, in which case Chinese volume will not change; or (2) maintain the same dollar price, raise the yuan price in China lo offset the devaluation, and experience a 10% drop in unit volume. Direct costs are 75% of the US sales price Additionally, financial management believes that it maintains the same yuan sales price, volume will increase at 10% per annum through year eight Dollar costs will not change. Al the end of 8 years, Manitowoc's patent expires and it will no longer export to China. After the yuan is devalued to Yuan 8.70/5, no further devaluations are expected I Manitowoc Crane raises the yuan price so as to maintain its dollar price, volume will increase at only 1% per annum through year eight, starting from the lower initial base of 9.000 units. Again, dollar costs will not change, and at the end of eight years Manitowoc Crane will stop exporting to China Manitowoc's weighted average cost of capital is 13%. Given these considerations, what should be Manitowoc's pricing policy? CASE 1 If Manitowoc Crane maintains the same yuan price and in effect sells for fever dollars the annual sales price per unit is equal to (526,000 x Yuan 90/5) - Yuan 705-523 609 2. The direct cost per und is 75% of the sales, or $26.000 0.75 - $19.500. Calculate the gross profits for years 1 through 4 in the following table (Round to the nearest dollar) Year 2 Year 3 Year 4 Year 1 10,000 23.609.25 5 23.609 23 23.609 25 23.609 2 Case 1 Sales volume (units) Sales price per unit Total sales revenue Direet cost per unit Total direct costs Gros pros $ 19.500 5 19.500 5 19.500 19.500 Calculate the gross profits for years 5 through in the following table Round to the nearest dollar Manitowoc Crane (8). Manitowoc Crane (US) coports heavy crane equipment to several Chinese dock facilities Sales are currently 10,000 units per year at the yuan equivalent of 526,000 each. The Chinese Yuan (renminbi) has been trading af Yuan7905, but a Hong Kong advisory service predicts the renminbi will drop in value next week to Yuan 70/5, after which it will remain unchanged for at least a decade. Accepting this forecast as given, Manitowoc Crane faces a pricing decision in the face of the impending devaluation. It may either (1) maintain the ameyan price and in effect sell for fewer dollars, in which case Chinese volume will not change or (2) maintain the same dollar price, raise the yuan price in China to offset the devaluation, and experience a 10% drop in un volume. Direct costs are 75% of the US sales price Additionally, financial management believes that if maintains the same yuan sales price, Volume will increase at 10% per annum through year eight Dollar costs will not change. Al the end of years, Manitowoc's patent experies and it will no longer export to China. After the yuan is devalued to Yuan 70/5, no further devaluations are expected if Manitowoc Crane raises the yuan price so as to maintain its dollar price, volume will increase at only 1% per annum through year eight, starting from the lower initial base of 9,000 units Again dollar costs will not change, and at the end of eight years Manitowoc Crane Will stop exporting to China Manitowoc's weighted average cost of capital is 13%. Given these considerations, what should be Manitowoc's pricing policy? Calculate the gross profits for years through in the following table (Round to the nearest dollar) Cane 1 Year 6 Year Year Sales volume and Silos perceperunt 5 23.609.25 23.609 25 23 609 2 23 600 2 Total sales revenue Direct cost per un 5 19.500 5 19.500 5 19.500 5 19 500 Total direct costs Gross profits Ir Manitowoc's weighted average cost of capital is 13%, what is the cumulative present value of the few.grow margin? Round to the nearest dollar) En numar in i thanninin to the nation CASE 2 If Manitowoc Crane maintains the same dollar price raises the yuan price in China to offset the devaluation, and experiences a 10% drop in unit volume, the annual sales price per unit is 526,000. The direct cost per unit is 75% of the sales, or $26.000X0.75 - $19.500 and the sales volume in year 1 is 10,000 X (10.10) - 9,000 Calculate the growth profits for years 1 through 4 in the following table: Round to the nearest dollar) Year 2 Year 3 Year 4 Year 1 9,000 26,000 5 $ 26.000 5 26.000 26,000 5 Case 2 Sales volume (units) Sales price per un Total sales revenue Direct cost per unit Total direct costs Grosso 5 19.500 5 19.500 5 19 500 5 19.500 Calculate the growth profits for vers through in the following table (Round to the nearest dollar Calculate the growth profits for years 5 through 8 in the following table: (Round to the nearest dollar. Year 5 Case 2 Year 6 Year 7 Year 8 Sales volume (units) Sales price per unit 26,000 $ 26,000 $ 26.000 26,000 Total sales revenue Direct cost per unit 19,500 $ 19.500 S 19.500 $ 19.500 Total direct costs Gross profits If Manitowoc's weighted average cost of capital is 13% what is the cumulative present value of the firm's gross margin? s(Round to the nearest dollar.)