Answered step by step

Verified Expert Solution

Question

1 Approved Answer

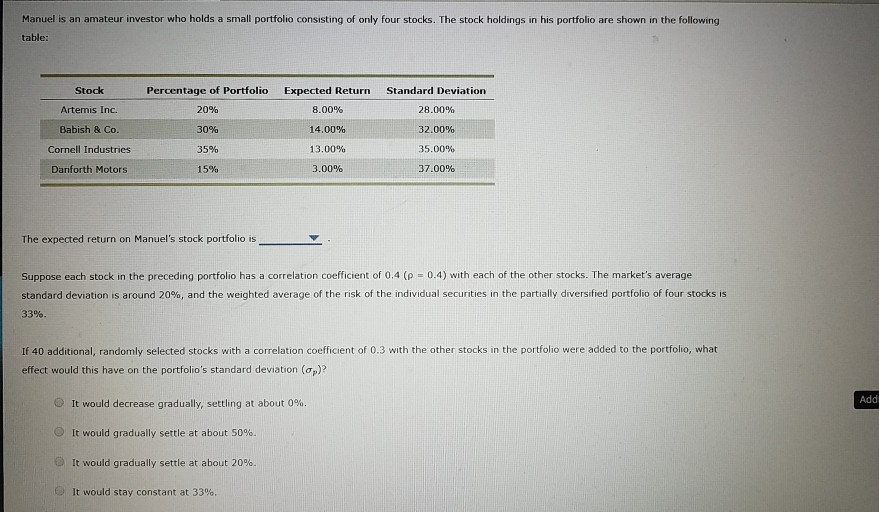

Manuel is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the

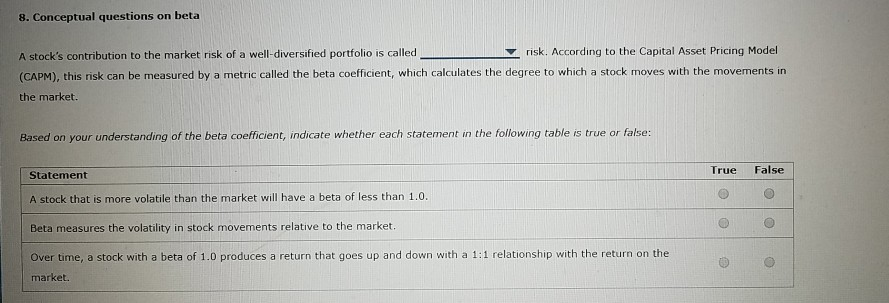

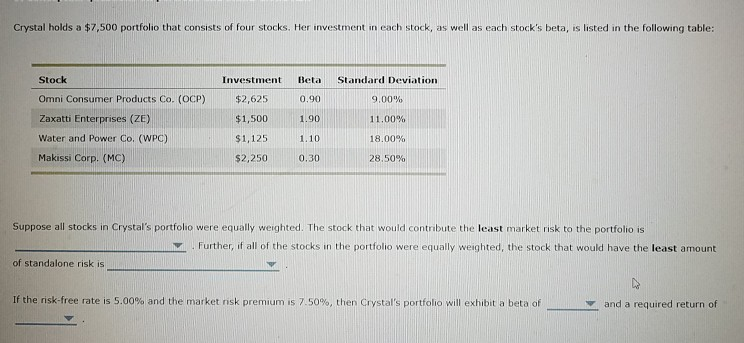

Manuel is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table: Stock Artemis Inc. Percentage of Portfolio 20% 30% Expected Return 8.00% Standard Deviation 28.00% Babish & Co. 14.00% 32.00% 35.00% Cornell Industries 35% 13.00% Danforth Motors 15% 3.00% 37.00% The expected return on Manuel's stock portfolio is Suppose each stock in the preceding portfolio has a correlation coefficient of 0.4 (P = 0.4) with each of the other stocks. The market's average Standard deviation is around 20%, and the weighted average of the risk of the individual securities in the partially diversified portfolio of four stocks is 33%. If 40 additional, randomly selected stocks with a correlation coefficient of 0.3 with the other stocks in the portfolio were added to the portfolio, what effect would this have on the portfolio's standard deviation (ap)? It would decrease gradually, settling at about 0%. Addi It would gradually settle at about 50%. It would gradually settle at about 20%. It would stay constant at 33%. 8. Conceptual questions on beta A stock's contribution to the market risk of a well-diversified portfolio is called risk. According to the Capital Asset Pricing Model (CAPM), this risk can be measured by a metric called the beta coefficient, which calculates the degree to which a stock moves with the movements in the market. Based on your understanding of the beta coefficient, indicate whether each statement in the following table is true or false: Statement True False A stock that is more volatile than the market will have a beta of less than 1.0. Beta measures the volatility in stock movements relative to the market. Over time, a stock with a beta of 1.0 produces a return that goes up and down with a 1:1 relationship with the return on the market. Crystal holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Standard Deviation Investment $2,625 Beta 0.90 9.00% $1,500 1.90 11.00% Omni Consumer Products Co. (OCP) Zaxatti Enterprises (ZE) Water and Power Co. (WPC) Makissi Corp. (MC) $1,125 1.10 18.00% $2,250 0.30 28.50% Suppose all stocks in Crystal's portfolio were equally weighted. The stock that would contribute the least market risk to the portfolio is Further, if all of the stocks in the portfolio were equally weighted, the stock that would have the least amount of standalone risk is If the risk-free rate is 5.00% and the market nisk premium is 7.50%, then Crystal's portfolio will exhibit a beta of and a required return of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started