Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Manning Systems is a commercial software vendor that sells billing and other financial software to companies around the globe. Manning operates a centralized call

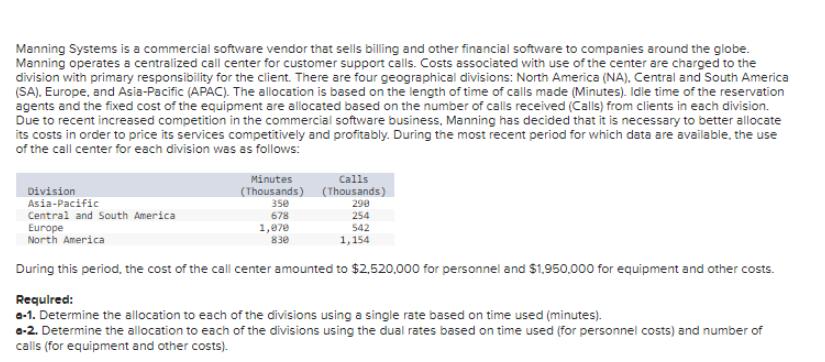

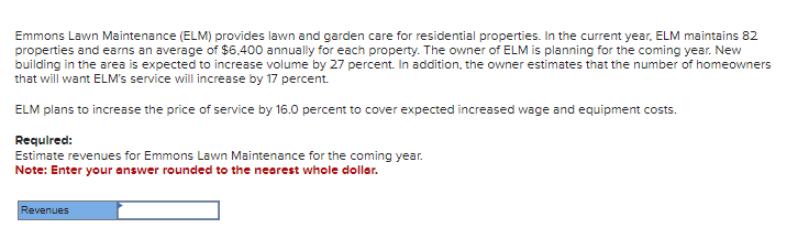

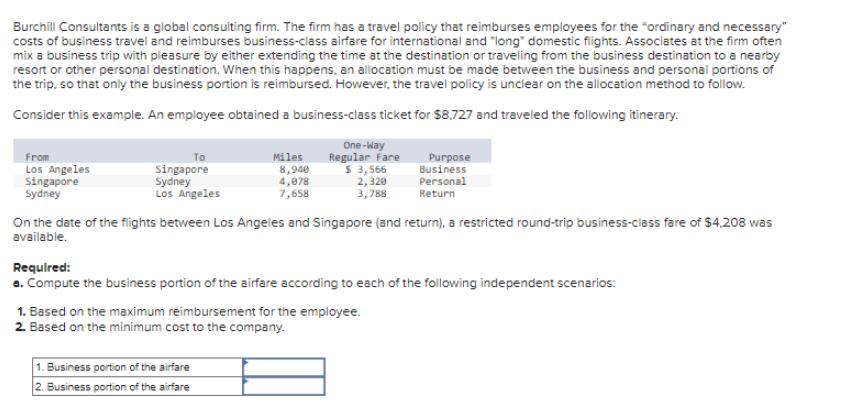

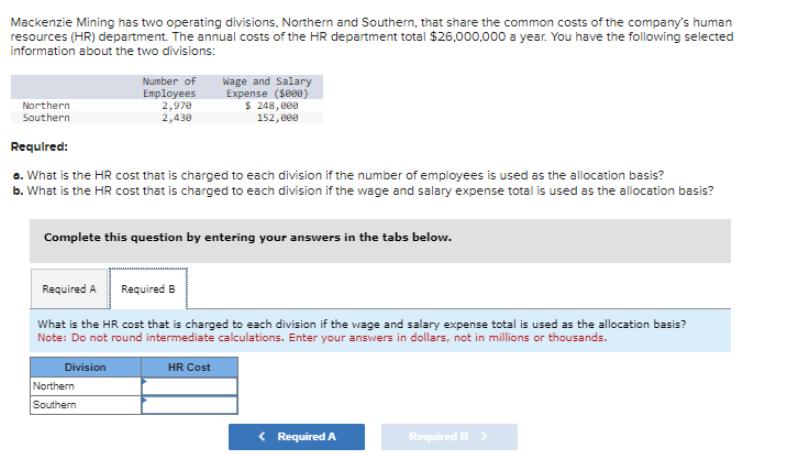

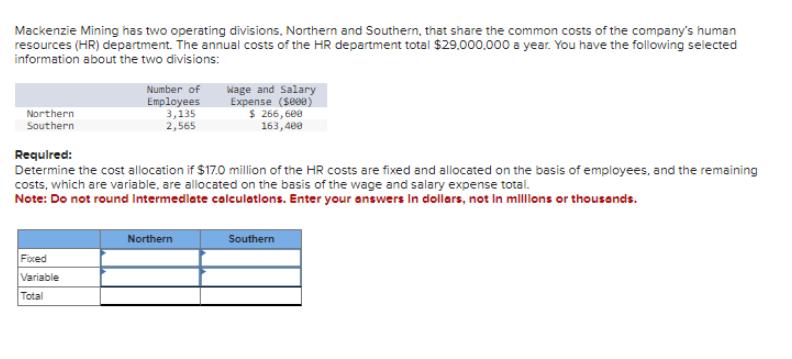

Manning Systems is a commercial software vendor that sells billing and other financial software to companies around the globe. Manning operates a centralized call center for customer support calls. Costs associated with use of the center are charged to the division with primary responsibility for the client. There are four geographical divisions: North America (NA), Central and South America (SA). Europe, and Asia-Pacific (APAC). The allocation is based on the length of time of calls made (Minutes). Idle time of the reservation agents and the fixed cost of the equipment are allocated based on the number of calls received (Calls) from clients in each division. Due to recent increased competition in the commercial software business, Manning has decided that it is necessary to better allocate its costs in order to price its services competitively and profitably. During the most recent period for which data are available, the use of the call center for each division was as follows: Division Asia-Pacific Central and South America Europe North America Minutes (Thousands) 350 Calls (Thousands) 290 678 254 1,070 830 542 1,154 During this period, the cost of the call center amounted to $2,520,000 for personnel and $1,950,000 for equipment and other costs. Required: -1. Determine the allocation to each of the divisions using a single rate based on time used (minutes). -2. Determine the allocation to each of the divisions using the dual rates based on time used (for personnel costs) and number of calls (for equipment and other costs). Emmons Lawn Maintenance (ELM) provides lawn and garden care for residential properties. In the current year, ELM maintains 82 properties and earns an average of $6.400 annually for each property. The owner of ELM is planning for the coming year. New building in the area is expected to increase volume by 27 percent. In addition, the owner estimates that the number of homeowners that will want ELM's service will increase by 17 percent. ELM plans to increase the price of service by 16.0 percent to cover expected increased wage and equipment costs. Required: Estimate revenues for Emmons Lawn Maintenance for the coming year. Note: Enter your answer rounded to the nearest whole dollar. Revenues Burchill Consultants is a global consulting firm. The firm has a travel policy that reimburses employees for the "ordinary and necessary" costs of business travel and reimburses business-class airfare for international and "long" domestic flights. Associates at the firm often mix a business trip with pleasure by either extending the time at the destination or traveling from the business destination to a nearby resort or other personal destination. When this happens, an allocation must be made between the business and personal portions of the trip, so that only the business portion is reimbursed. However, the travel policy is unclear on the allocation method to follow. Consider this example. An employee obtained a business-class ticket for $8,727 and traveled the following itinerary. From Los Angeles Singapore Sydney To Singapore Sydney Los Angeles Miles 8,940 One-Way Regular Fare 4,078 7,658 $ 3,566 2,320 3,788 Purpose Business Personal Return On the date of the flights between Los Angeles and Singapore (and return), a restricted round-trip business-class fare of $4,208 was available. Required: a. Compute the business portion of the airfare according to each of the following independent scenarios: 1. Based on the maximum reimbursement for the employee. 2. Based on the minimum cost to the company. 1. Business portion of the airfare 2. Business portion of the airfare Mackenzie Mining has two operating divisions, Northern and Southern, that share the common costs of the company's human resources (HR) department. The annual costs of the HR department total $26,000,000 a year. You have the following selected information about the two divisions: Northern Southern Required: Number of Employees 2,970 2,430 Wage and Salary Expense (5000) $ 248,000 152,000 a. What is the HR cost that is charged to each division if the number of employees is used as the allocation basis? b. What is the HR cost that is charged to each division if the wage and salary expense total is used as the allocation basis? Complete this question by entering your answers in the tabs below. Required A Required B What is the HR cost that is charged to each division if the wage and salary expense total is used as the allocation basis? Note: Do not round intermediate calculations. Enter your answers in dollars, not in millions or thousands. Division Northern Southern HR Cost < Required A Required B > Mackenzie Mining has two operating divisions. Northern and Southern, that share the common costs of the company's human resources (HR) department. The annual costs of the HR department total $29.000.000 a year. You have the following selected information about the two divisions: Number of Employees 3,135 2,565 Wage and Salary Expense ($800) $ 266,600 163,400 Northern Southern Required: Determine the cost allocation if $17.0 million of the HR costs are fixed and allocated on the basis of employees, and the remaining costs, which are variable, are allocated on the basis of the wage and salary expense total. Note: Do not round Intermediate calculations. Enter your answers in dollars, not in millions or thousands. Fixed Variable Total Northern Southern

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started