Question

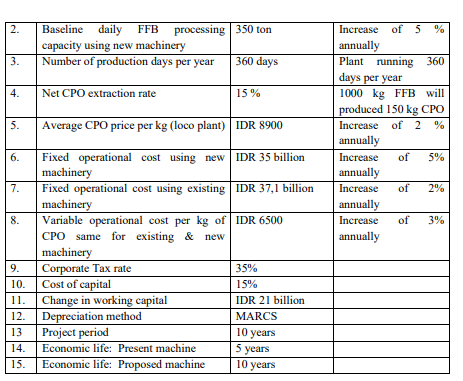

Manorang Hijau Plantation (MRHP) will implement Plantation Optimization program, this is to immediately overhaul the machinery and increase the production capacity of the CPO mill

Manorang Hijau Plantation (MRHP) will implement Plantation Optimization program, this is to immediately overhaul the machinery and increase the production capacity of the CPO mill from the current maximum daily processing capacity of 300 tons of Palm Oil

PT. GDAM management brought in the marketing, production management, procurement, capital investment, and accounting department to formulate estimates of the initial cost of the expansion, as well as future cash flow that can be used to evaluate this expansion.

a. Should PT. GDAM replace the machines? Explain your reasoning. Provide complete analysis showing : initial investment, operating cash flows, terminal cash flow, as well as depreciation schedules, and using set of capital budgeting techniques

b. If PT. GDAMs cost of capital increases by 5 percent, would your recommendation change?

c. At what cost of capital, would your recommendation change? Indicate your decision on a net present value profile of this investment decision

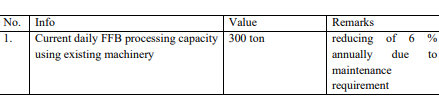

No. Info Value 1. Current daily FFB processing capacity 300 ton using existing machinery Remarks reducing of 6 % annually due to maintenance requirement 2. Baseline daily FFB processing | 350 ton capacity using new machinery Number of production days per year 360 days 3. 4. Net CPO extraction rate 15 % S. Average CPO price per kg (loco plant) IDR 8900 Increase of 5% annually Plant running 360 days per year 1000 kg FFB will produced 150 kg CPO Increase of 2% annually Increase of 5% annually Increase of 2% annually Increase of 3% annually 6. 7. 8. Fixed operational cost using new IDR 35 billion machinery Fixed operational cost using existing IDR 37,1 billion machinery Variable operational cost per kg of IDR 6500 CPO same for existing & new machinery Corporate Tax rate 35% Cost of capital 15% Change in working capital IDR 21 billion Depreciation method MARCS Project period Economic life: Present machine Economic life: Proposed machine 9. 10. 11. 12. 13 14. 15. 10 years 5 years 10 years No. Info Value 1. Current daily FFB processing capacity 300 ton using existing machinery Remarks reducing of 6 % annually due to maintenance requirement 2. Baseline daily FFB processing | 350 ton capacity using new machinery Number of production days per year 360 days 3. 4. Net CPO extraction rate 15 % S. Average CPO price per kg (loco plant) IDR 8900 Increase of 5% annually Plant running 360 days per year 1000 kg FFB will produced 150 kg CPO Increase of 2% annually Increase of 5% annually Increase of 2% annually Increase of 3% annually 6. 7. 8. Fixed operational cost using new IDR 35 billion machinery Fixed operational cost using existing IDR 37,1 billion machinery Variable operational cost per kg of IDR 6500 CPO same for existing & new machinery Corporate Tax rate 35% Cost of capital 15% Change in working capital IDR 21 billion Depreciation method MARCS Project period Economic life: Present machine Economic life: Proposed machine 9. 10. 11. 12. 13 14. 15. 10 years 5 years 10 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started