Question

Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December he performed $26,000 of legal services for a

Manny, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December he performed $26,000 of legal services for a client. Manny typically requires his clients to pay his bills immediately upon receipt. Assume Mannys marginal tax rate is 37 percent this year and next year, and that he can earn an after-tax rate of return of 9 percent on his investments.

a. What is the after-tax income if Manny sends his client the bill in December?

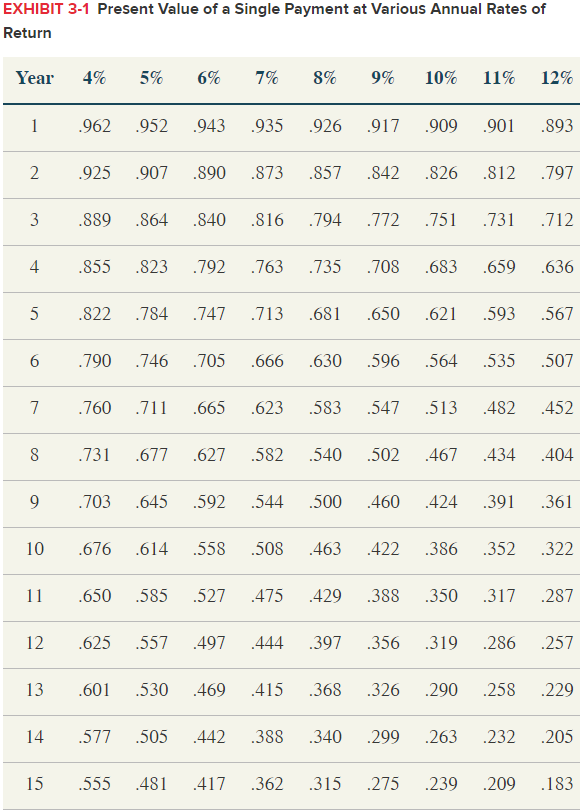

b. What is the after-tax income if Manny sends his client the bill in January? Use Exhibit 3.1. (Round your answer to the nearest whole dollar amount.)

c. Based on requirement a and b, should Manny send his client the bill in December or January?

December

January

EXHIBIT 3-1 Present Value of a Single Payment at Various Annual Rates of Return Year 4% 5% 6% 7% 8% 9% 10% 11% 12% 962 .952 .943 .935 926 .917 .909 .901 893 2 .925 .907 .890 .873 .857 842 826 .812 .797 3 889 864 .840 .816 .794 .772.751.731 .712 4 855 .823 .792 .763 .735 .708 .683 .659 .636 5 822 .784 .747 .713 681 .650 .62 .593 .567 6 .790 .746 .705 666 630 596 .564.535 .507 7.760 .711 665 .623 .583 .547 .513 482 452 8 731 .677 627 .582 .540 .502 467 434 404 9.703 645 .592 .544 .500 460 424 .391 .361 10 676 .614 .558 .508 463 422 .386.352 .322 11 .650 .585 .527 475 429.388.350.317 .287 12 625 .557 497 444 .397.356 .319.286 .257 13 601 .530 469 415 368.326 .290 .258 .229 14 .577 .505 442 .388 340 .299 .263 .232 .205 15 .555 481 417 .362 .315 .275.239 .209 .183

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started