Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mann Inc. offers a restricted stock award plan to its vice presidents. On January 1, 2018, the corporation granted 10 million of its $5 par

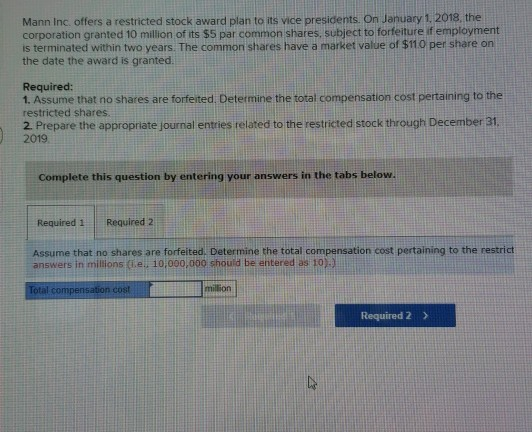

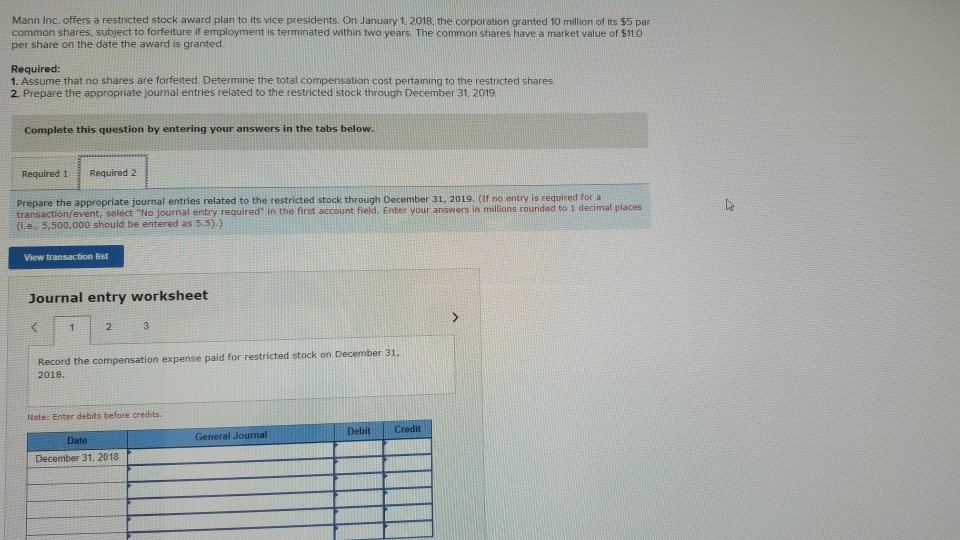

Mann Inc. offers a restricted stock award plan to its vice presidents. On January 1, 2018, the corporation granted 10 million of its $5 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market value of $110 per share on the date the award is granted. Required: 1. Assume that no shares are forfeited. Determine the total compensation cost pertaining to the restricted shares 2. Prepare the appropriate journal entries related to the restricted stock through December 31. 2019 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that no shares are forfeited. Determine the total compensation cost pertaining to the restrict answers in millions (ie. 10,000,000 should be entered as 10).) Total compensation cost million Required 2 > Mann Inc. offers a restricted stock award plan to its vice presidents. On January 1, 2018, the corporation granted 10 million of its $5 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market value of $11.0 per share on the date the award is granted. Required: 1. Assume that no shares are forfeited. Determine the total compensation cost pertaining to the restricted shares 2. Prepare the appropriate journal entries related to the restricted stock through December 31, 2019 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entries related to the restricted stock through December 31, 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal places (i.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started